Why Elite Law Should Raise Rates

If law firms have the bargaining power to raise standard rates an average of 3 percent, and realize a rate increase of 2.5 percent, then do they have the power to raise rates at, say, 7 percent and realize a 5 percent increase?

February 26, 2018 at 12:07 PM

14 minute read

Elite law's self-confidence has taken a beating. First the great recession hit, and now talk of disruption abounds. But the recession is over and disruption is far from an existential threat. It's time for elite law to rediscover belief in the value it provides and start to raise rates as it did before the recession. Specifically, elite firms should:

- Raise rates across the board.

- Discount from the higher rates where necessary.

- Increase rates more for partners.

- Increase rates more for more distinct practices.

- Exit, or leverage up, practices where realized rates (i.e. after discounting) don't rise.

Raise rates across the board

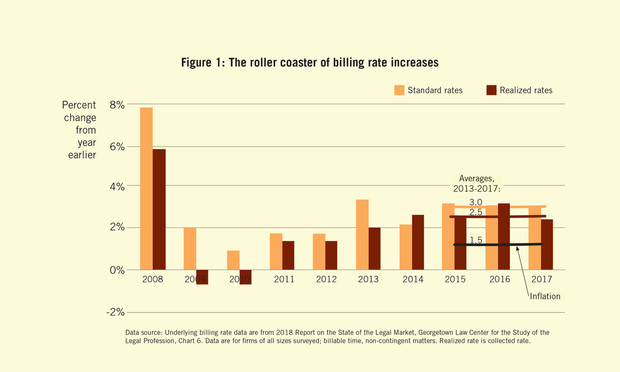

Billing rate increases have been on a roller coaster, see Figure 1. Before the onset of the great recession, standard rates rose 7 to 8 percent annually with realized (collected) rates rising 5 to 6 percent. When the recession hit, the standard rate increase dropped to between 1 and 2 percent and, as economics would predict, realized rates actually declined. Thereafter, things have steadily improved. The market now trundles along with standard rates rising at 3 percent and realized rates at 2.5 percent, comfortably above inflation at 1.5 percent.

The fact that realized rates have gone from declining to rising at a steady rate indicates that bargaining power has shifted back from clients to law firms. The question becomes: must the new steady-state rate of increase be lower than it was before the onset of the great recession? If law firms have the bargaining power to raise standard rates an average of 3 percent, and realize a rate increase of 2.5 percent, then do they have the power to raise rates at, say, 7 percent and realize a 5 percent increase?

Three conditions must be met for increasing rates to work for law firms. The first is that growth in the value clients derive from a firm's offerings should exceed the increase in rates. On this, the value a client derives is formally equal to the change in the risk-weighted expected value of the outcome of a client's business venture, or legal-proceeding, that results from the law firm's services. As the business world grows more uncertain, complex, and volatile, then services which mitigate these new risks create greater value for clients. Mitigating these emerging risks is what the leading-edge offerings of elite law firms do. Hence, these firms are at liberty to raise rates.

The second condition required for raising rates to be effective relates to competition. If Firm A raises rates and Firm B offers the same service at the pre-increase rate then, in theory, clients turn to Firm B. However, in the elite law world, firms' offerings are not that fungible—in the highly-specialized segments where elite firms play, there simply aren't that many viable “Firm B” providers. Even where there are other technically-capable firms, different firms offer different levels of reassurance because of clients' varying history and comfort with the idiosyncratic perspectives of individual lawyers. A related observation is that firms tend to raise rates at comparable rates. Thus, even where there is a viable Firm B, there may be little cost saving incentive for the client to switch firms.

The third condition is evidenced by the historical data: rate increases only stick when the economy is humming along. While there is always much uncertainty about the economy, and by historical standards we are overdue a recession, today's economic fundamentals look fairly robust. Firms should be assertive in benefitting from today's strong economic tailwinds, emboldened by the knowledge that they'll be buffeted by the headwinds when the economy turns.

The reason elite law firms have not been increasing rates assertively may have more to do with the emotional than with the rational. Elite law firms' belief in the value of the services they provide took a battering through the great recession, and gets beaten down daily by dire warnings of the industry's imminent disruption. But the recession has ended and disruption is not an existential threat to elite law firms. Nor is it an existential threat to the differentiated service lines within the portfolio of services offered by the broader group of preeminent firms. Yes, it'll hurt the commodity-only firms and commodity service lines within other firms, and it will require changes in how all firms operate, but it won't destroy the core of the elite law firm profit engine: big bucks for bespoke mitigation of major risks.

Discount from the higher rates where necessary

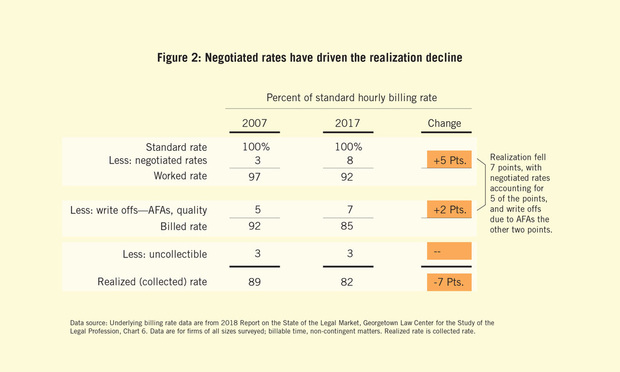

When I suggest raising rates assertively some partners respond that their clients won't pay any increase. True, some clients won't. But many will and many more will bear part of the increase. Thus, it's normal for an increase in standard rates to be accompanied by more discounting and hence a decline in realization (i.e. the ratio of realized, or collected, rates to standard, or rate card, rates). This is not of itself a problem as it's realized rates that drive a firm's economics. The important point is that, other than in the aftermath of a recession's onset, the effect of an increase in standard rates is a significant, albeit lower, increase in realized rates. For example, standard rates rose by 33 percent from 2007 to 2017 and, although realization declined from 89 to 82 percent, realized rates still rose by a healthy 22 percent.

It's instructive to take a closer look at the above realization decline. As shown in Figure 2, by far the biggest component of this decline was in the ratio of worked (i.e. negotiated or agreed) rates to standard rates—5 points of the 7-percentage point fall. This reflects growth of the volume of work being executed not at standard rates but at client or matter-specific discounted rates.

The dynamics of discounts are a competition between two irrationalities. On the one hand, clients have an irrational liking for discounts. They make clients feel they're getting a bargain and they're easy for the legal department to explain to management. The irrationality, of course, is that the focus should be on the discounted rate not on the distance between it and some putative standard rate.

On the other hand, firms have an irrational dislike for discounting. Too many firms still think of realization rate as a measure of profitability. It can be absurdly hard to get lawyers to internalize that, in order to assess profitability accurately, you have to look at the combined effect of leverage and realization using measures such as margin per partner hour. Indeed, higher-leverage and higher-discount work is often more profitable than lower-leverage and zero-discount work. But partners have been conditioned to think of discounts as a demerit, and partners hate demerits. This unhelpful conditioning gets reinforced by finance departments reporting on hours and realization but not on leverage or margin per partner hour.

The look at realization in Figure 2 also shows that two percentage points of decline are due to increased billing write offs. These write offs reflect quality-of-work issues and budget overruns. As quality issues are probably fairly constant, it's reasonable to attribute this increase to more budget overruns, in turn a reflection of more work being done under fixed, capped, or other alternative fee arrangements (AFAs). But here again, lower realization doesn't mean lower profitability—increased leverage can more than offset the realization decline. Indeed, over 70 percent of firms say AFAs are as profitable, or more profitable, than work billed at hourly rates, (data source: Altman Weil's 2017 Law Firms in Transition report).

Increase rates more for partners

Partners are often reticent to raise their own billing rates assertively. This is a problem of itself but also has severe second-order consequences. First, it effectively sets a cap on the billing rates of counsel and senior associates as there has to be headroom between their rates and those of partners. This becomes a constraint not just on revenue but on profitability. While typical businesses have their highest markup on their highest-value offerings, this billing rate cap leads many law firms to have a lower markup (i.e. the number of times a lawyer's billing rate exceeds their comp on a cost-per-hour basis) on senior associates and counsel than they realize on their relatively low-value junior associates. By compressing markups in this way, firms are leaving money on the table. There's consistent market feedback that indirectly corroborates this perspective: clients object most to the billing rates of junior lawyers.

Holding back on partner billing rates also makes it harder to raise leverage. Part of the reason some partners push back on raising their own rates is they feel some of the work they do is not truly partner level and hence shouldn't be billed at full partner-level rates. This underlying failure to delegate is a disservice to clients (by not letting the work flow to the lowest-priced lawyer capable of doing it), to associates (who are left bereft of experience), and to other partners (who contribute disproportionately to a firm's profit pool by leveraging more). Hence, part of the logic for raising partner rates is to realize the benefits of improved leverage.

Increase rates more for more distinct practices

If you offer customers something they need that you alone can provide then you can set the price close to the value they derive from your service. If, on the other hand, you offer customers something that many others offer, then you are constrained to pricing it at the level set by others. In reality, a law firm's various offerings fall at different points along a spectrum between these theoretical extremes. This simple observation has a pricing implication that many law firms effectively ignore: billing rates, and hence billing rate increases, should vary markedly across the range of a firm's offerings. In particular, the billing rates for a firm's offerings that are most distinct from those competitors can provide should be priced more aggressively than those for its less-distinct offerings.

The low billing rate growth we've seen of late may well be a manifestation of firms adhering to a philosophy of a single firm-wide billing rate increase and having this increase be set by the rate that is appropriate for the less-distinct offerings. The reality is that market dynamics have evolved in recent years to the point that a firm's pricing power varies sharply across its practices; adhering to a single increase set by the less-distinct offerings is now leaving serious money on the table. If internal firm harmony requires a single rate increase, then better to raise standard rates strongly across the board and discount from these as necessary for the less-distinct offerings.

Exit, or leverage up, practices where realized rates don't rise

There is an old adage in strategy consulting: 80 percent of strategy is deciding what not to do. The 'what not to do' for elite law firms is offer commodity services. How does one recognize commodity services? By definition, commodity services are offerings that many other firms can provide. By extension, commodity services are those where a firm effectively cannot set the price but must adhere to the price level set by rivals. This translates to commodity offerings being those where the realized rates (i.e. after discounting) don't rise following a standard rate increase.

To adhere to a strategy of differentiation, firms should exit practices where realized rates can't be increased above the rate of inflation. In some circumstances, so doing is more than the fabric of a partnership can bear. Where this is the case, an alternative that may buy some time is to operate the practice at greater leverage than the rest of the firm. So doing mitigates the effect of a commodity practice on per-partner profitability. However, it is really only a holding measure as leverage can't be increased indefinitely and managing businesses with dramatically different fundamental strategies requires an ambidexterity that few trained business leaders, let alone lawyers, possess.

Action implications

Most people make decisions based on objective facts interpreted through a lens of emotional biases and personal predispositions. Partners are alike most people in that they employ such a lens; partners are unlike most people in that they refuse to recognize they employ such a lens. There is nothing to be gained by leaders trying to get partners to recognize what they're doing; however, there is value in leaders shaping the lens through which partners interpret the world.

At many firms today, this lens says lawyers are of declining value and the market is stagnating. While this is true perhaps at the middle and lower tiers, this is objectively untrue for elite firms and for the differentiated practices within the broader swath of preeminent firms. This lens issue needs to be addressed first before partners can analyze robustly the case for billing rate increases. Specifically, the lens should be reshaped by restoring and bolstering partners' confidence in the value of their offerings. To this end, firm leaders should talk to clients (many of them really value you!), share more of the positive client feedback with partners, highlight firm recognition and awards, have clients come and speak at partner meetings, host alumni roundtable discussions of the value of outside counsel, etc. The forthcoming 2017 Am Law results will probably help too: despite the pervasive gloom and doom, the top end of the market is prospering; I suspect we'll see double-digit percent increases in profitability at most elite firms.

Having reshaped the lens, the next step is to create opportunities for partners to discuss billing rate history, profitability, and future billing rate policy. The key here is to give partners the data and let them chew on it. Don't lecture them or tell them what to do; rather give them the parameters and let them figure it out for themselves—so doing is the first step toward adoption of the desired changes.

Partners' deliberations should perhaps start with a review of the firm's billing rate history and dynamics, including firm-specific versions of Figures 1 and 2 here, supplemented with the same views for individual offices, practices and key clients. It would also be useful to profile how partner rates set a cap on rates for counsel and senior associates, leading to markup compression and, perversely, a firm having the lowest markups on the time of its highest value lawyers.

Partners should then discuss some of the less-obvious dynamics around billing rates. These could include, for example: the connection between leverage and partner billing rates (particularly how low partner rates suppress leverage); the pervasive observation that leverage varies more with individual partners than with practice or client type; and, in cultural contexts where it would help, partners could debate the relationship between compensation and billing rate—the two tend to correlate at professional services firms although it's sort of misleading as it's not a causal relationship; rather both are separately reflective of the economic value of a partner's practice, so proceed with caution.

The final element is for partners to discuss the process by which billing rates are set. While most partners prefer control of their own rates, many recognize that having an abstract committee set the rate allows them some plausible deniability in conversations with clients.

All this is to say it's a new billing rate world out there. Law firm leaders would do well to buy the option of increasing billing rates assertively at year end by starting to prepare partners for such increases now.

Hugh A. Simons, Ph.D., is a former senior partner and executive committee member at The Boston Consulting Group and the former chief operating officer at Ropes & Gray. PowerPoint versions of charts available upon request: [email protected].

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Strategic Pricing: Setting the Billable Hour at the Intersection of Psychology, Feedback and Growth

'Rethink Everything' or 'Optimize What's Working'? The Right Law Firm Strategy

7 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250