First Circuit: 'Waiving' Goodbye to Court

Litigators engaging the SEC must also be sure to review all language carefully to be sure they are not inadvertently waiving their clients' ability to seek judicial review of any disgorgement or any other penalties.

February 05, 2020 at 10:30 AM

6 minute read

In a recent decision which could have significant implications for settlements with the United States Securities and Exchange Commission (SEC), the United States Court of Appeals for the First Circuit affirmed a decision by the United States District Court for the District of Massachusetts that "the right to judicial review of [an] SEC order" may be waived. Jalbert v. SEC, No. 18-2043 at 2 (1st Cir. Dec. 20, 2019).

In a recent decision which could have significant implications for settlements with the United States Securities and Exchange Commission (SEC), the United States Court of Appeals for the First Circuit affirmed a decision by the United States District Court for the District of Massachusetts that "the right to judicial review of [an] SEC order" may be waived. Jalbert v. SEC, No. 18-2043 at 2 (1st Cir. Dec. 20, 2019).

Often when individuals, funds, corporations or other entities are investigated by the SEC, they will enter into settlements to avoid lengthy litigation and to limit the amount they pay in penalties. These settlements sometimes include disgorgements, which are usually intended to repay the victims of a fraud the amount they have lost, and civil penalties. Under the Supreme Court's recent ruling Kokesh v. SEC, disgorgement is a penalty where it is applied in a punitive manner or to deter. Kokesh v. SEC, 137 S.Ct. 1635 (2017). It is this last point under which Craig Jalbert sought to challenge a settlement with the SEC.

F-Squared Investments was an investment adviser firm located in Massachusetts, which the SEC investigated for securities fraud. On Dec. 4, 2014, during the course of the investigation, F-Squared executed an Offer of Settlement, an official offer statement to the SEC under Rule 240 of the Rules of Practice of the SEC, which stated the following: "By submitting this Offer, [F-Squared] hereby … waives, subject to acceptance of the offer … [j]udicial review by any court." Jalbert at 3. The SEC accepted Jalbert's offer and entered into a settlement which included an order requiring F-Squared to pay to the United States Treasury $30 million in disgorgement and a $5 million civil penalty.

F-Squared made the payments required by the SEC and, in July 2015, filed for bankruptcy. The bankruptcy court established the F2 Liquidating Trust to recover assets on behalf of F-Squared as its successor-in-interest, and it appointed Jalbert as the Trustee.

Subsequently, on Oct. 26, 2017, Jalbert filed a complaint on behalf of the F2 Liquidating Trust and "'all other individuals and entities similarly situated' who had 'money collected from them by the SEC as "disgorgement" without statutory authority or in excess of statutory authority.'" Id. at 4. The crux of Jalbert's argument was that in seeking and obtaining disgorgement, which was intended to punish F-Squared and deter future fraud, the SEC had exceeded its authority. The SEC filed a motion to dismiss for failure to state a claim, and the District Court granted the SEC's motion.

The First Circuit affirmed the District Court's dismissal on several grounds. First, it held that "F-Squared knowingly and voluntarily agreed to waive judicial review" and pointed out that "the Offer included an acknowledgment of F-Squared's" waiver. Id. at 8. Therefore, the court held, the waiver was valid and applied in this case.

Second, it held that the SEC's order of disgorgement did not constitute a separation-of-powers violation, and therefore judicial review could be waived. Jalbert had argued that, based on Kokesh, the "SEC exceeded its statutory authority in ordering disgorgement that is … punitive and unauthorized." Id. at 9. However, the court held that Jalbert's "argument does not implicate a structural separation-of-powers issue" because "this is not a case in which the 'usurp[ation of] the prerogatives of another branch of government' would be implicated." Id. at 10-11. The court further held that Jalbert's claim at most amounted to an ultra vires action by the SEC, which is a "waivable" claim. Id. at 12.

Third, the court held that, despite Jalbert's contention otherwise, the SEC has power to order disgorgement and that challenging such power was in fact challenging the settlement itself, which Jalbert had waived the right to do. The court held, "Contrary to Jalbert's contention, by challenging the validity of the disgorgement, he is challenging the Order itself because it was through that Order (to which F-Squared consented) that the SEC directed F-Squared to pay a disgorgement of $30 million into the Treasury." Id. at 15. Therefore, the court ruled, Jalbert had waived the right to challenge the SEC's ability to order disgorgement.

Fourth, the court held that the purpose or aim of Rule 240 is not to overcome judicial review of SEC actions. Jalbert argued that, under the Administrative Procedures Act, the SEC's actions were subject to judicial review and that Rule 240 could not be used to skirt that presumption. However, the court held, "F-Squared knowingly and voluntarily chose to enter into an early settlement and waive judicial review rather than partake in public administrative and cease-and-desist proceedings." Id. at 17-18. As such, the court found that the waiver was valid.

Finally, the court held that the contractual doctrine of mutual mistake of law did not serve to nullify the waiver for two reasons. First, the court determined that Kokesh did not change the law and invalidate the SEC's ability to require disgorgement. Second, the court held that even if Kokesh had changed the law, under Massachusetts law, a mistake "must be based on a fact 'capable of ascertainment at the time' the parties entered into the contract." However, the court noted that the mistake would not have been ascertainable at the time of the settlement because Kokesh was decided subsequent to the settlement. Therefore, F-Squared was capable of waiving judicial review of disgorgement.

The most important takeaway from this case is perhaps to be careful in negotiating settlements with the SEC. While this case presents a fairly unique scenario in which the subject of the investigation entered into bankruptcy, with a trustee subsequently challenging the waiver, it is important in negotiations with the SEC to be on alert for any such waivers, particularly as they relate to the judicial process. In the past several years, lawyers have started to look more closely at mandatory arbitration and forum selection clauses. Now, litigators engaging the SEC must also be sure to review all language carefully to be sure they are not inadvertently waiving their clients' ability to seek judicial review of any disgorgement or any other penalties. Otherwise, they just might be "waiving" goodbye to the courts.

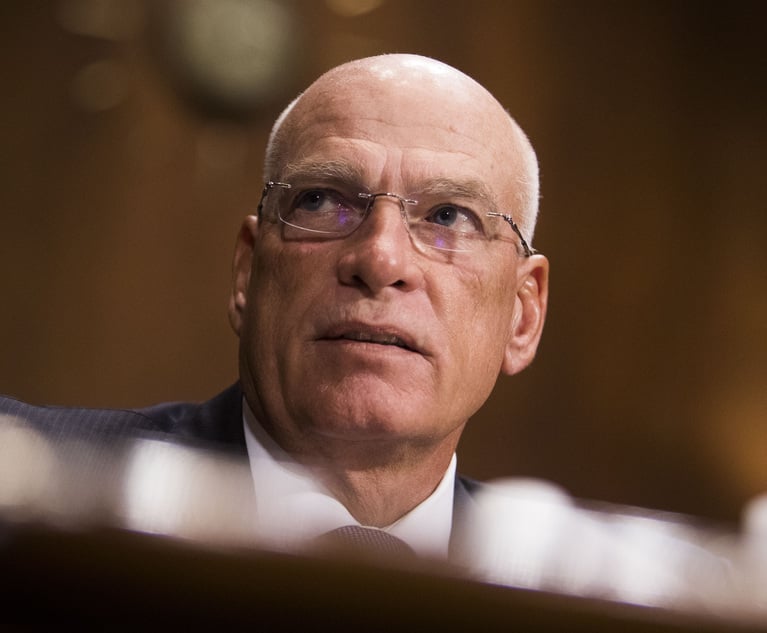

Patrick P. Dinardo is a partner with Sulivan & Worcester in Boston, and co-director of the firm's Litigation Department. Jeremy B. Siegfried is an associate at the firm, representing investment banks, hedge and private equity funds, and individuals in white collar and securities litigation matters and investigations.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Appropriate Relief'?: Google Offers Remedy Concessions in DOJ Antitrust Fight

4 minute read

'Serious Disruptions'?: Federal Courts Brace for Government Shutdown Threat

3 minute read

'Unlawful Release'?: Judge Grants Preliminary Injunction in NASCAR Antitrust Lawsuit

3 minute read

'Almost Impossible'?: Squire Challenge to Sanctions Spotlights Difficulty of Getting Off Administration's List

4 minute readTrending Stories

- 1Former McCarter & English Associate Fired Over 'Gangsta Rap' LinkedIn Post Sues Over Discrimination, Retaliation

- 2First-of-Its-Kind Parkinson’s Patch at Center of Fight Over FDA Approval of Generic Version

- 3The end of the 'Rust' criminal case against Alec Baldwin may unlock a civil lawsuit

- 4Solana Labs Co-Founder Allegedly Pocketed Ex-Wife’s ‘Millions of Dollars’ of Crypto Gains

- 5What We Heard From Litigation Leaders This Year

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250