Nixon Peabody Sees Partner Profits Surge

With a continued focus on delivering better value to clients, Nixon Peabody saw gains in gross revenue and profits per partner in 2017.

February 22, 2018 at 06:17 PM

4 minute read

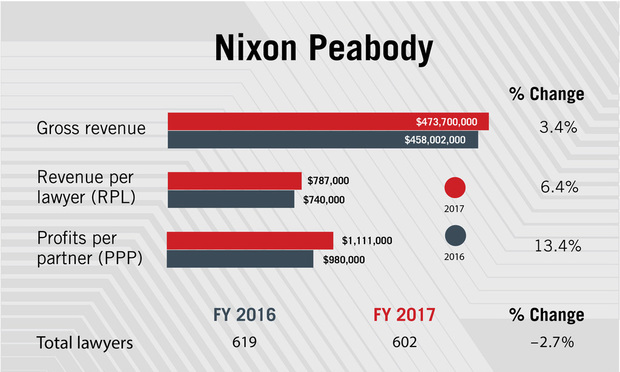

After a flat financial year in 2016, Nixon Peabody saw its top line grow 3.4 percent last year, to $473 million.

Revenue per lawyer at the firm, which as a result of a 1999 merger has its roots in Boston and Rochester, New York, grew 6.4 percent in 2017, to $787,000, up from $740,000 the year before. Profits per partner jumped 13.4 percent, to $1.1 million, up from $980,000 in 2016.

“We were very proud of our year,” said Nixon Peabody's CEO and managing partner Andrew Glincher, who assumed leadership of the firm in early 2011 after scuttled merger talks with Locke Lord.

Glincher attributed the firm's bolstered top line to organic growth fueled by a commitment to a strategy designed to deliver better value to clients.

“We had a great year because of strategic investments we've been making in our talent, in our focus on the marketplace, [making] our collaborations better,” Glincher said. “We're providing newer and better value to our clients in different ways.”

“We had a great year because of strategic investments we've been making in our talent, in our focus on the marketplace, [making] our collaborations better,” Glincher said. “We're providing newer and better value to our clients in different ways.”

Part of that investment was setting up an office in Raleigh, North Carolina, in October with the addition of four partners from K&L Gates. The opening of the outpost, Nixon Peabody's 13th office nationally and first in the southeastern U.S., was not initially a part of the firm's strategic plan, but a relationship with a $10 billion corporate client who wanted to use the firm more and more fueled its move to North Carolina's Research Triangle.

“That's how we want to grow … by client demand,” said Glincher, who declined to name the entity that lured Nixon Peabody to Tobacco Road. “Our best growth has been our clients wanting to increase their business and trust in us and that's worked out fabulously.”

Many of Nixon Peabody's offices had good years in 2017, said Glincher, noting specifically those in Boston, Chicago, Los Angeles and New York. (Nixon Peabody's Chicago office expanded three years ago after the firm absorbed local shop Ungaretti & Harris.) The firm saw growth across all of its practices, but most notably in corporate, real estate, M&A and litigation, the latter of which includes its white-collar and government investigations group, Glincher said.

Nixon Peabody had a role in representing Dutch soft drink bottler Refresco Group NV in its $1.25 billion purchase of Toronto-based soda manufacturer Cott Corp. The firm also advised longtime client Constellation Brands Inc., the spirits giant and owner of the Corona beer brand, on its $200 million purchase of a 9.9 percent stake in Smith Falls, Ontario-based Canopy Growth Corp., the world's largest publicly traded cannabis company.

Despite growth in its financials, the firm's total head count decreased 2.7 percent, to 602. The total number of equity partners also decreased 7 percent, to 133 in 2017, down from 143 the year before.

One of the firm's few lateral departures included the national leader of its intellectual property litigation practice, Russell Genet, who early last year decamped for a position as director for litigation financier Longford Capital Management LP.

Glincher said that Nixon Peabody has also worked over the last year to promote diversity initiatives across the firm.

“Diversity has also been at the top of my list—there's no goal that's more important,” said Glincher, noting that 40 percent of the firm's office managing partners are diverse, a group that includes its new Washington, D.C., managing partner Colette Dafoe.

In addition to the implementation of programs such as the Mansfield Rule and a RampUp program for parents, the firm has also worked in its community to promote diversity.

In October, Nixon Peabody's San Francisco office donated 2,300 square feet of its 16th floor and partnered with nonprofit LGBT business accelerator StartOut to launch the StartOut Growth Lab, where aspiring entrepreneurs can receive free legal advice and business know-how from the firm's lawyers.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Paul Hastings, Recruiting From Davis Polk, Adds Capital Markets Attorney

3 minute read

Goodwin Procter Relocates to Renewable-Powered Office in San Francisco’s Financial District

Greenberg Traurig Combines Digital Infrastructure and Real Estate Groups, Anticipating Uptick in Demand

4 minute readTrending Stories

- 1SurePoint Acquires Legal Practice Management Company ZenCase

- 2Day Pitney Announces Partner Elevations

- 3The New Rules of AI: Part 2—Designing and Implementing Governance Programs

- 4Plaintiffs Attorneys Awarded $113K on $1 Judgment in Noise Ordinance Dispute

- 5As Litigation Finance Industry Matures, Links With Insurance Tighten

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250