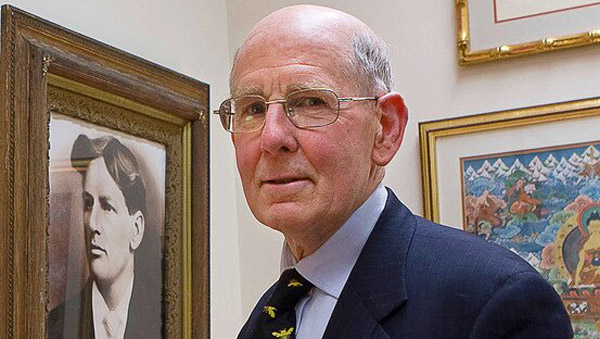

Gary Shilling.

Gary Shilling. Gary Shilling, the money manager who predicted the housing bubble that led to the 2008 Great Recession and the global inventory overhang that preceded the 1973-1974 recession, is no longer saying the U.S. economy is in a recession, but he hasn't abandoned those concerns.

While other economists and market strategists "believe that a recession has been averted and are relieved that the first phase of the trade deal with China is at hand … we remain cautious," writes Shilling in his latest Insight report. "Enthusiasm may not have reached the high level that virtually guarantees a bear market in equities, but it's moving in that direction … A 2020 recession is a strong possibility."

In previous 2019 Insights, Shilling said the U.S. economy was already in recession.

Recessions are becoming increasingly difficult to predict in what Shilling describes as an "atypical economy." The excesses that usually build up in the economy, in the housing market, manufacturing and even wages, which prompt reaction from the Federal Reserve to slow things down, are lacking, according to Shilling.

In the housing sector, lending conditions are tight and demand from young people, who traditionally lead the market for new homes, is soft, writes Shilling. Business inventories now are better controlled and traditionally a big issue for manufacturing, which accounts for a smaller share of the U.S. economy. Wages are rising but at a slower rate than previously due to globalization.

Given these differences from past expansions, Shilling doesn't expect that the current business expansion will end as others have before, with the Fed "worried about economic overheating" and hiking interest rates to slow the economy. Nor does he believe that the shocks that inspired more recent recessions such as the dot-com implosion, which led to the 2001 recession, or the subprime mortgage market collapse, which ended with the 2007-2009 Great Recession, will be repeated.

He sees "no glaring excesses that are just begging to be unwound," but rather several potential shocks that could end the business expansion, among them:

1. Excessive Debt in China and among U.S. businesses, where BBB-rated corporate debt now comprises more than half of total issues outstanding. A dip below BBB into junk bond territory, which large institutional investors like pension funds are not allowed to own, could "induce dumping of other low-quality bonds in a self-feeding downward spiral," writes Shilling.

2. Trade War Escalation. Shilling does not believe the Phase One agreement between the U.S. and China, which was recently announced, will necessarily prevent another escalation of the conflict. The agreement doesn't address China's subsidies to domestic companies and Chinese pressure on American businesses to share technology, which he says is "the heart of the U.S.-China struggle for global dominance." Moreover, Shilling doesn't trust Trump, whose "past record of unpredictability" suggests that even the limited deal reached in December may not be completed or will be followed by "anything but more uncertainty."

3. U.S. Consumer Retrenchment and Deflation. "U.S. consumer spending is the only major source of economic strength at home and abroad, so we're watching it closely to signal the next major moves in the economy and financial markets," writes Shilling. The November retail sales report provides him no solace. Sales rose just 0.2%; excluding gasoline and vehicle purchases they were flat. Slower consumer demand could also feed expectations of deflation which could further depress spending and become self-fulfilling.

4. Corporate Profits. A nosedive in overpriced U.S. stocks could precipitate the next recession, according to Shilling. The share of profits in the national economy is sliding and pretax profits have fallen 13% in five years. Even after accounting for the 2017 corporate tax cuts, profits are merely flat. At the same time, S&P 500 earnings per share through mid-November reached a record high, culminating a 31% jump in the past five years due to creative accounting, one-shot boosts, share buybacks and shifts of intellectual property to offshore tax havens among multinationals — all factors that are not likely to be sustained.

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View AllTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250