Debevoise Hits Record High Revenue, Profits Per Partner

Thanks to increased client demand, Debevoise & Plimpton saw gross revenue soar to $822 million and profits per partner jump to nearly $2.9 million, all-time highs for the firm.

February 26, 2018 at 03:26 PM

4 minute read

After a dip in profits in 2016, Debevoise & Plimpton rebounded in 2017 by posting new, all-time financial highs.

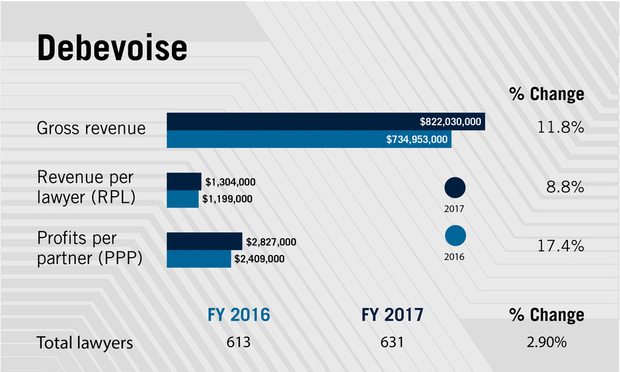

The Am Law 100 firm's gross revenue grew 11.8 percent last year, to $822 million, a record high for Debevoise. Profits per partner at the firm also hit a record high, jumping 17.4 percent in 2017, to $2.827 million, while revenue per lawyer grew 8.8 percent, to $1.304 million.

Debevoise presiding partner Michael Blair, who assumed leadership of the New York-based firm in 2011, said the significant financial growth of the firm was directly attributable to strong growth in client demand.

“It wasn't just one, two or three really big projects,” Blair said. “It was, to a remarkable degree, just an across the board increase in client demand that in the aggregate was the largest that we've seen in more than a decade.”

“It wasn't just one, two or three really big projects,” Blair said. “It was, to a remarkable degree, just an across the board increase in client demand that in the aggregate was the largest that we've seen in more than a decade.”

All of the firm's priority industry groups—banking, health care, insurance, private equity and technology, media and telecommunications—experienced an increase in client demand in 2017, as did Debevoise's offices across Asia, Europe and the United States, Blair said.

The firm's litigation practice also saw an uptick in civil litigation and international disputes, while on the transactional side Debevoise's capital markets and M&A practice also had an increase, Blair added.

Debevoise landed roles on some of 2017's most high-profile deals. The firm advised Tribune Media Co. on its $3.9 billion sale to Sinclair Broadcast Group Inc. It also advised Discovery Communications Inc. on its acquisition of Scripps Networks Interactive Inc., a transaction valued at $14.6 billion. The firm closed out 2017 by advising Time Inc. on its $2.8 billion sale to magazine publishing rival Meredith Corp.

In the health care arena, a budding practice for the firm, Debevoise represented Japan's Sawai Pharmaceutical Co. Ltd. on its $1.05 billion buy of Minnesota-based pharmaceutical manufacturer Upsher-Smith Laboratories Inc. The firm also advised private equity giant TPG Capital Management and fellow buyout firm Welsh, Carson, Anderson & Stowe on their $4.1 billion acquisition of Kindred Healthcare Inc.

Head count at the firm also increased 2.9 percent last year to 631 up from 613 the year prior. The number of equity partners at Debevoise also grew 3 percent, to 138. In 2017, Debevoise welcomed back a number of former lawyers following notable stints in public service.

Former litigation partners Andrew Ceresney and Mary Jo White both returned to the firm from the U.S. Securities and Exchange Commission. Ceresney, the former enforcement director at the SEC, rejoined Debevoise in March as co-chair of its litigation department. White led the SEC for four years under the Obama administration before heading back to Debevoise as senior chair and head of the firm's new strategic crisis response and solutions group.

“We established [the group] shortly after they came back to us,” Blair said. “[It] helps clients deal with large-scale crisis and that's the kind of work that [White] and [Ceresney] have done throughout their careers.”

Since its inception, the group has already advised on several high-profile matters, including assisting Wells Fargo & Co. on its annual self-assessment following several notable scandals. In late January, the National Football League retained White to lead an independent inquiry into Carolina Panthers owner Jerry Richardson. White also recently led a Debevoise team that handled an internal investigation for the University of Rochester into the school's response to a sexual harassment scandal. The firm reportedly received at least $4.5 million for that work, according to news reports.

Elsewhere on the lateral market front, Debevoise brought Kara Brockmeyer, another ex-SEC lawyer and former chief of the regulator's Foreign Corrupt Practices Act Unit, as a partner for its strategic crisis response, white-collar and regulatory defense groups in Washington, D.C. The firm also recruited Ropes & Gray corporate partner Paul Rubin to its health care practice in the nation's capital and picked up Clifford Chance insurance partner Clare Swirski in London.

Debevoise did also see some notable partner departures. In December, Kirkland & Ellis raided the firm for global investment management and funds head Erica Berthou and deputy corporate chair Jordan Murray.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Weil, Loading Up on More Regulatory Talent, Adds SEC Asset Management Co-Chief

3 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250