Higher Law: Marijuana Makes Stimulus Bill—For Now | New Bankruptcy Dispute Unfolds | Headlines: Pro Golf and CBD | Who Got the Work

Welcome to Higher Law. This week we're looking at banking help, maybe, for marijuana businesses • a CBD company's fight for bankruptcy protection • pro bono effort to seal marijuana conviction records • pro golfers' support for CBD. Thanks for reading!

May 14, 2020 at 04:00 PM

9 minute read

Welcome back to Higher Law, our weekly briefing on all things cannabis. I'm Cheryl Miller, reporting for Law.com from Sacramento.

This week we're looking at banking help, maybe, for marijuana businesses • a CBD company's fight for bankruptcy protection • pro bono effort to seal marijuana conviction records • pro golfers' support for CBD

Thanks as always for reading. Have a practice announcement to share? Hosting a webinar? Got a great story idea? Send all the news my way at [email protected]. You can call me, too ,at 916.448.2935. Follow me on Twitter @capitalaccounts.

New Federal Aid Bill Includes Marijuana-Banking Protections, for Now

There's good news and bad news for marijuana companies in the latest COVID-19 relief package introduced by Democratic leaders in the U.S. House of Representatives.

>> The good news is the $3 trillion bill, dubbed the Heroes Act, includes language that would offer legal protections to banks that serve state-licensed marijuana businesses. The cannabis industry has been lobbying for similar legislation for years and cheered in 2019 when the Democrat-controlled House passed the SAFE Banking Act. Senate Republican leaders have since iced the bill.

Aaron Smith, executive director of the National Cannabis Industry Association, applauded the language's inclusion in coronavirus aid. "Our industry employs hundreds of thousands of Americans and has been deemed 'essential' in most states," Smith said in a prepared statement. "It's critically important that essential cannabis workers are not exposed to unnecessary health risks due to outdated federal banking regulations."

>> Now the bad news: The federal bill does not include any provisions allowing marijuana- and marijuana-related businesses–including law firms serving industry clients–to access small business loans or other aid programs. The International Cannabis Bar Association was among numerous industry players lobbying lawmakers to include state-legal marijuana operators in any new relief package.

"While larger, better capitalized players may be able to weather this storm, smaller cannabis businesses may not be able to do so absent some economic stimulus," said NORML political director Justin Strekal. "By continuing to deny these small businesses eligibility to [Small Business Administration] assistance, it is possible that we could see an acceleration of the corporatization of the cannabis industry in a manner that is inconsistent with the values and desires of many within the cannabis space."

>> Of course, there may be worse news ahead. Senate Republicans have scoffed at House Democrats' proposal. Marijuana Moment reported Tuesday that the Senate Republican Caucus called the marijuana-banking language part of House Speaker Nancy Pelosi's "political-pipe-dream of a bill" in a tweet. The tweet was later deleted. On Wednesday Texas Republican Senator Ted Cruz tweeted deridingly, too, about how many times the word "cannabis" appears in the bill.

"I'm not sure that the SAFE Act part of this bill will survive when the Heroes Act hits the Senate floor," Claudia Springer, chair of Reed Smith's cannabis law team, wrote in an email. "While this would certainly be a significant development with regard to cannabis enterprises, my guess is that Democrats will be willing to give this up if they can get other parts of the law that are really important to them."

>> Read the Heroes Act here. The National Cannabis Industry Association helpfully notes that cannabis banking language starts on page 1,066.

SPONSORED BY ALM PARTNERS

Personal Finance for Dummies, 9th Edition ($16.99 Value) FREE for a Limited Time

Take stock of your financial situation. From budgeting, saving, and reducing debt, to making timely investment choices and planning for the future, Personal Finance For Dummies provides fiscally conscious readers with the tools they need to take charge of their financial life. READ MORE

UCANN Tells Bankruptcy Judge It's All About CBD, Not Weed

Last week we wrote about Colorado CBD patent holder United Cannabis Corp.'s bankruptcy filing. U.S. Bankruptcy Judge Joseph Rosania Jr. was pondering whether to toss the case since federal law still says marijuana is illegal.

This week, UCANN's attorney, Aaron Conrardy of Wadsworth Garber Warner Conrardy argued in a filing that the company can indeed seek bankruptcy protection because it's all about hemp-derived CBD, not pot. True, Conrardy said, the company is a "passive investor" in Canadian medical marijuana company WeedMD. But those 87,000 shares are only worth about $25,000 and are "not necessary" to any reorganization plan.

Not so fast, Alan Motes, trial attorney for the U.S. trustee, wrote in response. UCANN, through its Prana Bio Medicinal line, sells products that contain THC. " In fact, the Debtors' main internet page promotes products containing THC," Motes wrote, referring to a screenshot showing product pictures and a description of products formulated from " THC-based cannabis strains." Motes also noted that UCANN owned a company with a 50 percent stake in land in Jamaica for which the company had sought a license to conduct cannabis research.

"Based on this public record, dismissal appears warranted," Motes wrote.

Rosania had not ruled as of Thursday morning.

Conrardy wrote that UCANN"s bankruptcy filing was prompted by a CBD price drop late last year, the COVID-19 pandemic and legal action by its largest creditor, Miner's Delight LLC.

Who Got the Work

>> Sharon Nelles and David Maxwell James Rein of Sullivan & Cromwell have entered appearances for global cannabis company Cronos Group Inc., Cronos CEO Mike Gorenstein and chief financial officer Jerry Barbato in a pending securities class action. The suit was filed March 12 in the U.S. District Court for New York's Eastern District by Rigrodsky & Long. The case is assigned to U.S. District Judge Joan Azrack.

>> Members of the Association of Corporate Counsel's Nevada chapter are working with the Legal Aid Center of Southern Nevada Inc. in a pro bono campaign to seal records for people with marijuana misdemeanor offenses and misdemeanor offenses for victims of sex trafficking, Corporate Counsel reports."The goal of this project partnering Legal Aid Center and ACC Nevada is to help vulnerable populations in Nevada regain dignity and employment in their lives," Krystal Saab, the immediate past president of ACC Nevada, said in an email

>> Reinhart Boerner Van Deuren filed a trademark lawsuit in the U.S. District Court for Wisconsin's Western District on behalf of Accelerated Analytical Inc. and Act Laboratories LLC, providers of testing services to growers of cannabis plants and manufacturers of cannabidiol products. The complaint targets Lifted Liquids Inc. and Nicholas Warrender. Counsel have not yet appeared for the defendants.

>> Gunster, Yoakley & Stewart removed a shareholder lawsuit against the managers of GrowHealthy Holdings LLC. The suit, related to GrowHealthy's acquisition by cannabis holding company iAnthus Capital Holdings, was filed by Searcy Denney Scarola Barnhart & Shipley on behalf of GHH co-founders Beverly Roberts and Craig Roberts, who opposed the merger.

In the Weeds… and on the Green

>> Some pro golfers are speaking out in support of CBD. "Their advocacy would appear to signal a growing acceptance of CBD use in the conservative world of professional golf, which has been slow to distinguish between recreational and medicinal use of marijuana-derived products." [NYT]

>> Help wanted: Budtenders. The nation's unemployment rate may be skyrocketing but marijuana companies in more than a half-dozen states report hiring thousands of workers despite the pandemic and accompanying economic downturn. "We've seen a surge in demand all over the country," Curaleaf CEO Joseph Lusardi said. "We're seeing more patients become registered every day and we're adding employees in just about every area of the business to meet the demand." [Politico]

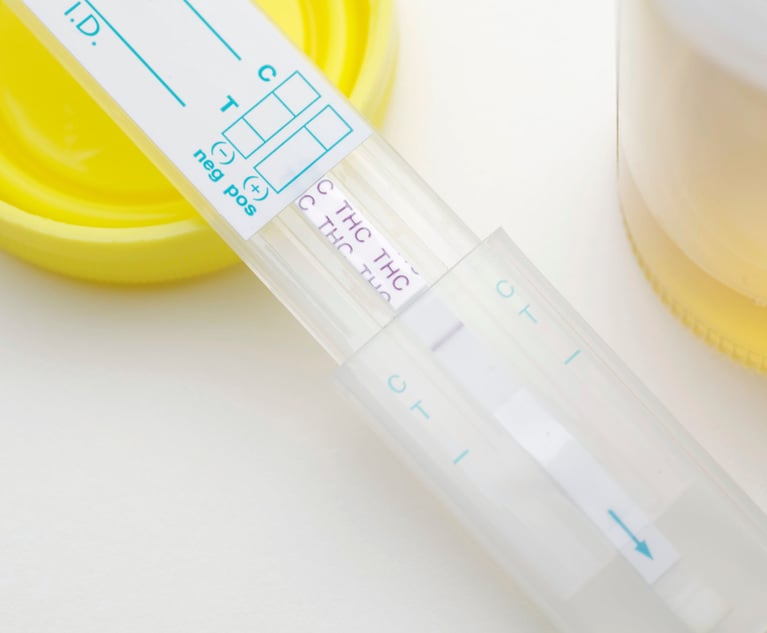

>> A worker fired after CBD use can collect jobless benefits. The occupational therapist was taking CBD oil to ease cancer symptoms when she tested positive for marijuana in a workplace drug test. A Commonwealth Court panel found that the woman's CBD oil use did not violate state law or her employer's rules and, thus, she can't be denied unemployment compensation. [PennLive]

>> COVID-19 aid for pot companies? No. CBD gummies-makers? Sure. "At least three specialty CBD vendors scored a total of over $4 million in federal loans in April, according to Securities and Exchange Commission filings reviewed by VICE News." State-licensed marijuana companies remain ineligible for small business loans, however. [VICE]

>> Maine opens the door to out-of-state marijuana investors. "The state and Wellness Connection of Maine reached a legal agreement Monday stipulating that the Office of Marijuana Policy will no longer enforce a residency requirement on those seeking an adult-use cannabis business license." Wellness Connection sued the state in March, challenging the residency requirement as an unconstitutional infringement on its right to interstate commerce. [Portland Press Herald]

The Calendar Things

May 14 - The Marijuana Industry Trade Association of Arizona hosts the virtual event "The Future of Arizona Adult Use." Scheduled speakers include Laura Bianchi and Justin Brandt of Bianchi & Brandt and Joe Keene of Sacks Tierney.

May 20 - Business Insurance presents the webinar "Cannabinoid Product Risk Management." Panelists include Arun Kurichety, executive vice president and general counsel of KushCo and Wilson Elser partner Ian Stewart.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

NY Cannabis Marketing Rulings / Rescheduling Effects / Honigman's Work on Trademark Suit / Goodbye

9 minute read

Workplace Weed and Labor Pacts / State AGs and Hemp / Maryland Licensing Suit / Vicente Sues Recruiter

9 minute readLaw Firms Mentioned

Trending Stories

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250