Goodwin Procter revenue reaches record high to clear $1bn

Am Law 100 firm sees PEP hit $2.15m as global revenue hits $1.032bn; London office brings in $36m

February 13, 2018 at 07:00 AM

4 minute read

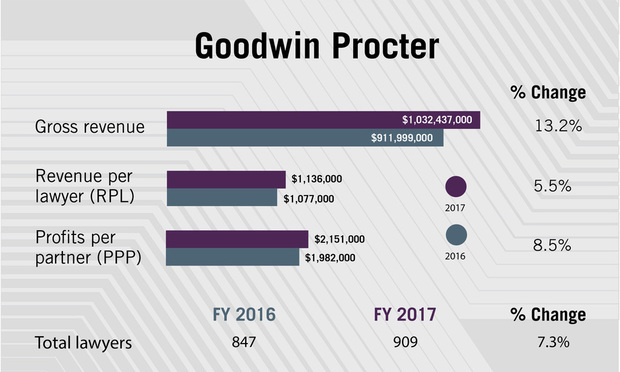

In its fifth consecutive year of financial growth, Goodwin Procter's gross revenue surged 13.2% to $1.032bn, in 2017, a record high for a firm that got its start more than 100 years ago in Boston.

And after dips last year in revenue per lawyer and profits per partner, Goodwin saw both metrics grow by 5.5% and 8.5%, respectively, to $1.136m and $2.151m, in 2017.

London office revenue for 2017 stood at $36.14m.

"We seem to be on a very good trend," joked chairman David Hashmall, who assumed leadership of the Am Law 100 firm in 2014.

In addition to across the board financial growth, Goodwin also grew its headcount 7.3%, from 847 in 2017 to 909 last year.

In addition to across the board financial growth, Goodwin also grew its headcount 7.3%, from 847 in 2017 to 909 last year.

Hashmall said the firm's strong financial performance last year was due to a combination of its investment in key cities, such as Paris, as well as its focus on expanding in six core practice areas: technology and life sciences; securities, white-collar litigation and regulatory matters; real estate capital markets; private equity; intellectual property litigation; and financial institutions.

"I think at the end of the day it's really paying dividends," said Hashmall of Goodwin's strategy, which included a mid-2016 rebranding of the firm as 'Goodwin'. (While the firm's official name remains Goodwin Procter, the latter half of that name has been dropped in marketing materials.)

Hashmall also noted that Goodwin's private equity practice, which late last year picked up two Paul Hastings partners in Hong Kong, saw 41 percent growth in 2017.

The firm, whose Asian operations have implemented a hiring program designed to attract individuals with myriad language skills, also brought on several lateral hires in key markets as a part of its strategic plan.

Goodwin Procter kicked off 2017 with the addition of Freshfields Bruckhaus Deringer litigation partners Marshall Fishman and Gabrielle Gould for its financial industry practice in New York. The firm also picked up Salil Gandhi, of counsel at Gunderson Dettmer Stough Villeneuve Franklin & Hachigian, as a partner for its technology companies group in New York.

Other high-profile lateral recruits included longtime Orrick, Herrington & Sutcliffe IP litigation partner Neel Chatterjee, brought on as part of Goodwin's plan to build out its technology litigation practice in Silicon Valley, as well as Anthony Alexis, a former enforcement director at the Consumer Financial Protection Bureau, to head the firm's consumer financial services enforcement practice from Washington, DC.

David Hashmall.

David Hashmall.Goodwin also had key roles on some of the largest deals of 2017. The firm's Bay Area base took the lead for underwriters on a $3bn initial public offering by Snap Inc, owner of the photo-sharing service Snapchat. A week later, the firm advised underwriters on a $300m IPO by Blue Apron Holdings Inc, a New York-based meal-kit delivery company.

"Putting aside the metrics of it, we think it was a great year as far as what we did for our clients," Hashmall said.

But beyond the deals and wins in 2017, Hashmall and Michael Caplan, Goodwin Procter's chief operating officer, said their firm is focused on working with their clients not just on their demand for legal services, but also their operational needs.

"We are hitting clients on both ends," Caplan said. "Both with the practice of law and the business of law."

Goodwin Procter works with clients on operational issues, whether that's implementing and testing new technology, marketing or business communications free of charge, which complements the firm's own high-growth practices such as private equity, real estate and technology and life sciences. Caplan said this serves to build a full-service partnership that has become a differentiator for client, while also demonstrating how the law remains a people- and relationship-driven business.

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

K&L Gates Sheds Space, but Will Stay in Flagship Pittsburgh Office After Lease Renewal

Trending Stories

- 1'It's Not Going to Be Pretty': PayPal, Capital One Face Novel Class Actions Over 'Poaching' Commissions Owed Influencers

- 211th Circuit Rejects Trump's Emergency Request as DOJ Prepares to Release Special Counsel's Final Report

- 3Supreme Court Takes Up Challenge to ACA Task Force

- 4'Tragedy of Unspeakable Proportions:' Could Edison, DWP, Face Lawsuits Over LA Wildfires?

- 5Meta Pulls Plug on DEI Programs

Who Got The Work

Michael G. Bongiorno, Andrew Scott Dulberg and Elizabeth E. Driscoll from Wilmer Cutler Pickering Hale and Dorr have stepped in to represent Symbotic Inc., an A.I.-enabled technology platform that focuses on increasing supply chain efficiency, and other defendants in a pending shareholder derivative lawsuit. The case, filed Oct. 2 in Massachusetts District Court by the Brown Law Firm on behalf of Stephen Austen, accuses certain officers and directors of misleading investors in regard to Symbotic's potential for margin growth by failing to disclose that the company was not equipped to timely deploy its systems or manage expenses through project delays. The case, assigned to U.S. District Judge Nathaniel M. Gorton, is 1:24-cv-12522, Austen v. Cohen et al.

Who Got The Work

Edmund Polubinski and Marie Killmond of Davis Polk & Wardwell have entered appearances for data platform software development company MongoDB and other defendants in a pending shareholder derivative lawsuit. The action, filed Oct. 7 in New York Southern District Court by the Brown Law Firm, accuses the company's directors and/or officers of falsely expressing confidence in the company’s restructuring of its sales incentive plan and downplaying the severity of decreases in its upfront commitments. The case is 1:24-cv-07594, Roy v. Ittycheria et al.

Who Got The Work

Amy O. Bruchs and Kurt F. Ellison of Michael Best & Friedrich have entered appearances for Epic Systems Corp. in a pending employment discrimination lawsuit. The suit was filed Sept. 7 in Wisconsin Western District Court by Levine Eisberner LLC and Siri & Glimstad on behalf of a project manager who claims that he was wrongfully terminated after applying for a religious exemption to the defendant's COVID-19 vaccine mandate. The case, assigned to U.S. Magistrate Judge Anita Marie Boor, is 3:24-cv-00630, Secker, Nathan v. Epic Systems Corporation.

Who Got The Work

David X. Sullivan, Thomas J. Finn and Gregory A. Hall from McCarter & English have entered appearances for Sunrun Installation Services in a pending civil rights lawsuit. The complaint was filed Sept. 4 in Connecticut District Court by attorney Robert M. Berke on behalf of former employee George Edward Steins, who was arrested and charged with employing an unregistered home improvement salesperson. The complaint alleges that had Sunrun informed the Connecticut Department of Consumer Protection that the plaintiff's employment had ended in 2017 and that he no longer held Sunrun's home improvement contractor license, he would not have been hit with charges, which were dismissed in May 2024. The case, assigned to U.S. District Judge Jeffrey A. Meyer, is 3:24-cv-01423, Steins v. Sunrun, Inc. et al.

Who Got The Work

Greenberg Traurig shareholder Joshua L. Raskin has entered an appearance for boohoo.com UK Ltd. in a pending patent infringement lawsuit. The suit, filed Sept. 3 in Texas Eastern District Court by Rozier Hardt McDonough on behalf of Alto Dynamics, asserts five patents related to an online shopping platform. The case, assigned to U.S. District Judge Rodney Gilstrap, is 2:24-cv-00719, Alto Dynamics, LLC v. boohoo.com UK Limited.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250