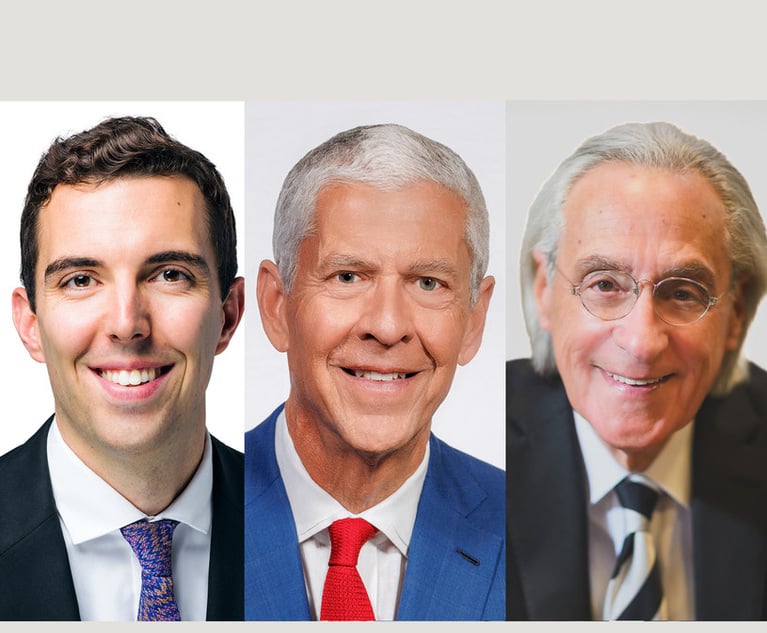

Jim Schell, Mayer Brown. Courtesy photo

Jim Schell, Mayer Brown. Courtesy photoWith Skadden's Retirement Policy Looming, Partner Moves to Mayer Brown

At Mayer Brown, said Jim Schell, "I wouldn't have to worry about a 'time for you to go' business model. I want to be active, I have been active, and this was an ideal home for me to continue to do that."

January 06, 2020 at 07:42 PM

3 minute read

The original version of this story was published on The American Lawyer

A former private equity team leader has left Skadden, Arps, Slate, Meagher & Flom for Mayer Brown, looking to practice beyond Skadden's mandatory retirement age and attracted to the Chicago-founded firm's talent and expertise.

Jim Schell joined Mayer Brown as a New York partner in its corporate and securities practice group. Schell was previously head of the interdisciplinary private equity funds team in the investment management group at Skadden, where he had practiced since 1986.

In an interview, Schell said he was interested in continuing to practice in the private funds formation area into the later years of his legal career and past Skadden's mandatory retirement age of 70.

"There was a desire on my part to continue a very active practice and do so unencumbered by institutional requirements that ran contrary to that," he said. "When you add in the respect and affection I have for people here [at Mayer Brown] from prior experiences, it was a relatively easy decision."

The retirement policy was not the only factor in his move.

Schell said he was in talks with multiple firms before landing at Mayer Brown. He said he was attracted to Mayer Brown's culture and global footprint and had relationships with multiple partners in the corporate group with whom he previously practiced at Skadden. Additionally, he said that many of his clients, whom he declined to name but said they were in the accounting and private equity industries, were eager to continue their relationship with him.

"My clients are looking down the road for how best to structure their businesses in a kind of fluid, global environment, and I wanted to ensure I could do that for them for a long period of time," he said. "I had that opportunity [at Mayer Brown]—I wouldn't have to worry about a 'time for you to go' business model. I want to be active, I have been active, and this was an ideal home for me to continue to do that."

John Noell Jr., head of Mayer Brown's global investment management and fund formation group, said Schell's hire is the latest addition in a years-long growth strategy for the group, which began more than 15 years ago and has become more pointed in the last half-decade.

"It's been a priority in the last five years to take what we'd created in real estate funds and broaden our capabilities to pick up other kinds of private equity real estate," he said, noting that while the firm has always had talent in those areas, it hasn't always had the size necessary to support clients that were large, global financial institutions. "Gaining a broader set of funds formations skills was an important objective for us."

Noell added that strategic hires such as Schell's deepened the expertise in the firm's various fund formation teams.

"What's interesting about this area is that the lines between sub-specialties get blurred over time," he said. "The bigger the team we have with good colleagues at all levels—from partners to associates to of counsel—the better we'll be able to serve all of those clients."

Representatives at Skadden did not immediately respond to request for comment.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Bosworth Claims It Was Kline & Specter, Not Him, That Breached Settlement Terms

4 minute read

Climate Groups Demonstrate Outside A&O Shearman and Akin London Offices

CSX Joins Rest of Big Four Railroad Companies in Installing New Generation of Legal Leadership

Law Firms Mentioned

Trending Stories

- 1Judicial Ethics Opinion 24-60

- 2California Implements New Law Banning Medical Debt From Credit Reports

- 3Trump Picks Personal Criminal Defense Lawyers For Solicitor General, Deputy Attorney General

- 4Climate Groups Demonstrate Outside A&O Shearman and Akin Offices

- 5Republican Who Might Become FTC's Next Chair Blasts Democratic Commissioners' 'All Mergers Are Bad' Mindset

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250