Akin Gump Boosts Partner Profits as Deals, Lobbying Spur Gains

“In every way that you are measuring success in a law firm, we had a very strong year,” said Akin Gump chair Kim Koopersmith.

February 05, 2018 at 05:21 PM

4 minute read

Akin Gump's Kim Koopersmith.

Akin Gump's Kim Koopersmith.

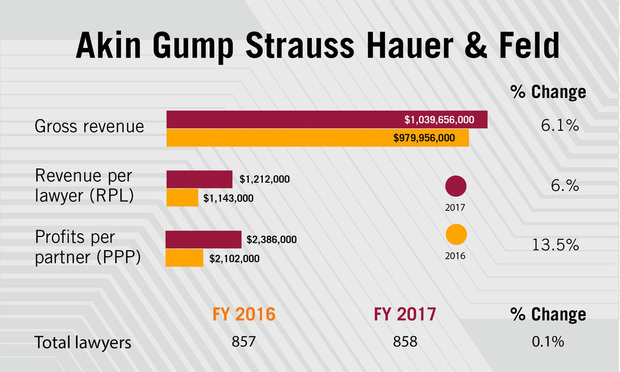

Akin Gump Strauss Hauer & Feld posted double-digit gains in profits per partner in 2017, increasing its average payouts by 13.5 percent to $2.4 million during another strong year for lobbying and dealmaking.

“In every way that you are measuring success in a law firm, we had a very strong year,” said Kim Koopersmith, the firm's chair since 2013.

Gross revenues rose 6.1 percent last year to $1.039 billion, and revenue per lawyer was up 6 percent to $1.14 million. The 858-lawyer firm boasted 195 equity partners in 2017, one short of the previous year.

The firm was the 29th largest U.S. law firm by revenue in The American Lawyer's 2016 and 2017 Am Law 100 rankings. This year's ranking will be released in the magazine's May issue.

Akin Gump has continued to dominate the D.C. lobbying world. Open Secrets' rankings show it as the highest earner again last year, with $38.7 million in lobbying income in 2017. Lawmakers focused this year on health care and tax reform, issues for which the firm has a strong bench, and that helped fuel the lobbying income gains, Koopersmith said.

Akin Gump has continued to dominate the D.C. lobbying world. Open Secrets' rankings show it as the highest earner again last year, with $38.7 million in lobbying income in 2017. Lawmakers focused this year on health care and tax reform, issues for which the firm has a strong bench, and that helped fuel the lobbying income gains, Koopersmith said.

But Koopersmith stressed that Akin Gump's overall financial performance hinges on far more than its legislative-oriented practices.

“We are [a] very well-rounded firm,” she said. “Our corporate practice was on fire all yearlong.”

The firm's M&A lawyers advised VCA Inc. on its $9.1 billion sale to Mars Inc., 7-Eleven Inc.'s on its purchase of 1,030 Sunoco stores, Sanchez on its $2.3 billion joint-venture acquisition with Anadarko of assets in the South Texas Eagle Ford shale play, and LUKOIL on its $1.45 billion sale of a mining subsidiary.

Litigation victories last year included beating back class certification in a consumer class action against VIZIO Inc. and several wins in contested bankruptcy proceedings, such as for Hercules Offshore Inc. and Icelandic banks' bondholders. The firm prevailed in a multipronged, multiyear defense of the former AIG Inc. CEO Martin Sullivan, who, after the 2008 recession, had come under the scrutiny of Congress, the U.S. Securities and Exchange Commission and civil plaintiffs.

Akin Gump also continued to gain ground internationally, thanks in part to its late 2014 absorption of a high-profile restructuring team based in London and Frankfurt from the now defunct Bingham McCutchen, Koopersmith said.

“The Bingham acquisition has been extremely successful,” she said. It was “one of the smartest things” that the firm has done under her leadership, which began in 2013, she added.

In 2017, according to ALM Intelligence's Legal Compass' database, the firm added 10 lateral partners, including Obama administration officials Howard Sklamberg, the former deputy commissioner for global regulatory operations and policy at the U.S. Food and Drug Administration, and Kevin Wolf, former assistant secretary of commerce for export administration, as well as Courtney York, an M&A lawyer who came from Akin Gump's Texas rival, Baker Botts.

“We have our eyes open to see if there are ways for us to grow in London,” Koopersmith said.

For now, the firm remains smaller than it was when the financial crisis struck a decade ago. In 2008 the firm had 983 lawyers—125 more than it does now.

“What I have tried to focus on is wise strategic growth,” Koopersmith said. “The growth will come from us identifying client needs, not just because we have a desire to be big,” she said, adding: “I like what our firm looks like now.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Donziger Faces Criminal Contempt Prosecution Team at Seward & Kissel

Off the Salary Battlefield, Public Sector Struggles With Retention, Student Debt

6 minute readTrending Stories

- 1Decision of the Day: Judge Dismisses Defamation Suit by New York Philharmonic Oboist Accused of Sexual Misconduct

- 2California Court Denies Apple's Motion to Strike Allegations in Gender Bias Class Action

- 3US DOJ Threatens to Prosecute Local Officials Who Don't Aid Immigration Enforcement

- 4Kirkland Is Entering a New Market. Will Its Rates Get a Warm Welcome?

- 5African Law Firm Investigated Over ‘AI-Generated’ Case References

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250