Ballard Spahr Revenue Up 3.4 Percent, PPP Up 5.6 Percent

In a year when it announced two significant mergers, Ballard Spahr was more profitable than expected.

February 20, 2018 at 05:16 PM

6 minute read

The original version of this story was published on The Legal Intelligencer

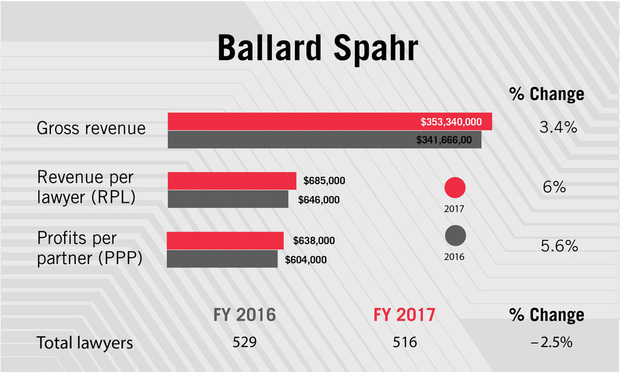

Ballard Spahr posted increases in both revenue and profits per partner last year, according to preliminary ALM reporting, while overall lawyer head count declined slightly from 2016.

The firm also announced two significant mergers in 2017, though the larger deal—with Minneapolis-based Lindquist & Vennum—did not take effect until this year.

Revenue increased by 3.4 percent in 2017, to $353.3 million, and revenue per lawyer rose 6 percent to $685,000.

Profits per equity partner rose 5.6 percent from $604,000, reaching $638,000 in 2017. Net income was flat at $139.6 million.

“It was better than we had expected, and I think even better from our perspective in light of the fact that we also were involved in two pretty significant transactions during the year,” said chairman Mark Stewart, noting the firm's merger deals with Lindquist & Vennum and media law boutique Levine Sullivan Koch & Schulz.

“When we made our projections we didn't know [those deals would happen],” Stewart continued. “It would have been understandable if there was some loss.”

While acknowledging rate pressures affected certain practices, Stewart said the firm exceeded its expectations in terms of PPP, and all practices were “up a little.”

Real estate was profitable, and the litigation practice was busy, he said, with an especially active year in the Delaware Chancery Court. And the firm's public finance group “had a huge fourth quarter,” Stewart said, due to changes in the tax law that left clients scrambling for answers.

Clients also sought to push through certain transactions before year-end as the proposed tax bill evolved in the fall, as they worried about how tax implications for those deals might change in 2018, Stewart said.

Ballard Spahr prepaid some of its own 2018 expenses, Stewart said, knowing they might not be deductible under new tax laws this year. And the firm took some efficiency measures, including updating its technology and project management. It also closed an office in San Diego, where “we weren't able to accomplish … what we wanted to accomplish.”

Merger Spree

Ballard Spahr had 516 lawyers in 2017, a decrease of 2.5 percent, while the partnership tier shrank by 5.2 percent to 219. The firm has no nonequity tier.

At the same time, the firm announced two mergers that added to its ranks.

As of Jan. 1, Minneapolis-based midsize firm Lindquist & Vennum merged into Ballard Spahr. The deal was announced just after Labor Day in 2017. Lindquist & Vennum had over 150 lawyers, and accounting for practices that separated from the firm before the merger became official, Ballard Spahr netted an additional 107 lawyers from the deal.

Less than two weeks later, Ballard Spahr announced another combination that was effective immediately, acquiring 25 lawyers from Levine Sullivan Koch & Schulz.

Those lawyers “rocketed the media practice to the very top,” Stewart said, referring to late 2017 performance. “While we had that practice [before the merger], it wasn't anything like what it is now.”

Stewart said already in 2017, the Levine Sullivan lawyers were creating business not just in their own practice area, but in others as well. And the addition has been helpful in attracting other potential lateral hires, he said.

“It's been a real pleasure to watch their reputation have an effect,” Stewart said.

The two deals came after a merger drought of sorts for Ballard Spahr, whose last significant combination was its 2013 acquisition of Stillman & Friedman, a white-collar and securities litigation boutique that provided Ballard Spahr entry into New York.

After the 2013 deal, Stewart said he told the firm its focus should be on strengthening existing practice groups through smaller group acquisitions.

For a while, “nothing came to me or to the firm that was so attractive that made me rethink that,” he said. “Then at our annual meeting in 2016, I changed my view a bit because it was really difficult to add a couple here and a couple there and get the impact we were looking for.”

Looking Ahead

Integration will be a top priority for 2018, Stewart said, and that started before the Lindquist & Vennum deal became official. So far, it's gone better than he expected, he said.

The firm has no major lateral hires on the table, Stewart said. But he did note that Lindquist & Vennum's strength in corporate transactions and litigation has made that a greater area of focus for the firm, which it might want to enhance in some markets like Atlanta. The white-collar practice will likely continue to grow, he said, and the real estate finance group in New York.

Predicting the effect of both mergers on 2018 financial results is tricky, Stewart said, and it's likely Ballard Spahr will have a flat year in terms of profits, even though revenue will grow.

“We're also trying to be honest with ourselves that the integration of two firms is not easy and there will be time lost to do that right,” Stewart said. “At the same time, there's not a day that goes by that I don't get a report that a former Lindquist person got a matter they would not have previously got because of our resources.”

Since September the firm has gotten more calls from law firms looking to combine, Stewart said, but there are no firm plans on future mergers. Still, the calls are “flattering,” he said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Faegre Drinker Adds Three Former Federal Prosecutors From Greenberg Traurig

4 minute read

Ex-Holland & Knight Attorney Improperly Accessed Client File to Gain Upper Hand in Divorce Proceedings, Suit Alleges

5 minute read

Trending Stories

- 1Pro Hac Vice in Georgia: Rule Change for Nonresident Attorneys

- 2The Benefits of E-Filing for Affordable, Effortless and Equal Access to Justice

- 3AI and Social Media Fakes: Are You Protecting Your Brand?

- 4A Primer on Using Third-Party Depositions To Prove Your Case at Trial

- 5‘Catholic Charities v. Wisconsin Labor and Industry Review Commission’: Another Consequence of 'Hobby Lobby'?

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250