Kramer Levin Financials Again Hit Record High

The firm's 2017 profits per partner topped $2 million for the first time.

March 09, 2018 at 03:59 PM

4 minute read

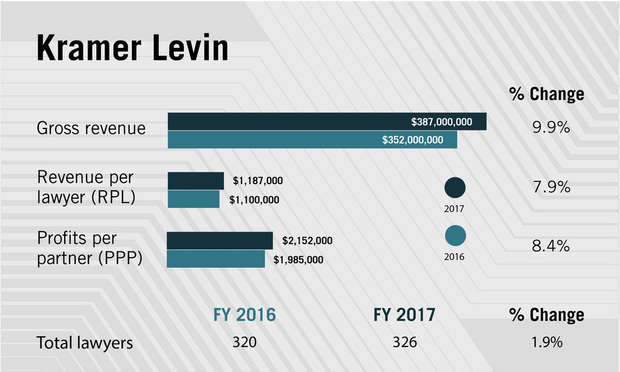

Kramer Levin Naftalis & Frankel posted a second consecutive year of record financial results in 2017, earning a gross revenue of $387 million as its profits per equity partner exceeded $2 million for the first time, according to preliminary ALM reporting.

The firm's gross revenue of $387 million marks a 9.9 percent increase over the $352 million posted in 2016. The firm's net income also grew 9.9 percent, rising to $152.76 million in 2017 from $138.95 million in 2016.

Revenue per lawyer and profits per equity partner also grew in 2017 at the 326-lawyer firm. Kramer Levin had an RPL value of $1.187 million, up 7.9 percent over the $1.1 million the firm posted in its 2016 results. And, after nearing $2 million in partner profits in 2016, Kramer Levin passed that milestone in 2017, with a PPP figure of $2.152 million.

Revenue per lawyer and profits per equity partner also grew in 2017 at the 326-lawyer firm. Kramer Levin had an RPL value of $1.187 million, up 7.9 percent over the $1.1 million the firm posted in its 2016 results. And, after nearing $2 million in partner profits in 2016, Kramer Levin passed that milestone in 2017, with a PPP figure of $2.152 million.

Kramer Levin managing partner Paul Pearlman said he was pleased with the firm's results, noting that the 2017 financials were record highs and came after the firm had previously reached records in 2016.

“It was a very strong year for our firm,” said Pearlman. “It was gratifying to us to put together such strong back-to-back years.”

He added that the firm's positive results in 2017 stemmed from contributions on both sides of the Atlantic. Kramer Levin has offices in New York and Silicon Valley in the U.S., as well as an outpost in Paris.

“It was a record year for all our financial metrics and was a combination of what happened in New York and Paris,” Pearlman said.

The firm's headcount remained relatively stable, rising from 320 lawyers in 2016 to 326 in 2017. Kramer Levin hired four lateral partners in 2017—three in New York and one in Paris—and its partnership ranks comprised 71 equity partners and 36 non-equity partners. Overall, the firm's partner count experienced year-over-year growth of 2.9 percent.

Paul Pearlman

Paul PearlmanPearlman said lawyers in each of the firm's key practices were firing on all cylinders, including its corporate, restructuring, litigation and real estate and land use groups.

Among other work, the firm represented VICI Properties, a real estate investment trust (REIT) that grew out of the Caesars Entertainment Corp. bankruptcy in a series of transactions toward the end of 2017 and into 2018. That work included advising on VICI's formation in October and in November a $1.14 billion deal in which the REIT acquired land and real property improvements associated with the Harrah's Hotel and Casino in Las Vegas and leased it back to Caesars Entertainment. In February, VICI completed a $1.4 billion initial public offering, and while the deal closed this year, a chunk of the work took place in 2017.

On the litigation front, Kramer Levin's white-collar team, led by partner Barry Berke, represented New York City Mayor Bill de Blasio in connection with investigations into the politician's fundraising efforts. That work, which resulted in a dropped investigation with no allegations of wrongdoing against de Blasio, reportedly racked up fees of at least $2 million.

The firm's restructuring group also remained active in 2017, picking up roles for creditors committees in the bankruptcies of retailer Toys “R” Us Inc. and oil and gas drilling contractor Seadrill Ltd. Describing the body of work in 2017 and the firm's back-to-back record financial years, Pearlman said they can be attributed to the breadth of practices at Kramer Levin and a relatively even contribution from those groups to the firm's business.

“For a firm of our size, we have tremendous balance,” Pearlman said. “Whether the economy is good or bad, we seem to perform pretty well.”

Looking ahead, Pearlman is not expecting any major disruptions in the firm's business. As evidence of a continued string of success, he said so far Kramer Levin was keeping active in 2018.

“We tend to be a firm that's steady as it goes,” he said. “The first two months of this year have been extremely busy. In fact, our billable hours per day, in three of the last four months, were among the highest that we've ever had.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Are Counsel Ranks Getting 'Squeezed' as Nonequity and Associate Pay Grows?

5 minute read

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250