Fried Frank's Gross Revenue Hits Record High

The New York-based Am Law 100 firm saw a third straight year of financial growth in 2017.

March 12, 2018 at 05:55 PM

4 minute read

After posting its best-ever financial year in 2016, Fried, Frank, Harris, Shriver & Jacobson enjoyed another record-breaking performance last year.

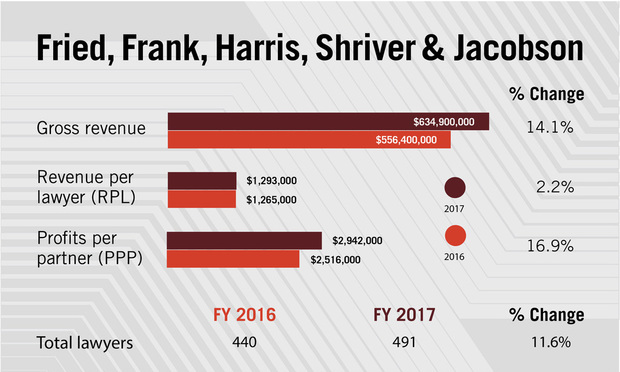

In its third consecutive year of growth in several key financial metrics, the firm saw gross revenue rise 14.1 percent in 2017, to $634.9 million, up from $556 million the year before. Revenue per lawyer rose 2.2 percent, to $1.29 million, while its profits per partner jumped nearly 17 percent, to $2.94 million.

This financial success is a direct result of a strategic plan implemented by the New York-based Am Law 100 firm in 2014 that focuses on advising clients on their most complex, sophisticated work and growing its six core transactional practices—asset management, capital markets, finance, M&A, private equity and real estate—in the U.S. and Europe, said Fried Frank's global chairman David Greenwald.

“The efforts of everyone at the firm in executing our strategy has been central to the success we've achieved,” added Greenwald, a former deputy general counsel at The Goldman Sachs Group Inc. who returned to the firm in 2013 and took over as leader the following year amid the departure of Valerie Ford Jacob to Freshfields Bruckhaus Deringer.

Overall head count at Fried Frank also increased 11.6 percent last year, to 491 lawyers, up from from 440 in 2016. The number of equity partners at the firm ticked up 3.8 percent, to 109, up from 105 the year before.

Overall head count at Fried Frank also increased 11.6 percent last year, to 491 lawyers, up from from 440 in 2016. The number of equity partners at the firm ticked up 3.8 percent, to 109, up from 105 the year before.

Fried Frank, whose fiscal year ended on Feb. 28, saw strong performances across all of its practices globally, Greenwald said. The firm's gross revenue growth was driven primarily by its asset management, capital markets, litigation and real estate. (Real estate remains a premier practice at Fried Frank, which each year sponsors a holiday gala in New York attended by property industry titans.)

Thanks to an active transactional market in the U.S., Greenwald said that Fried Frank was able to expand its client base and gain market share in 2017. In addition, the firm's London office, which brought on Ashurst real estate duo Darren Rogers and Patrick Williams, has “paid dividends” and continues to grow along with Fried Frank's business in Europe, Greenwald said.

“We continue to focus on executing our strategy and meeting the growing demands of our clients,” said Greenwald, a process that he noted includes being active in the lateral market.

In New York, the firm added former Cadwalader, Wickersham & Taft finance partner Adam Summers, while also welcoming ex-Davis Polk & Wardwell counsel Meredith Mackey as a capital markets partner and adding former Akin Gump Strauss Hauer & Feld investment management partner Jeremy Berry. Fried Frank also hired former D.E. Shaw Investments LP general counsel John Liftin as senior counsel and ex-Orrick, Herrington & Sutcliffe partner Brian Margolis as special counsel for its corporate department in New York.

Greenwald said that Fried Frank is still looking to grow its litigation practice, which last year recruited Matthew Parrott, the former head of Katten Muchin Rosenman's New York real estate and distressed debt litigation group.

Fried Frank also advised on several high-profile deals in 2017. The firm served as outside counsel to Coach Inc. on its $2.4 billion acquisition of fashion rival Kate Spade & Co. Fried Frank also advised Sinclair Broadcast Group Inc. on its pending $6.6 billion acquisition of Tribune Media Co., one of the largest television station operators in the country. (Sinclair has recently been criticized for allegedly introducing political bias to some of its local news anchors.)

Fried Frank also counseled JPMorgan Chase & Co. in connection with its planned headquarters redevelopment at New York's 270 Park Avenue, the first major project under midtown Manhattan's rezoning plan.

As for 2018, Greenwald said the firm is focused on continuing to perform, but declined to discuss whether Fried Frank would entertain potential tie-up talks with other firms.

“We've had three great years in a row [and] that puts some pressure on us to continue performing,” Greenwald said.

He added that Fried Frank, which shuttered its operations in Asia three years ago, remains well-positioned to serve its clients in the coming year, especially given the current strength of markets in Asia, Europe and the U.S.

“I'm bullish on 2018,” he said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Law Firms Expand Scope of Immigration Expertise Amid Blitz of Trump Orders

6 minute read

Trending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250