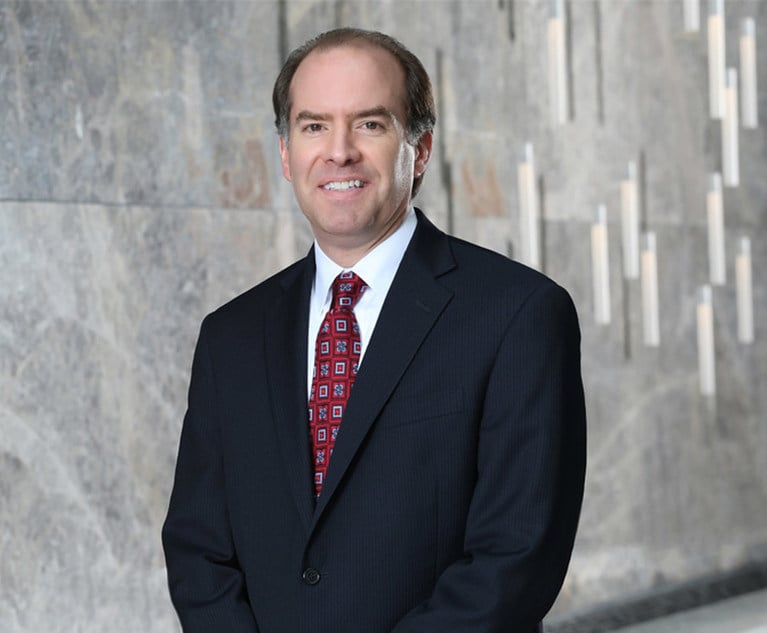

Kannon Shanmugam of Paul Weiss speaks last year at a Federalist Society event in D.C. Photo: Diego M. Radzinschi/ALM

Kannon Shanmugam of Paul Weiss speaks last year at a Federalist Society event in D.C. Photo: Diego M. Radzinschi/ALMPaul Weiss Pokes Gibson Dunn in New SCOTUS Brief in Consumer Bureau Case

Paul Weiss appellate leader Kannon Shanmugam wants the U.S. Supreme Court to take his challenge to the Consumer Financial Protection Bureau. The court received a new and competing petition, from Gibson, Dunn & Crutcher, a few days ago.

October 04, 2019 at 03:17 PM

6 minute read

The original version of this story was published on National Law Journal

Updated at 3:53 p.m.

A prominent Washington appellate lawyer who is seeking to challenge the Consumer Financial Protection Bureau in the U.S. Supreme Court took a dig Friday at competing bids to contest the agency's constitutionality in the upcoming term.

In a filing with the high court, Paul, Weiss, Rifkind, Wharton & Garrison partner Kannon Shanmugam appeared to take issue with a rival appellate team's suggestion that his case would not raise an important question for the justices: What relief should be given to financial companies if the CFPB is ultimately found unconstitutional?

An appellate team at Gibson, Dunn & Crutcher—including former U.S. Solicitor General Theodore Olson and Helgi Walker, a leader of the firm's regulatory group—had argued earlier in the week that its own challenge to the CFPB would more directly address that question.

Shanmugam on Friday described as "puzzling" the Gibson Dunn team's contention that his challenge was lacking. He argued his case inherently raises that same question presented in Gibson Dunn's petition.

"Parties do not seek this court's review on constitutional questions for kicks; they do so in order to obtain meaningful relief," Shanmugam wrote. "Accordingly, when the court hears constitutional cases, it routinely proceeds to consider and decide the appropriate remedy upon finding a constitutional violation, regardless of whether the petition itself presented a separate remedial question."

The Paul Weiss reply brief does not name Gibson Dunn but instead refers to the firm's client, All American Check Cashing, a Mississippi-based company that has challenged the CFPB's constitutionality in the U.S. Court of Appeals for the Fifth Circuit. Although the appeals court has not ruled in that case, the Gibson Dunn team opted to seek the Supreme Court's review nonetheless. They argued the question of the CFPB's constitutionality had been adequately considered by lower courts across the country.

Shanmugam, noting that the Fifth Circuit had yet to rule in Gibson Dunn's case, described the competing firm's petition as "unusual," saying it asked for "the extraordinary remedy of certiorari before judgment."

Gibson Dunn's Walker said Friday: "We look forward to addressing the arguments that Seila Law has made about the All American petition in our reply. For now, I would note that Seila Law does not disagree that the remedies question is an essential piece of the constitutional puzzle that the court should address, as we have argued—our case is the ideal vehicle for addressing that important practical issue."

Helgi Walker of Gibson Dunn & Crutcher.

Helgi Walker of Gibson Dunn & Crutcher.

The design of the CFPB, a regulatory agency born from the Dodd-Frank reforms that followed the financial crisis, has long rankled the business advocates and Republicans on Capitol Hill. At issue is whether the CFPB's independent, single-director structure—designed to protect the agency's leader from being fired at will by the president—violates the Constitution's separation of powers clause.

For years, the CFPB defended its constitutionality with the backing of the U.S. Justice Department. But under the Trump administration, the Justice Department and even the CFPB itself have abandoned that stance and argued that the Supreme Court should strike down the agency's structure.

Lawyers for the U.S. House of Representatives, lining up against the Trump administration's Justice Department, on Friday urged the U.S. Supreme Court not to disturb a the Ninth Circuit ruling in the Seila Law case that kept in place the single-director structure of the consumer bureau.

The House legal team, led by general counsel Douglas Letter, said Democrats should be allowed to back the consumer bureau as a friend-of-the-court because Main Justice and the agency itself were no longer defending the constitutionality of the single-design scheme.

U.S. Solicitor General Noel Francisco. Photo: Diego M. Radzinschi / NLJ

U.S. Solicitor General Noel Francisco. Photo: Diego M. Radzinschi / NLJ

"The Solicitor General has decided not to defend this Act of Congress, and the House should be allowed to do so as an amicus," Letter said in a new filing in the case Seila Law v. CFPB.

The consumer agency's notification of its switched position meant that the House could not earlier file a friend-of-the-court brief supporting the single-director design, Letter said in Friday's filing in the Supreme Court.

Central to the challenges to the consumer bureau's structure are Supreme Court separation-of-powers rulings in Humphrey's Executor v. United States (1935) and Morrison v. Olson (1988).

The Justice Department's brief said in its brief that the Supreme Court "should consider" overturning those two rulings if the justices conclude they cannot get around them to declare the independent CFPB director as unlawful.

In his brief Friday, Letter took a dig at the mere suggestion the court would entertain overturning those two earlier rulings.

"While the Solicitor General might prefer an executive branch without any independent regulatory agencies, there is no sound reason for this court to overrule eighty years of precedent that has played a significant role in shaping our modern system of government," Letter wrote. "Nor is there any basis for this court to strip Congress of its authority to create agencies with a measure of independence from presidential control, where such a structure 'is necessary to the proper functioning of the agency or official.'"

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Stock Trading App Robinhood Hit With Privacy Class Action 1 Month After Alleged Data Breach

Congress and Courts Are Considering Litigation Financing: Is Disclosure Imminent?

8 minute read

Auditor Finds 'Significant Deficiency' in FTC Accounting to Tune of $7M

4 minute read

'A World of Credit': Ex-FTX Executive Gary Wang Sentenced to Time Served Following Cooperation

Trending Stories

- 1Friday Newspaper

- 2Judge Denies Sean Combs Third Bail Bid, Citing Community Safety

- 3Republican FTC Commissioner: 'The Time for Rulemaking by the Biden-Harris FTC Is Over'

- 4NY Appellate Panel Cites Student's Disciplinary History While Sending Negligence Claim Against School District to Trial

- 5A Meta DIG and Its Nvidia Implications

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250