For Alternative Providers, Your Biggest Client Is Their Biggest Opportunity

Large law firms should learn from the growth of alternative legal service providers, according to a new survey by the Corporate Legal Operations Consortium.

November 14, 2017 at 05:55 PM

7 minute read

At conferences or in conversation, the growth of an organization called CLOC, the Corporate Legal Operations Consortium, is often referenced as a data point to show how quickly the legal marketplace is changing.

The story is often as simple as this: CLOC's first annual conference last year drew 500 attendees. That number doubled this year to around 1,000. Many expect the gathering could double again next year.

But what does CLOC actually say about the rate of change in the legal marketplace? The group released a survey on Monday that shows some changes in the market, such as the use of alternative legal service providers, are not yet evenly distributed. But there is a warning sign for law firms in the data: The largest companies are the most receptive to using new ways to solve their legal problems.

A study of 156 companies showed about 65 percent had never used an alternative legal service provider, such as Axiom Global Inc. or Elevate Services Inc. (the two most popular among respondents that had used an “ALSP”). While that number caught some by surprise, including Elevate founder and executive chairman Liam Brown, there is an important caveat: Fortune 500 companies are much more likely to use an alternative provider.

Among the Fortune 500 companies that responded to the CLOC survey, 46 percent had used at least one alternative provider. Only 29 percent of non-Fortune 500 companies had done the same. There is a clear trend that the larger the company, the more likely it has contracted with an alternative provider of legal services.

Among companies with $10 billion or more in revenue, 42 percent had used an ALSP. That number was 32 percent of companies that have between $1 billion and $9.9 billion in revenue; and 24 percent for companies under $1 billion in revenue. In other words, the biggest clients represent the biggest opportunity for companies like Axiom and Elevate.

Connie Brenton, CLOC chairman and chief of staff and director of legal operations at Sunnyvale, California-based data management company NetApp Inc., said the study represents a baseline figure she expects will continue to grow, especially with the largest companies leading the way.

“When a Fortune 500 GC sees that 46 percent of their peers have leveraged [a legal service outsource firm], it is not risky any longer,” Brenton said.

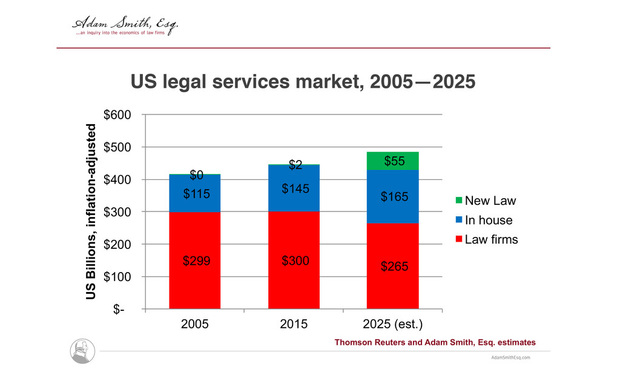

Bruce MacEwen, president of Adam Smith Esq. and a consultant to law firms, expects the market for “new law” services such as those offered by Elevate and Axiom to drive the most growth in the U.S. legal services market during the next decade. MacEwen predicts a market that was worth some $2 billion in 2015, according to Thomson Reuters Corp., will grow to $55 billion by 2025.

That growth will come at the expense of U.S. law firms, which MacEwen predicts will see their revenue fall to $265 billion in 2025 from $300 billion in 2015. Citing the CLOC survey's statistic of one-third market penetration for ALSPs, MacEwen said that figure would likely grow to one-half in the next year or two.

“This is the kind of thing [that] is accelerating very quickly,” MacEwen said.

Another survey released this week provided more evidence that legal vendors are gaining momentum in their competition for law department dollars.

Legal consultancy Altman Weil Inc. said that 20 percent of law departments increased their spending on legal vendors this year, compared to 12 percent who decreased it. Law firms, meanwhile, are facing more headwinds: 41 percent of departments cut their spending on firms, compared to 32 percent who increased it.

The Altman Weil survey also states that using vendors to outsource legal work is among the most effective means of generating efficiency gains. More than 73 percent of respondents who said they had outsourced work to an outside vendor said it resulted in a significant efficiency improvement. Even so, the study states that it was a tactic used sparingly (by 19 percent of respondents), and more often by the largest companies (38 percent of respondents with 51 or more in-house lawyers had outsourced work).

Elevate's Brown, who also founded alternative service provider Integreon Inc., said his company is most often hired by larger companies. But he also sees smaller companies interested in some of Elevate's services, mostly its technology offerings.

Brown said he expects the lines will gradually blur between law firms and “law companies”—his term for ALSPs—with the two more frequently working together. One example of that came when Elevate teamed up with Toronto-based contract review company Kira Systems Inc. to help Baxter International Inc. spin off its Baxalta biotech division.

Elevate contracted with Kira to identify contracts that needed review and developed a workflow to do that, which ultimately saved $500,000 and more than 5,000 hours of review time. But Brown credited a Baker McKenzie partner who worked with Baxter as being crucial to the work.

“The real thing was the partner at the firm was happy to be innovative and go along with that workflow,” Brown said.

He expects the broader “blurring” between companies like Elevate and global legal giants like Baker McKenzie to occur within the next 10 years.

“I don't think it will happen quickly,” Brown said. “Most corporations will use law firms and law companies somewhat interchangeably with their own internal law department. And they will simply figure out what is the best portfolio of resources. Where do we need expertise? Where do we need hands doing the work?”

New York-based Axiom, which ranked in the CLOC survey as the second most commonly used ALSP (by 8.3 percent of respondents) behind Los Angeles-based Elevate (9 percent), said it worked with 25 percent of Fortune 500 companies in 2016. In its 17-year history, Axiom has worked with more than half of the Fortune 100, including companies like Dell Technologies, Johnson & Johnson and Kraft Foods, the latter of which is now known as Kraft Heinz Food Co.

“When we talk to the Fortune 500 about their legal needs, we see a lot of excitement for an ALSP like Axiom to get legal work done more efficiently, more seamlessly and at scale,” said Jessica Hunt, global head of marketing and strategy at Axiom.

One of CLOC's broader long-term goals is to change U.S. regulations around the unauthorized practice of law and ownership rules of law firms. Loosening those restrictions, CLOC leaders said, would help both law firms and alternative service providers.

Brenton and Jeffrey Franke, senior director of global legal operations at Yahoo Inc., said alternative providers are much more data-driven and focused on cost than law firms. The latter, meanwhile, are somewhat inhibited by the partnership model from investing in technology that clients are demanding.

“It creates some serious disincentives and some seriously non-optimal mechanisms for decision-making,” Franke said. “For example, investing in technology in a partnership when you're going to zero-out the dollars at every year does not really lead to long-term planning and thinking.”

Interested in change in the legal marketplace? Email [email protected] to sign up for “The Law Firm Disrupted,” a new email briefing from Law.com and The American Lawyer. Written once a week by reporter Roy Strom, the newsletter keeps you in the know about the evolving legal services landscape.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Will a Market Dominated by Small- to Mid-Cap Deals Give Rise to a Dark Horse US Firm in China?

'Ridiculously Busy': Several Law Firms Position Themselves as Go-To Experts on Trump’s Executive Orders

5 minute read

The Law Firm Disrupted: For Office Policies, Big Law Has Its Ear to the Market, Not to Trump

Trending Stories

- 1Treasury GC Returns to Davis Polk to Co-Chair White-Collar Defense and Investigations Practice

- 2Decision of the Day: JFK to Paris Stowaway's Bail Revocation Explained

- 3Doug Emhoff, Husband of Former VP Harris, Lands at Willkie

- 4LexisNexis Announces Public Availability of Personalized AI Assistant Protégé

- 5Some Thoughts on What It Takes to Connect With Millennial Jurors

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250