King & Spalding Stays in Growth Mode as Partner Profits Top $2.5M

The firm surpassed the $2.5 million mark in profit per equity partner and racked up a string of notable recruits last year.

March 06, 2018 at 03:10 PM

8 minute read

The original version of this story was published on Daily Report

King & Spalding is not resting on its laurels.

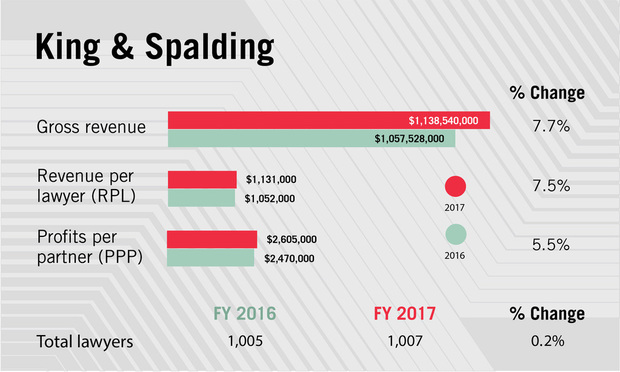

The firm reported revenue of $1.14 billion last year, a 7.7 percent increase over 2016, and net income of $505.1 million, up 4.3 percent.

That pushed up average revenue per lawyer (RPL) by 7.5 percent to $1,131,000. Average profit per equity partner (PPP) jumped by 5.5 percent to $2,605,000, breaking the $2.5 million mark for the first time.

King & Spalding also opened a Chicago office with the former U.S. attorney for the Northern District of Illinois, Zach Fardon, and made other notable hires in New York, Houston and elsewhere.

Even so, King & Spalding's chairman, Robert Hays, said the firm could have done even better.

“It was not spectacular in terms of the numbers. It was strong, though,” Hays said, adding that the firm did “tremendous legal work.”

“It was not spectacular in terms of the numbers. It was strong, though,” Hays said, adding that the firm did “tremendous legal work.”

“I think my partners would agree with me that we could have actually done better,” Hays said. “The first half of the year was not as good as I'd hoped, but that changed in the second part of the year.”

Hays said revenue and net income in the first half of 2017 were higher than for the prior year but not at the targeted levels. (In 2016, the firm's revenue increased by 3.8 percent, and net income increased by 8.2 percent.)

“Admittedly, we err on the side of an aggressive budget,” he added.

At midyear, Hays said, he and his partners “did some reflection, so that we were competing in a way that was closer to what we had budgeted and expected. I'm proud to say that at year-end we met budget because we dug down the second half of the year.”

“In terms of the high-profile nature of the work and market recognition of our lawyers and practices—that is something we're proud of,” he added.

One major engagement—defending Equifax in its massive data-breach litigation—popped up in the second half of the year. Equifax engaged King & Spalding at the beginning of August after a hack exposed personal information reported to affect at least 145 million Americans.

More than 350 consumer class actions and 70 suits from financial institutions have been consolidated under Chief Judge Thomas Thrash Jr. of the U.S. District Court for the Northern District of Georgia. (Thrash appointed plaintiffs leadership teams in February.)

Equifax is also the subject of probes by state attorneys general around the country and at least four federal investigations. The Equifax engagement came after previous large cases defending Home Depot in customer data breach litigation and General Motors over faulty ignition switches wound down in 2016.

King & Spalding raised rates last year in the 3 to 4 percent range, Hays said. (The average increase in lawyer billing rates for Citi Private Bank Law Firm Group's basket of 189 large firms was 3.7 percent.)

“We are off to a better start [of the year] than we've ever had,” Hays said, in terms of demand as measured by accrual hours.

The Talent

Head count remained flat at 1,007 lawyers on average last year, after King & Spalding added a net of 69 lawyers the prior year.

“We do like the full utilization,” Hays said, “but we are seeing some demand that exceeds capacity … to the point where there is more concern about having enough of the right people to do the work.”

“That is a problem I like,” he added.

Partnership head count also kept nearly constant. King & Spalding reported 194 equity partners last year, down from 196 equity partners in 2016, and had 398 total partners, up from 396. The firm recruited 31 lateral partners last year, up from 19 in 2016.

In a surprise coup, the firm convinced Fardon, the former U.S. attorney for the Northern District of Illinois, to launch a new Chicago office instead of returning to Latham & Watkins, where he had been a partner.

That office is up to nine lawyers, so far focused on litigation and the firm's marquee government investigations practice. The hires include partners Patrick Otlewski from the U.S. Attorney's Office in Chicago and, from Perkins Coie, Patrick Collins—who'd earlier prosecuted Illinois Gov. George Ryan with Fardon when both were AUSAs—and Jade Lambert. Another partner, Brad Giordano, joined the financial restructuring practice from Kirkland & Ellis in January.

King & Spalding stepped up its corporate game in New York, recruiting M&A hotshot James Woolery to head its mergers and acquisitions and corporate governance practice. Woolery left a partnership at Cravath, Swaine & Moore in 2011 to co-head the North American M&A practice for JPMorgan Chase & Co., then joined Cadwalader, Wickersham & Taft, where he was set to become that firm's chairman. He left Cadwalader in 2014 to start a hedge fund, Hudson Executive Capital.

Big partner hires for the tort litigation practice, also in New York, included John Hooper, who'd headed Reed Smith's complex litigation group and served as lead negotiator for Toyota's Takata MDL air bag litigation. He joined with three other Reed Smith partners, Kelly D'Auria, Eric Gladbach and Jacqueline Seidel.

Also in New York, the firm landed Richard Walker for its government investigations practice from Deutsche Bank, where he was global general counsel for 14 years after serving as SEC enforcement director.

In Houston, King & Spalding added six transactional partners to its energy practice: David Runnels, Darren Inoff, Jason Peters and Cindy Lin from Andrews Kurth and Stuart Zisman and Roxanne Almaraz from Bracewell.

The firm lost a number of partners to the Trump administration and other government posts, most notably FBI Director Chris Wray, who'd headed its government investigations practice. Also in the government investigations practice, Rob Hur left to become a top aide to Deputy Attorney General Rod Rosenstein and in November was nominated as U.S. attorney for Maryland, while Amelia Medina became senior counsel to Rosenstein.

International trade partners Gil Kaplan became the undersecretary of international trade at the Department of Commerce, and Stephen Vaughn became general counsel to the U.S. Trade Representative.

As King & Spalding expands elsewhere, the percentage of lawyers based in Atlanta continues to shrink—down to less than 40 percent of the firm's 1,000-plus attorneys.

The new Chicago office gives King & Spalding 20 offices in the United States and abroad, but Hays said the firm's primary goal is to grow in its existing offices, not open new ones.

“We tend to think more in terms of what we're doing than where we're doing it,” he said, noting that the firm already has offices in cities like New York and London that are major legal markets and hubs in the global economy.

The Work

“We're eager to double down on the strengths of the trial practice,” Hays said, adding that the firm has been able to build its top-ranked international arbitration practice on those roots. “We want to grow further in the area of global disputes.”

Expanding the firm's government investigations practice and its transactional practices in corporate finance and investments, which Hays noted have “picked up considerably in the last couple of years,” are two other broad areas of emphasis.

Notable billion-dollar deals last year included advising the majority owner of Florida hair care company Vogue International on its $3.3 billion sale to Johnson & Johnson Consumer Inc. and advising HD Supply on the sale of its Waterworks business unit for $2.5 billion to private equity firm Clayton, Dubilier & Rice.

King & Spalding represented ConocoPhillips in the $13.3 billion sale of its interest in the Foster Creek Christina Lake oil sands partnership and the majority of its western Canada Deep Basin gas assets to Cenovus Energy. In Singapore, it advised the AES Corp. on the $1.05 billion sale of its majority stake in the Masinloc power plant in the Philippines.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Holland & Knight Promotes 42 Lawyers to Partner, Prioritizing Corporate Practices

3 minute read

Wachtell Helps Miami Dolphins Secure One of NFL’s First Private Equity Deals

3 minute read

830 Brickell is Open After Two-Year Delay That Led to Winston & Strawn Pulling Lease

3 minute readTrending Stories

- 1Day Pitney Announces Partner Elevations

- 2The New Rules of AI: Part 2—Designing and Implementing Governance Programs

- 3Plaintiffs Attorneys Awarded $113K on $1 Judgment in Noise Ordinance Dispute

- 4As Litigation Finance Industry Matures, Links With Insurance Tighten

- 5The Gold Standard: Remembering Judge Jeffrey Alker Meyer

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250