9 Things to Know About a New Regulator Group That Might Like You

The Retirement Security Working Group could also push for new producer education requirements.

November 12, 2019 at 04:24 PM

4 minute read

Saving for RetirementThe original version of this story was published on Law.com

1. The NAIC created it in August, at its summer meeting in New York.

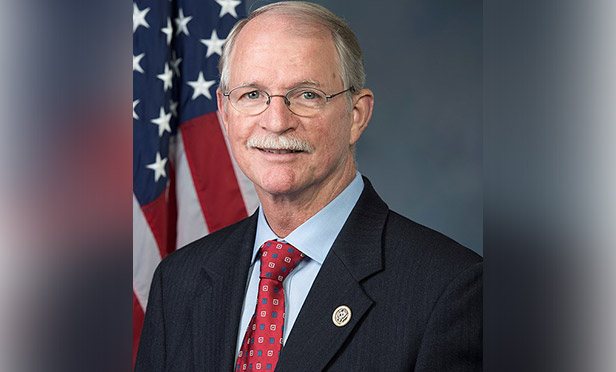

Stephen Taylor, the insurance commissioner for the District of Columbia, told members of the Life Insurance and Annuities Committee that starting a working group would help the NAIC act on an ongoing Retirement Security Initiative. He said that several other commissioners already wanted to join the working group, and that one thing that the working group could do would be to draft a document describing the challenges facing America's retirement savers and retirees. (Related: NAIC Creates a Retirement Security Working Group)

2. The working group has its own section on the NAIC's website.

The working group's website section is available here. The Meeting Materials tab includes a link to the NAIC's Calendar system. Members of the public can pay to get access to the calls.

3. The working group has eight founding members.

In addition to the District of Columbia, the jurisdictions participating in the working group are Iowa, Maryland, Minnesota, New York state, Rhode Island, Utah and Washington state.

4. The agenda for the meeting includes a presentation by Vince Shorb of the National Financial Educators Council (NFEC).

NFEC is a financial literacy program provider. The clients listed on its website range from Transamerica to the Salvation Army.

5. The working group could review existing state consumer protection laws.

The working group members and practical constraints will shape what the new working group really does. Taylor suggested at the NAIC's summer meeting that the working group might inventory state laws that apply to retirement-related transactions, to identify places where new laws or amendments could enhance consumer protection.

6. The working group could help regulators reach out to consumers.

Taylor suggested that the working group could help develop a public media retirement security campaign, and a retirement security curriculum that could emphasize the importance of saving, minimizing debt, and planning for long-term care expenses.

7. The working group could add to continuing education requirements for agents and brokers.

Taylor said the working group could help develop exam questions for producers in connection with topics such as needs analysis and suitability.

8. The working group could help develop new income planning concepts.

Taylor said the working group could work with another group for regulators, the Interstate Insurance Product Regulation Commission, to work with the IIPRC to develop ideas for new lifetime income products.

9. The working group could listen to insurers' concerns.

Taylor said the working group could help facilitate a forum that would give insurers and other industry participants a chance to talk about topics such as regulatory obstacles. — Read Annuity Group's Third Video Focuses on 'Family Readiness', on ThinkAdvisor. — Connect with ThinkAdvisor Life/Health on Facebook, LinkedIn and Twitter.

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View AllTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250