2017 Saw Dip in Securities Class Settlements

Settlement values for securities class actions and the legal fees they produced dropped to levels not seen since the early 2000s, according to a new report.

January 31, 2018 at 11:00 AM

5 minute read

New York Stock Exchange.

New York Stock Exchange.

Following a banner year for high-dollar securities class action settlements in 2016, plaintiffs lawyers who represent investors in such cases had a less lucrative 2017, with settlement values and legal fees dropping to lows not seen in more than a decade, economic consulting firm NERA said in a new report.

NERA Economic Consulting released its year-end review of trends in securities class actions on Monday, reporting that the average settlement value for securities suits was $25 million in 2017—less than half what it was in 2016. When adjusted for inflation, the average settlement value in 2017 was the lowest that figure has been since 2001, NERA said.

Those settlement values translated to smaller payouts of fees and expenses to plaintiffs lawyers involved in the cases, who took in a collective $467 million in 2017—the lowest amount since 2004, according to NERA.

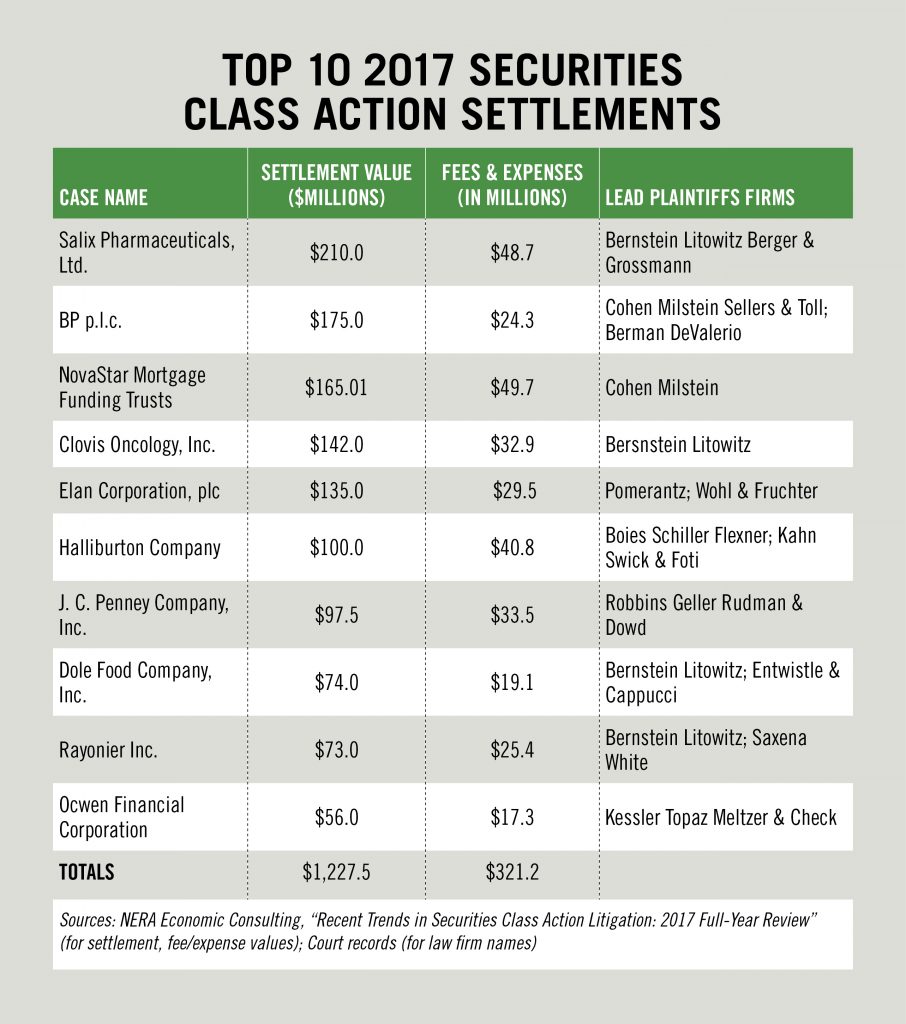

(see below for chart of top 2017 securities class action settlements)

The picture was very different in 2016, when plaintiffs lawyers took in just shy of $1 billion, according to an analysis done in June by The American Lawyer. That analysis, based on a separate report by Securities Class Action Services—a division of Institutional Shareholder Services Inc.—also showed that certain law firms, including Bernstein Litowitz Berger & Grossmann and Robbins Geller Rudman & Dowd, repeatedly served as lead counsel in some of the largest securities class action settlements ever.

Those two firms also appeared as lead counsel in the top 10 settlements struck in 2017, according to NERA's report and court records. Bernstein Litowitz was involved as lead or co-lead counsel for investors in four of the 10 largest settlements of 2017—extracting, in those cases, settlement payments worth $499 million from companies such as Salix Pharmaceuticals Ltd., Clovis Oncology Inc., Dole Food Co. Inc. and Rayonier Inc. Those four cases resulted in legal fees and expenses totaling $126.1 million, NERA said. Bernstein Litowitz had co-counsel in two of the cases—Entwistle & Cappucci in the Dole case and Saxena White in the Rayonier case.

Other law firms behind the top securities settlements of 2017 include Cohen Milstein Sellers & Toll, which served as co-lead counsel alongside Berman DeValerio in a $175 million settlement with BP plc, and as lone lead counsel in a $165 million settlement on behalf of NovaStar Mortgage Inc. investors.

Boies Schiller Flexner, an Am Law 200 firm that does some plaintiffs' side work in addition to its defense-focused work, also appeared among the top securities settlements in 2017, guiding Halliburton Co. investors to a $100 million settlement with co-lead counsel from Kahn Swick & Foti. The Halliburton case resulted in legal fees and expenses of $40.8 million, according to NERA.

Despite lower-than-normal settlement values overall, NERA noted that its 2017 figures didn't take account of at least one massive settlement reached just after 2017 ended. That deal, worth $2.95 billion, was made public in January and resolves securities litigation arising out of the corruption and bribery scandal that has plagued Brazil's state-owned energy company Petrobras. Pomerantz serves as lead counsel for investors in that class action.

Following the NERA report, Cornerstone Research, another organization that tracks securities litigation trends, on Tuesday issued its annual look at securities lawsuits. Among other findings, Cornerstone said that 412 new securities class actions were filed in 2017—a 52 percent uptick over 2016 and more than double the average from 2007 to 2016.

Cornerstone's report also takes a closer look at trends related to lead plaintiffs and the law firms that represent them, finding that since 2013, a larger share of individuals—as opposed to public pension funds and other institutional investors—served as lead plaintiffs in securities cases. That stands in contrast to the period from 2004 to 2012 when institutional investors were either more likely or equally likely to be named lead plaintiff.

Cornerstone attributes that trend, in part, to “a shift in litigation strategies by some plaintiff law firms.” For lawsuits filed in 2017, the report found, roughly 60 percent were led by individual plaintiffs, while institutional investors were lead plaintiff in about 35 percent of filings.

The report also highlights three firms—The Rosen Law Firm, Pomerantz and Glancy Prongay & Murray—which Cornerstone said have been responsible for more than half of the initial securities complaints filed in court over the past four years. In 2016, for example, those firms filed 66 percent of initial complaints, although they were appointed lead counsel only 36 percent of the time, according to Cornerstone.

“These firms have been largely responsible for … the increasing frequency of the appointment of individuals, rather than institutional investors, as lead plaintiff,” the Cornerstone report said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Ridiculously Busy': Several Law Firms Position Themselves as Go-To Experts on Trump’s Executive Orders

5 minute read

Why U.S. Big Law Was Mostly Sidelined in Asian IPOs in New York Last Year

Trump RTO Mandates Won’t Disrupt Big Law Policies—But Client Expectations Might

6 minute read

Trump's RTO Mandate May Have Some Gov't Lawyers Polishing Their Resumes

5 minute readTrending Stories

- 1On The Move: Ex-Partner Returns to Lead Nelson Mullins Corporate Group, Burr & Forman Hires University GC as COO

- 2Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

- 3SEC Revokes Biden-Era Crypto Accounting Guidance

- 4CNN's $16M Settlement With Trump Sets Bad Precedent in Uncertain Times

- 5Regulating Charities: A Small Suggestion

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250