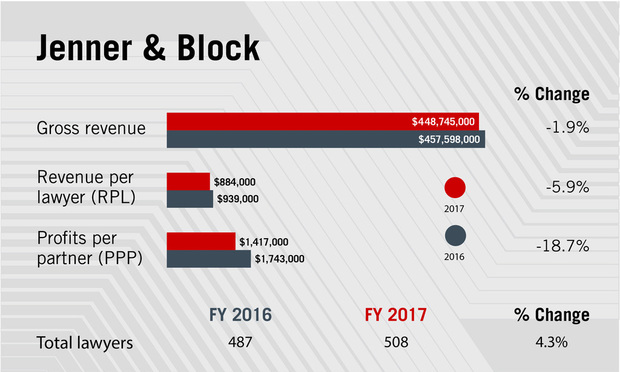

Jenner Revenue Slips, Profits Fall Amid Investments in Talent

Revenue dipped about 2 percent at the litigation powerhouse last year, while profits per partner tumbled nearly 20 percent.

March 02, 2018 at 02:12 PM

4 minute read

Two years removed from one of the strongest two-year financial runs among Am Law 100 firms, Jenner & Block last year saw its second straight year of flat-to-down financial performance.

Revenue at the Chicago-based firm, known for its top-tier litigation practice, dropped 1.9 percent in 2017 to $448.7 million. Profits per partner tumbled nearly 19 percent to $1.4 million.

The fall in PPP stemmed in part from expenses related to a surge in the firm's nonequity partner ranks, which rose about 14 percent to 117 partners last year. Compensation of nonequity partners rose 27 percent from the year prior.

The firm's equity partner ranks expanded from 109 to 111 partners, while total head count jumped 4.3 percent to 508 lawyers.

Jenner had a largely flat financial year in 2016, when revenue dipped 1.6 percent and profits per partner nudged up 1.5 percent. But it grew its head count by nearly 12 percent in 2016, which caused revenue per lawyer to fall nearly 12 percent. The firm in 2016 also topped the Am Law list of Big Law firms dedicated to pro bono, something the firm has done a record eight times.

Jenner had a largely flat financial year in 2016, when revenue dipped 1.6 percent and profits per partner nudged up 1.5 percent. But it grew its head count by nearly 12 percent in 2016, which caused revenue per lawyer to fall nearly 12 percent. The firm in 2016 also topped the Am Law list of Big Law firms dedicated to pro bono, something the firm has done a record eight times.

Flat financial results from 2016 represented the end of a staggering two-year bull run at the firm: From fiscal 2013 to 2015, revenue rose 23 percent and PPP grew 39 percent. Some law firm analysts say litigation-focused firms can have more volatile financial swings.

Managing partner Terrence Truax said the growth in the firm's nonequity ranks last year reflected investments the firm made in a number of newer practice groups, including aviation and energy, as well as in the firm's core practices.

“That's a decision we've made around focusing on those core areas for us that we are hopeful and confident are going to redound to our benefit,” Truax said. “As we think downfield and towards the future, it's very much client-centric as we look at our current mix of clients and how we can better serve them.”

Still, Truax said the firm was not satisfied with its year-end financial performance, and it is “committed to do better.” He said the firm believes that investing in talented practice groups that serve the needs of its clients is what drove the firm's performance from 2013 to 2015 and what will drive it in the future.

“I don't want to be mistaken—our financial performance is key and central in the high-end space we play in,” he said.

The firm began 2017 on a lateral hiring spree, with a string of notable additions in the spring.

In May it brought on Brandon Fox, former chief of the public corruption and civil rights section at the U.S. attorney's office in Los Angeles. The same month former acting U.S. Solicitor General Ian Gershengorn returned to lead the firm's appeals practice, and the firm took a trio out of the Federal Communications Commission. Jenner also launched an aviation practice in March with the addition of three partners.

Truax said demand for legal services largely remains flat, even if there was a slight pickup in the fourth quarter of the year, as some industry reports suggested. Longer-term, Truax said the firm continues to grow its investment in technology, particularly in knowledge management initiatives.

“Firms that get their head around how to most effectively leverage information to better serve clients are going to be more competitive,” Truax said. “They'll deliver a more efficient, more value-based service to clients. And that's true, too, for a firm like ours that very much wants to be playing in the high-end, bet-the company work.”

Truax said the firm also had a strong year for pro bono in 2017, and the early part of 2018 had given reason for optimism.

“We are excited about some of the work we've recently done and some of the new work we've had in,” Truax said. “And we're excited to translate some of the investment we've made in the last year or so to continue. Those are multiyear exercises that we're very focused on.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Meet the Finalists: The American Lawyer's Young Lawyers of The Year

A Law Firm Divided: How Generational Differences Are Fracturing Firms

Trending Stories

- 1Day Pitney Announces Partner Elevations

- 2The New Rules of AI: Part 2—Designing and Implementing Governance Programs

- 3Plaintiffs Attorneys Awarded $113K on $1 Judgment in Noise Ordinance Dispute

- 4As Litigation Finance Industry Matures, Links With Insurance Tighten

- 5The Gold Standard: Remembering Judge Jeffrey Alker Meyer

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250