Record Profits, Revenue for Schulte Roth in 2017

The firm built on steady years in 2015 and 2016, increasing its revenues and profits to their highest-ever levels in 2017.

March 15, 2018 at 04:44 PM

4 minute read

Alan S. Waldenberg of Schulte Roth & Zabel.

Alan S. Waldenberg of Schulte Roth & Zabel.

Schulte Roth & Zabel had another year of steady financial growth in 2017, posting record revenue north of $424 million and partner profits higher than $2.5 million, also a record high.

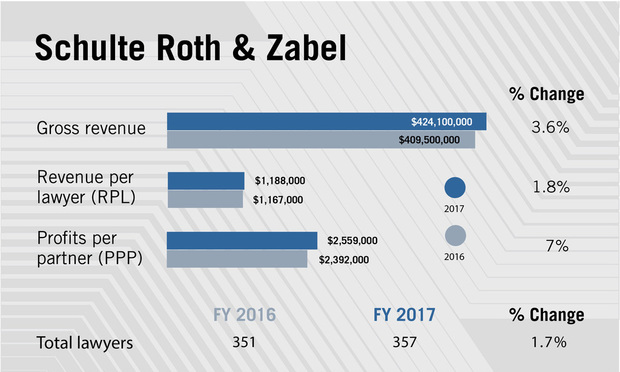

Building on steady results in 2016 and 2015, Schulte Roth took in gross revenue of $424.1 million in 2017, up 3.6 percent over the prior year's results of $409.5 million. Revenue per lawyer at the 357-attorney firm was $1.188 million, a 1.8 percent increase compared with the prior year, according to preliminary ALM data.

The firm's profits also grew in 2017 compared with 2016, with net income rising 5.7 percent to $209.8 million and profits per partner growing 7 percent to $2.56 million. In 2017, Schulte Roth counted 82 partners in its equity ranks, down from 83 in 2016; the firm has no nonequity partners.

“We think we had a terrific year. We had a record year in revenue, in profits and profits per partner,” said partner and executive committee chairman Alan Waldenberg.

Waldenberg said Schulte Roth's 2017 results were the product of contributions from across the firm, including its transactional and fund formation specialists, activist shareholder practice and litigation group. The firm, he said, completed “numerous multibillion-dollar fund launches” for clients such as Cerberus Capital Management and Bridgestone Capital in the United States and London-based hedge fund Marshall Wace.

Waldenberg said Schulte Roth's 2017 results were the product of contributions from across the firm, including its transactional and fund formation specialists, activist shareholder practice and litigation group. The firm, he said, completed “numerous multibillion-dollar fund launches” for clients such as Cerberus Capital Management and Bridgestone Capital in the United States and London-based hedge fund Marshall Wace.

On the transactions front, Schulte Roth guided private equity firm Veritas Capital to an acquisition of PricewaterhouseCoopers' U.S. public sector consulting business. The firm also has a key role in a currently pending deal announced in February, serving as legal adviser to grocery chain Albertsons Cos. on a proposed merger with Rite Aid Corp.

“Every year we're good for a couple really, really large deals,” said Waldenberg.

The Schulte Roth executive committee chair also highlighted the firm's shareholder activism group, describing it as “the premier shareholder activist practice in the country.” One high-profile assignment for that group in 2017 involved representing billionaire investor Nelson Peltz in a proxy battle with Procter & Gamble Co. Although Peltz ended up falling short in his proxy battle, the activism effort led to a P&G announcement late in 2017 that Peltz would join the company's board.

The shareholder activist group at Schulte Roth was also the beneficiary of the firm's only lateral hire in 2017. Early in the year, the firm brought on Aneliya Crawford from Olshan Frome Wolosky, a lawyer who was part of the team that represented Peltz in the P&G proxy fight.

The firm's litigation team also stayed busy in 2017 as lead defense counsel in a corruption case against Joseph Percoco, a former aide in the administration of New York Gov. Andrew Cuomo. That case involved an eight-week trial that, on Wednesday, resulted in a mixed verdict that convicted the former Cuomo aide on three of the six charges he faced.

While that representation is ongoing, Schulte Roth picked up another high-profile case recently, having been retained as defense counsel for former Equifax Inc. chief information officer Jun Ying, who was charged on Wednesday with insider trading related to stock he allegedly sold before the credit rating company publicly acknowledged its massive data breach last summer.

Looking ahead, Waldenberg said the first several weeks of 2018 have him optimistic that Schulte Roth will remain on a positive financial trajectory.

“All our practices seem to be busy and all our clients seem to be happy,” he said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Perkins Coie Hires Anthony Shannon as Chief People Officer

Profits Surge Across Big Law Tiers, but Am Law 50 Segmentation Accelerates

4 minute read

Is It Time for Large UK Law Firms to Begin Taking Private Equity Investment?

7 minute readTrending Stories

- 1Uber Files RICO Suit Against Plaintiff-Side Firms Alleging Fraudulent Injury Claims

- 2The Law Firm Disrupted: Scrutinizing the Elephant More Than the Mouse

- 3Inherent Diminished Value Damages Unavailable to 3rd-Party Claimants, Court Says

- 4Pa. Defense Firm Sued by Client Over Ex-Eagles Player's $43.5M Med Mal Win

- 5Losses Mount at Morris Manning, but Departing Ex-Chair Stays Bullish About His Old Firm's Future

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250