Aligning Partner Compensation to Actual Contribution

As new compensation allocations take effect in the new year, firms should ensure they are paying partners in accordance with their true economic contributions.

October 30, 2017 at 01:30 PM

7 minute read

Shutterstock

Shutterstock

As we approach year-end and another compensation cycle, it's appropriate to step back and think about how individual partner compensation is determined. At many firms, there is a natural tendency to base this year's comp on last year's, plus or minus an adjustment based largely on the firm's financial performance. This is entirely understandable. However, there's an inherent danger: what if a partner's annual increases have been slightly above those justified by the economics of their practice so that the compounded effect is to have compensation significantly above that warranted by contribution? Or if a valuable partner's compensation has grown year-by-year at a rate below that of the increase in their economic contribution so that now there's a sizeable gap that makes them a flight risk?

For these reasons, it behooves compensation committees to take stock of partners' economic contributions relative to their compensation now before the compensation process gets into high gear. This is not to say that compensation committees should link a partner's compensation exclusively to economic contribution. There are multifarious factors beyond the profitability of a partner's practice that come into play in determining a partner's compensation. Nonetheless, profitability must play an important role if a firm is to be fair to partners and to not defections of high-performing partners to rivals prepared to pay closer to the economic contribution of a practice.

The challenge is in how to do so. Simple profitability measures that work in other businesses don't work in law for two reasons: partner compensation can be viewed as both profit and expense; partner roles can be viewed as both to originate (i.e. be the salesforce) and to execute (i.e. be the production group).

There is a way to cut through these dualities. It is to look at the “balance of trade” in margin, that is to look at contributions to firm profits from each partner's practice relative to allocations from firm profits through compensation. Views of this balance of trade from origination and execution perspectives can be overlaid to allow leaders to assess comprehensively the compensation of individual partners.

Balance of trade in margin

Law firms all follow the same financial model: partners generate margin from their practices; the total margin generated by all partners is used first to cover overhead costs with the remainder becoming the firm profit pool; this pool is ultimately distributed back to partners as compensation.

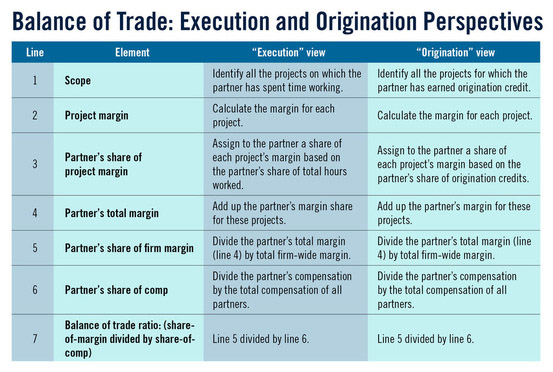

For every partner at a firm, one can look at the margin that partner's practice generates as a percentage of the total margin generated by all partners; similarly, one can look at a partner's compensation as a percentage of the total compensation of all partners. These percentages contrast the partner's relative contribution to, and allocation from, the firm profit pool. The ratio of the two, i.e. the ratio of share-of-margin to share-of-comp, can be thought of as a balance of trade in margin: for ratios above one, partners are contributing more than they're taking; for ratios below one, they're taking more than they're contributing. The ratio can be looked at from both origination and execution perspectives, see Table 1.

There are some subtleties with the methodology worth noting. One has to do with how contribution is calculated, specifically that it is based on a margin determined as realized revenues net of the direct cost of the lawyers working on the project rather than net of fully-loaded costs. The reason for this is that the partner controls the level of seniority of the professionals deployed on the project, and their time commitment, but does not control support personnel wages, office costs, and firm-wide overhead. Including cost elements beyond a partner's control in a measure for which the partner is considered to be responsible misaligns responsibility and control, a sure way to engender frustration.

Another subtlety is in why the methodology looks at share of margin and share of comp rather than at the absolute dollar amounts of each. This is primarily because looking at aggregate dollar numbers can be misleading (e.g. the contribution number does not reflect all costs) and hard to grasp (aggregate numbers have no context; percentages are more natural). Looking at percentages helps too as they are comparable year-to-year in a way that dollars are not because of inflation, growth in the number of partners, changes in overhead levels, etc.

Lastly, it's worth noting that the methodology can be refined by, for example, excluding the margin contribution and compensation for partners in firm-wide leadership roles, those recently promoted, recent lateral hires, and calls on the profit pool to fund pension plans, etc.

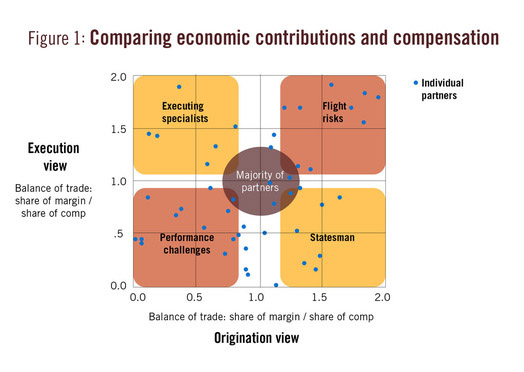

By overlaying the balance of trade of individual partners from origination and execution perspectives on a chart, as shown in Figure 1, compensation committees can get a comprehensive view of how a partner's economic contribution aligns with their compensation. Each point on the chart represents an individual. The majority of partners will cluster near the center of the grid, where the balance of trade in margin on both views is between 0.7 and 1.3. There will also be some natural outliers; for example, partners with primarily execution roles will show in the top left as having a high balance of trade (ratio above one) on the execution (vertical) axis but a low balance of trade (ratio below one) on the origination (horizontal) axis. Similarly, senior statesmen—partners who maintain broad trusted-adviser relationships with clients from whom they source work that they route to others to execute—will show in the bottom right, i.e. with balances of trade that are high from the origination perspective but low from the execution perspective.

The areas that typically require leaders' attention are the top right and bottom left quadrants. The former are partners who are generating significantly more margin than they're taking home in compensation, from both origination and execution perspectives, and are thus high flight risks. The bottom left group has the opposite balance of trade—contributing less than they are taking from both origination and execution perspectives. For both these cases, leaders can use the balance of trade methodology to identify separately the changes in practice economics and compensation that would be required to restore balance. There is, of course, a real-world linkage between these two quadrants: while compensation changes in the lower left quadrant can be especially challenging as there may be highly-respected long-tenured partners in the quadrant. However, it's necessary to address these situations to have the capacity to mitigate the flight risk of high-performance partners in the top right quadrant.

In a legal market increasingly characterized by aggressive competition between law firms for the most commercially-successful partners, getting partner compensation right is profoundly important and arguably the highest-responsibility of any firm's leadership. Being more analytical and more informed can only help, even when it requires rethinking how one looks at the economic fundamentals.

Hugh A. Simons, Ph.D., is an ALM Intelligence Fellow. He is a former senior partner and chief financial officer at The Boston Consulting Group and former chief operating officer at Ropes & Gray. The ALM Intelligence Fellows Program is a collaboration between ALM and leading thought leaders in the legal industry. The program aims to foster the development of data-driven research on key topics related to the business of law.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Strategic Pricing: Setting the Billable Hour at the Intersection of Psychology, Feedback and Growth

'Rethink Everything' or 'Optimize What's Working'? The Right Law Firm Strategy

7 minute readTrending Stories

- 1We the People?

- 2New York-Based Skadden Team Joins White & Case Group in Mexico City for Citigroup Demerger

- 3No Two Wildfires Alike: Lawyers Take Different Legal Strategies in California

- 4Poop-Themed Dog Toy OK as Parody, but Still Tarnished Jack Daniel’s Brand, Court Says

- 5Meet the New President of NY's Association of Trial Court Jurists

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250