Skilled in the Art: Neal Katyal Asks SCOTUS for the Big Kahuna + Lawyers React to Section 101 Silence + Another Multimillion-Dollar Verdict for Irell

A few outtakes from the trademark damages arguments in Romag v. Fossil at the U.S. Supreme Court.

January 14, 2020 at 10:26 PM

6 minute read

Welcome to Skilled in the Art. I'm Law.com IP reporter Scott Graham. Here's what's cooking today:

• A few outtakes from the trademark damages arguments in Romag v. Fossil at the U.S. Supreme Court.

• SCOTUS has decided it doesn't have a Section 101 problem.

• Irell & Manella scores a nine-figure verdict (again).

As always, you can email me your thoughts and follow me on Twitter.

Williams & Connolly partner Lisa Blatt.

Williams & Connolly partner Lisa Blatt.

Clear and Convincing Kahunas at the Supreme Court

Inferences. Presumptions. Materiality. Those are all words I've heard in relation to evidence. In Tuesday's Romag v. Fossil arguments at the Supreme Court, I heard a new phrase:

The Big Kahuna.

That's, at minimum, the role willfulness ought to play when judges decide whether to award infringer's profits for trademark violations, Hogan Lovells partner Neal Katyal told the high court.

Katyal was arguing that willfulness should be a necessary prerequisite for such an award. But short of that, he asked the court to "make very clear that willfulness is a key factor, the big kahuna or something like that" in a list of any equitable factors for deciding such an award.

I have a full news story on the arguments here at the National Law Journal, but that was pretty much the highlight from my point of view. A few other notes:

➤ Does Alabama count? Williams & Connolly partner Lisa Blatt had only a few precedents to support Romag Fasteners' case, and one of them was an 1883 case from Alabama. Blatt seemed slightly defensive. "Nothing wrong with Alabama. It counts as a case," she told the court.

Katyal was dismissive. "At the end of the day, she's got one case from Alabama in 1883, which … never actually resulted in an award of profits." Katyal insisted he has no beef with Alabama. "We're not saying it's because it's from Alabama or something like that. It's literally never been cited again for [Romag's] proposition."

➤ Those were the days, my friend. I have to say that I sometimes find Federal Circuit convention of referring to opposing counsel as "my friend" as somewhat strained, but I'm thinking it beats the apparent no-holds-barred approach at the Supreme Court.

Though Katyal did initially refer to Blatt as "my friend" twice at the outset of his argument, he referred to Blatt as "she" more than 20 times, which at least on the cold transcript seemed jarring. "She sought $6 million, every dollar in profits for the sale of these handbags, and that's what she was referring to with this attribution thing," he said at one point.

In fairness, Blatt used "he" to refer to Katyal several times and never called him her friend.

➤ Too cool for (Ivy League) school. In rebuttal, Blatt pushed back on Katyal's trashing of her analysis. "I don't know what to say. I didn't go to a fancy law school, but I'm very confident in my representation of the case law," she told the court.

"Ms. Blatt, Texas is a fine law school," Justice Ruth Ginsburg told Blatt at the close of the argument.

The Section 101 Switcheroo

It was almost like an intervention.

Solicitor General Noel Francisco's office told the Supreme Court last month, you really need to reconsider your patent eligibility jurisprudence. All 12 judges of the Federal Circuit told the court, you really need to reconsider your patent eligibility jurisprudence.

The SG and the Federal Circuit agreed: Athena Diagnostics v. Mayo Collaborative Services was an ideal vehicle for doing so.

The Supreme Court apparently decided, after requesting the SG's views a year ago, that it doesn't really have a patent eligibility problem after all.

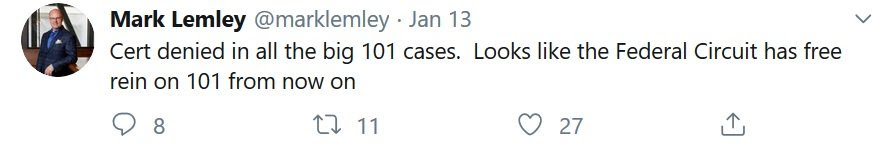

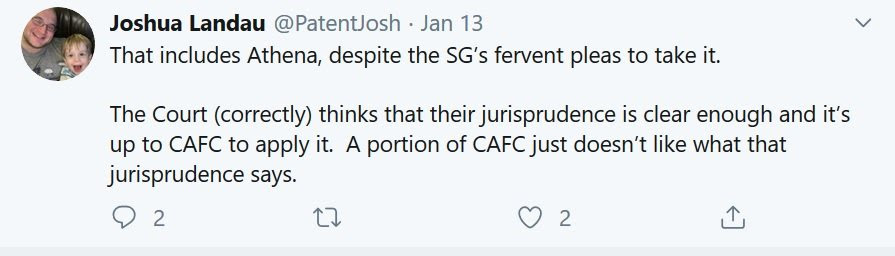

Some reaction from around Twitter:

I thought George Mason law professor Adam Mossoff had an interesting contrarian take on the no-decisions at IP Watchdog: "I am heartened that the U.S. Supreme Court did not grant cert today in the patent eligibility cases. It let stand the important decisions in Berkheimer and Vanda, in which the Federal Circuit has begun to exercise its appropriate discretion within the Alice-Mayo framework to set limits on the boundless and willy-nilly decision-making that has been destroying legitimate patented innovations. But I am also relieved it did not grant cert in Athena Diagnostics. … Seven of the nine Justices that unanimously decided Alice are still on the Court. …"

Another Big Verdict for Irell

Irell & Manella may be getting smaller, but it's not getting any poorer.

The firm just notched its third nine-figure patent infringement verdict in the last three months. Jurors in Marshall, Texas, awarded United Services Automobile Association $102 million on Friday against Wells Fargo.

If that sounds familiar, it's because Irell pinned a $200 million on Wells Fargo on behalf of the same client in November. Friday's verdict involved different patent families that relate to the same mobile check cashing technology.

Irell also won a $750 million verdict for Juno Therapeutics in Los Angeles in December.

"This verdict further validates our position that we created mobile deposit capture technology," said Nathan McKinley, USAA vice president of corporate development, said in a written statement. "Wells Fargo, and the rest of the banking industry, has benefited from our technology, and we look forward to working with banks to create reasonable and mutually beneficial license agreements."

Irell partners Lisa Glasser and Jason Sheasby headed a team that included associates Tony Rowles, Andrew Strabone, Benjamin Manzin-Monnin, Kelsey Schuetz and Ingrid Petersen. Wells Fargo was represented by Winston & Strawn and Ward & Smith.

That's all from Skilled in the Art today. I'll see you all again on Friday.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Skilled in the Art With Scott Graham: I'm So Glad We Had This Time Together

Design Patent Appeal Splinters Federal Circuit Panel + Susman Scores $163M Jury Verdict + Finnegan Protects Under Armour's House

Law Firms Mentioned

Trending Stories

- 1States Accuse Trump of Thwarting Court's Funding Restoration Order

- 2Microsoft Becomes Latest Tech Company to Face Claims of Stealing Marketing Commissions From Influencers

- 3Coral Gables Attorney Busted for Stalking Lawyer

- 4Trump's DOJ Delays Releasing Jan. 6 FBI Agents List Under Consent Order

- 5Securities Report Says That 2024 Settlements Passed a Total of $5.2B

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250