Inside Track: Lawyers Flocking to Fintech See Higher Calling

"Financial services is one of the largest industries on the planet, but until recently the way it operated had remained unchanged for decades," venture capitalist Satya Patel told Forbes.

December 09, 2021 at 09:30 AM

5 minute read

Welcome to Inside Track, a briefing from Law.com editor and reporter Greg Andrews providing insights that help in-house counsel navigate their rapidly changing world. Have an opinion? Email me here. Want to be alerted to this dispatch in your inbox every Thursday? Sign up here.

Kevin Smith, the newly appointed chief legal officer of fintech startup EquityBee, not only thinks his new employer is a promising business. In a small way, he hopes it makes the world a better place.

"I love working with smart, creative people building companies, products and services that add value to people's lives," he said of EquityBee, which connects employees who want to exercise stock options with the capital to do so. "Fintech companies in general are at the center of a really interesting Venn diagram where innovation in technology, law, policy and regulation overlap."

His zeal is everywhere in fintech these days, which helps explain why the sector is raising unprecedented billions in growth funding. Just through the first nine months of 2021, the fundraising haul was $91.5 billion, nearly twice the total for all of 2020, according to CB Insights.

The deluge of cash also helps explain why top attorneys from all kinds of backgrounds, including Fortune 500 firms, are racing to get in on the action. Opportunities especially abound in cryptocurrency, which is lawyering up in preparation for government regulation that industry leaders believe ultimately will fuel growth.

Oliver Linch, who last month left Shearman & Sterling in London to become general counsel of the crypto exchange Bittrex Global, summed up the new mindset.

"Bittrex Global feels that the regulated tortoise wins the race," he told Law.com's Hugo Guzman last month. "There's no advantage to playing fast and loose with anything. In fact, we want to be sure that we comply with and help shape the legal environment so that our users feel protected."

Crypto attorneys are in the driver's seat as they mull offers. As Tal Lifshitz, a partner with Kozyak Tropin & Throckmorton in Coral Gables, Florida, put it: "For the right people, the right level of experience, on a scale of 1 to 10, it's an 11."

The opportunities extend far beyond crypto, Satya Patel, co-founder of the venture capital firm Homebrew, told Forbes.

"Financial services is one of the largest industries on the planet, but until recently the way it operated had remained unchanged for decades," he said. "And because of that, there are huge segments of the population that are underserved or ignored by current financial services players. Fintech is changing all of that by decreasing costs, increasing access and improving experiences for financial products and services."

Just this year, 200 fintech companies have achieved unicorn status, meaning they have achieved valuations topping $1 billion, according to CB Insights.

One of those was New York-based Current. It was launched by former Morgan Stanley currency trader Stuart Sopp in 2015 with the stated aim of making banking more accessible. The company says its platform provides members "greater stability, faster money and cost efficiencies."

Current in April raised $220 million, which boosted the company's valuation to $2.2 billion.

Not surprisingly, top legal talent is jumping aboard. In September Jodi Golinsky quit as associate general counsel of the Canadian e-commerce firm Shopify to become Current's first general counsel.

In another big fintech hire this fall, Adam Schuman, the "Wolf of Wall Street" prosecutor and partner at Perkins Coie, left Big Law to become general counsel of Menai Financial Group. Menai is a digital asset investment and trading company founded by former Morgan Stanley co-president Zoe Cruz.

Like many in fintech, Schuman strikes an evangelical tone.

"I look forward to supporting Menai in delivering a reliable and secure infrastructure to create better institutional-grade access to the digital asset space and help accelerate the democratization of finance," Schuman said.

Of course, some of the fintech startups will soar, while others will falter or outright fail. So legal jobs in the tumultuous sector aren't for everyone.

But those with a sense of adventure are excited to buckle up for the ride.

As Bittrex Global's Linch put it, "The joy of a job like this is I can't tell you what comes next, because I don't know where the business opportunities are going to take us."

Reading List

>>Corporate legal department spending increased, albeit slightly, heading into 2021, HBR Consulting's latest law department survey found. Survey editor Lauren Chung told Law.com's Phillip Bantz that's pretty good, considering the pandemic. "What was surprising and really positive for the industry more broadly is that law departments are still in the mode of investing versus cutting back," she said.

>>Legal chiefs' broadening job responsibilities are underscoring the importance of "soft skills," such as emotional intelligence, communication and teamwork, Law.com's Trudy Knockless reports. Stephanie Corey, co-founder of UpLevel Ops, drilled the point home: "I have yet to see a successful leader who is a poor communicator, fails to recognize their teams, and who lacks influence."

>>Six Flags Entertainment Corp. eliminated its general counsel role, a move that is leading to the departure of Laura Doerre after 20 months in the job, I reported over the weekend. A company spokeswoman said the job elimination was part of a reorganization intended to reduce management layers, not cut costs.

>>Law360 profiles the three ex-Big Law attorneys who are trying to solve the Major League Baseball lockout.

>>The Guardian explores whether Twitter's new privacy policy goes too far.

>>U.S. Rep. Zoe Lofgren, a Democrat fighting antitrust bills that target Big Tech, is the mother of Google in-house counsel Sheila Zoe Lofgren Collins—a tie some observers find problematic, the New York Post reports.

NOT FOR REPRINT

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Legal Departments Gripe About Outside Counsel but Rarely Talk to Them

4 minute read

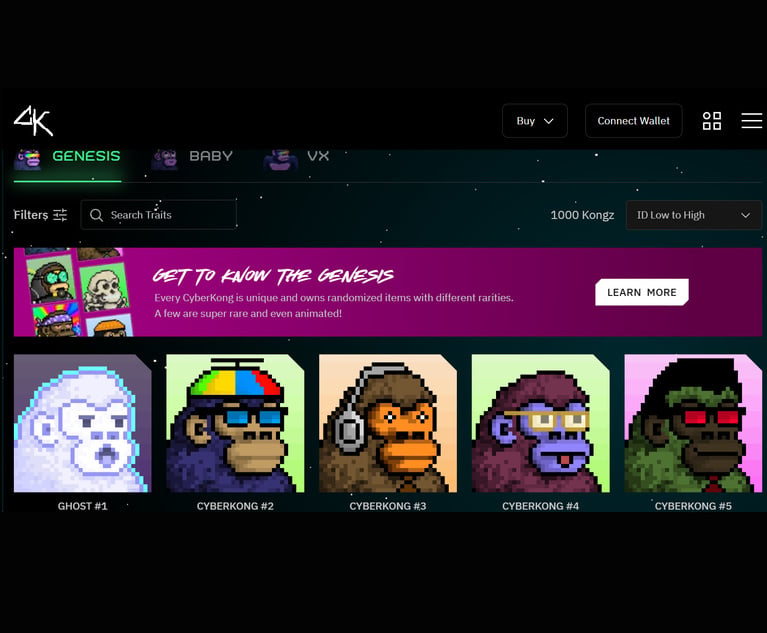

‘Badge of Honor’: SEC Targets CyberKongz in Token Registration Dispute

3 minute read

FTC, DOJ Withdrawal of Antitrust Guidelines for Collaboration Infuriates Republicans

5 minute readLaw Firms Mentioned

Trending Stories

- 1Call for Nominations: Elite Trial Lawyers 2025

- 2Senate Judiciary Dems Release Report on Supreme Court Ethics

- 3Senate Confirms Last 2 of Biden's California Judicial Nominees

- 4Morrison & Foerster Doles Out Year-End and Special Bonuses, Raises Base Compensation for Associates

- 5Tom Girardi to Surrender to Federal Authorities on Jan. 7

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250