Revenue Gains Propel Mayer Brown Past Pre-Recession Record

With a 4.2 percent jump in revenue in 2017, Mayer Brown became the latest law firm of its size to catch up to its own performance before the 2008 financial crisis.

February 21, 2018 at 02:58 PM

4 minute read

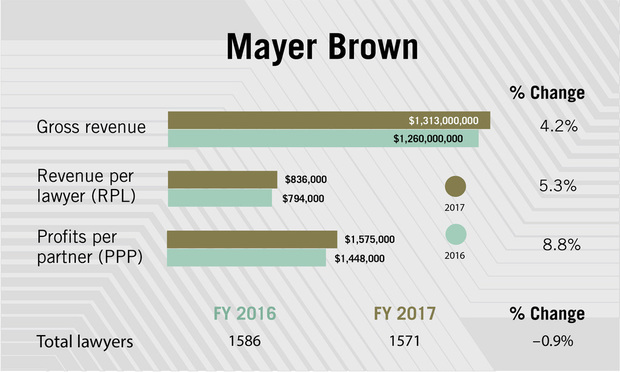

Mayer Brown had a record 2017, with revenue eclipsing the firm's pre-recession highs for the first time and profits per equity partner rising 8.8 percent to $1.575 million.

Revenue at the Chicago-founded firm grew 4.2 percent in 2017 to $1.313 billion, according to preliminary ALM data. The firm's lawyer and partner head count both narrowly declined, pushing revenue per lawyer up 5.3 percent over the prior year, to $836,000.

“2017 represented a continuation of a multiyear trend in deepening and improving our relationships with our clients and with one another,” said firm chairman Paul Theiss. “The result of that was a record financial year. And we thank our clients for that.”

Overall attorney head count declined 0.9 percent to 1,571, while the equity partnership contracted by 1.4 percent, for 292 partners last year. The modest declines came after a relative growth spurt in 2016.

Overall attorney head count declined 0.9 percent to 1,571, while the equity partnership contracted by 1.4 percent, for 292 partners last year. The modest declines came after a relative growth spurt in 2016.

Theiss, who has led the firm since 2012, said its performance across practices was relatively even, adding it “would be hard to pick out a particular practice area” that drove the firm's revenue and profit growth.

He did note, however, that the firm's international insurance practice had a record year in 2017. That practice recently added well-known litigator Robert Harrell from Norton Rose Fulbright in Houston. Brian McKenna, a corporate and securities partner the firm added from Debevoise & Plimpton in Hong Kong last month, also represents insurance companies.

Mayer Brown hired 18 lateral partners last year, compared to 49 in 2016. Notable 2017 additions include a real estate financing duo in Los Angeles, M. Scott Cooper and Daniel Liffmann, who joined from Sidley Austin. And the firm picked up three partners in Asia in August, two of whom came from Standard Chartered Bank Ltd., to co-lead a trade and structured finance practice in Asia.

Playing Catch Up

Mayer Brown has seen revenue growth for six straight years. And since Theiss took the reins in 2012, revenue has grown 20 percent and profits per partner are up 38 percent.

Nonetheless, it is one of the last law firms of its size to exceed revenue posted for fiscal year 2008, which was the pre-recession high-water mark for most firms.

Among the law firms to rank in the Am Law 20 last year, the only firm that took longer than Mayer Brown to reach its pre-recession revenue mark was Weil, Gotshal & Manges. Weil's revenue topped out in 2009 at $1.233 billion, and it beat that number for the first time in 2016, when it brought in $1.266 billion.

Among firms that ranked in the Am Law 20 in 2009—a club that included Mayer Brown with its $1.294 billion in revenue—there are only two firms that have failed to beat their revenue performance from that year. Those are McDermott Will & Emery and now-defunct Dewey & LeBoeuf, which collapsed in 2012. McDermott posted $966 million in revenue in 2008. Its best year since 2016 when it reached $908.5 million. (McDermott's 2017 revenue has not yet been reported.)

Theiss said Mayer Brown's performance ramped up through 2017, with the fourth quarter proving to be a better market—as many reports indicated.

“Certainly we saw increasing momentum through 2017, and we started out 2018 continuing that,” Theiss said. “We look forward to continuing to collaborate with our clients and grow those relationships. And if we're able to do that, then 2018 will be a successful year for us.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Holland & Knight Snags 2 Insurance Partners in New York and Philadelphia From Goodwin

3 minute read

Inside Gordon Rees' Repositioning From Insurance to Advertising and AI

Locke Lord Picks Up Sidley Insurance Lawyer, Thompson Coburn Cybersecurity Practice Leader

3 minute read

Paul Hastings Nabs Another Insurance Partner From Sidley

Trending Stories

- 1SurePoint Acquires Legal Practice Management Company ZenCase

- 2Day Pitney Announces Partner Elevations

- 3The New Rules of AI: Part 2—Designing and Implementing Governance Programs

- 4Plaintiffs Attorneys Awarded $113K on $1 Judgment in Noise Ordinance Dispute

- 5As Litigation Finance Industry Matures, Links With Insurance Tighten

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250