UK Firms Struggle to Keep Pace on European Q3 Deal Rankings

Only the Magic Circle firms make the top 20 adviser firms for European M&A, the latest stats show.

October 04, 2019 at 05:44 AM

3 minute read

Europe

Europe

U.K. firms have been usurped by their U.S. and European counterparts for advising on the highest value deals during the third quarter of the year, with U.K. firms taking just five of the top 20 spots for European M&A.

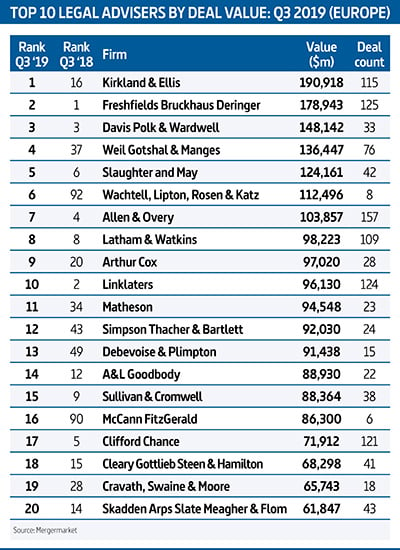

Click on table for larger view

Click on table for larger viewAccording to data from Mergermarket, the only U.K. firms included in the top dealmaking firms for Europe in Q3 were the Magic Circle firms, with Clifford Chance coming in 17th.

U.S. firm Kirkland & Ellis topped the list of firms for value, having worked on 155 deals worth $190 billion, putting it ahead of corporate rival Freshfields Bruckhaus Deringer, which placed second.

Davis Polk & Wardwell placed third in the rankings, ahead of its U.S. rivals Weil Gotshal & Manges in fourth, Wachtell, Lipton, Rosen & Katz in sixth and Latham & Watkins in eighth.

Irish firms, meanwhile, have increased their presence in the European tables, with Arthur Cox leaping up the tables to take ninth place, marginally ahead of Linklaters.

Matheson, A&L Goodbody and McCann FitzGerald also all made it into the top 20, placing higher than Clifford Chance.

In the U.K. M&A adviser tables, Allen & Overy took first place for value ahead of Freshfields and Kirkland. However, only seven of the firms in the U.K. value table were Britain-based.

Overall, both European and U.K. deal volumes for the quarter dropped to their lowest point since 2013, while collective values stayed fairly constant.

Kirkland & Ellis corporate partner Roger Johnson said: "We have been working very hard for clients on large carve outs such as Nestle as well as take privates such as Merlin and Inmarsat. The M&A and debt markets continue to be very active across Europe."

Commenting on the factors influencing the Irish M&A market in Q3, Arthur Cox corporate partner Cian McCourt said: "The challenges we see are probably common to most European firms. Brexit continues to act as a drag on confidence and deal execution while global issues such as the U.S./China trade war are also weighing on sentiment.

"On the flip side, we expect interest in Ireland to increase from North America and Western Europe as a hedge against Brexit given its position as an English speaking member of the Eurozone.

Robbie McLaren, a corporate partner at Latham & Watkins, added: "There have been lots of inbound acquisitions of UK businesses due to the current FX challenges of sterling. The majority of these businesses, however, are U.K. based but operate internationally – this means they're hedged, to an extent, from the worst effects of a no-deal Brexit. Similarly, there has been a significant uptick in public to private transactions and we expect this to continue."

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Chicago Law Requiring Women, Minority Ownership Stake in Casinos Is Unconstitutional, New Suit Claims

5 minute read

Free Microsoft Browser Extension Is Costing Content Creators, Class Action Claims

3 minute read

Fired by Trump, EEOC's First Blind GC Lands at Nonprofit Targeting Abuses of Power

3 minute read

Indian Law Firm Cyril Amarchand Rolls Out AI Strategy, Adopts Suite of AI Tools

Trending Stories

- 1Public Notices/Calendars

- 2Wednesday Newspaper

- 3Decision of the Day: Qui Tam Relators Do Not Plausibly Claim Firm Avoided Tax Obligations Through Visa Applications, Circuit Finds

- 4Judicial Ethics Opinion 24-116

- 5Big Law Firms Sheppard Mullin, Morgan Lewis and Baker Botts Add Partners in Houston

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250