Nelson Mullins Tops Big Prior Year, Breaks $1M in PPP

The South Carolina-based firm kept on a growth trajectory during its first year among the Am Law 100.

March 20, 2018 at 05:08 PM

6 minute read

The original version of this story was published on Daily Report

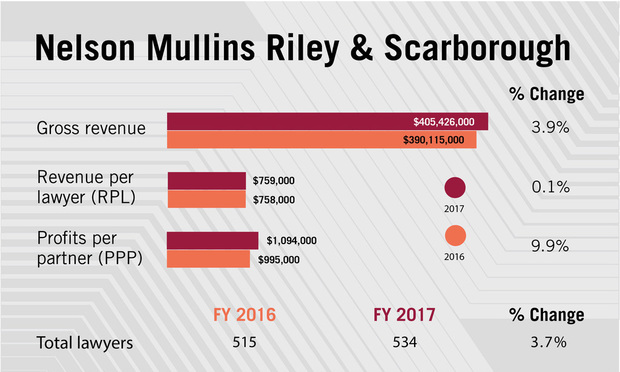

Nelson Mullins Riley & Scarborough posted another strong year in 2017, breaking the $1 million mark in profits per partner.

That followed double-digit increases in revenue (up 21 percent) and profit (up 24.5 percent) for the Southeastern super-regional firm in 2016, when the firm's rapid growth catapulted it into the Am Law 100.

The firm reported $405.4 million in revenue in 2017, up 3.9 percent, and a 10.1 percent increase in net income to $158.2 million. That pushed up profit per partner (PPP) by $99,000 to $1.094 million. The equity partnership grew by just one, to 145 equity partners.

Overall head count jumped by a net of 19 lawyers to 534 lawyers, which kept revenue per lawyer (RPL) flat at $759,000.

The firm's managing partner, Jim Lehman, said Nelson Mullins ended the year over budget, noting that it has done so for each of the last six years.

“We would have been very happy just to get close to 2016,” he said. Lehman said the big revenue and profit jumps in 2016 were fueled by several large projects, both big litigation matters and “second request” work for M&A transactions, triggered by regulator requests for additional document production.

“We would have been very happy just to get close to 2016,” he said. Lehman said the big revenue and profit jumps in 2016 were fueled by several large projects, both big litigation matters and “second request” work for M&A transactions, triggered by regulator requests for additional document production.

“2017 was more across-the-board performance,” he said, adding that he expects 2018 performance to be more like that of 2017. “We believe that this year is going to be a strong year.”

Revenue Restatement

Nelson Mullins restated its 2016 and 2017 revenue to include an additional stream of e-discovery revenue from a fast-growing data storage and analytics affiliate, EnCAP, that it launched at the end of 2015, and which Lehman said “grew significantly” in 2017.

EnCAP augments the firm's traditional e-discovery practice, Encompass, started in 2009, which has become a top revenue-generator for the firm with its own client base.

Taking the EnCAP income into account increases Nelson Mullin's previously reported 2016 revenue by $9.7 million to $390.1 million and its 2017 revenue by almost $20 million ($19.932,000) to $405.4 million. The restatement does not affect the net income or PPP that the firm reported for 2016 and 2017, since the EnCAP income was already accounted for in the firm's profit distribution.

Lehman noted that the EnCAP unit's revenue will likely decrease in 2018, since the team just finished a big project.

Rapid Rise

Nelson Mullins has grown fast in the last five years. Since 2013, it has increased revenue 50 percent (from $270.5 million) and net income by 61.5 percent (from $98 million)—resulting in its ascension 30 spots (from No. 118 to No. 88 last year) in the Am Law 100/200.

During that period, RPL increased from $580,000 to $759,000 and PPP soared from $630,000 to $1,094,000.

The firm's average annual head count has grown at a slower 14.6 percent rate (from 466 lawyers to 534 last year). Meanwhile, the firm pared its equity partner ranks (from 156 to 145 last year), which helped to boost the PPP growth.

Lehman, who has been Nelson Mullins' managing partner since 2012, said the firm has added laterals without taking on any debt. “I like to think that we are cautious and conservative,” he said. “We have no long-term borrowings beyond a short-term credit line.”

Instead, Lehman said, the middle-market-focused firm has “been a beneficiary of the disruption in the industry” since the 2008 recession that reshaped the legal market. “We've benefited from lawyers who've chosen to move upstream to our platform—or downstream, because we may have a friendlier rate environment,” he explained.

“And No. 2, we think we're very attractive to clients, being in the third or fourth quartile of the Am Law 100 with our rate structure.” He explained that Nelson Mullins can offer lower rates than some firms of the same size and breadth, in part, because a lot of its operations are in less expensive places.

“It's not an area that anyone should take for granted,” Lehman cautioned. “Our clients have different expectations than 15 years ago.”

“This is about clients, right?” he added. “If a law firm can hear the clients' needs and be a problem-solver at a value proposition that meets their budget requirements, that's a win-win.”

Offices and Talent

Nelson Mullins added 31 lateral partners in 2017. “We were really fortunate to have some wonderful talent knock on our door,” Lehman said, estimating that the firm fielded about twice as many inquiries as the prior year.

The firm's Atlanta office has fueled its rapid growth. The Atlanta location has doubled in head count in the last decade (from 76 lawyers in 2008 to 150 at present) and become its largest office, with more lawyers than its Columbia, South Carolina, headquarters.

“We plan to continue growing the corporate practice in Atlanta and our middle-market M&A and finance practices,” Lehman said.

Meanwhile, Nelson Mullins is growing beyond its Southeastern roots. It opened a Los Angeles office last year—its first on the West Coast—following a Denver office in 2016. Both are focused on its automotive practice, one of the largest in the country, which advises motor vehicle manufacturers and distributors on regulatory compliance and disputes involving dealers.

Richard Otera, a former in-house lawyer at Honda North America and general counsel for Sumitomo Electric Industries, is the managing partner for the Los Angeles office. Partners Kevin Colton, Lisa Gibson and Maurice “Mo” Sanchez with associate Jessica Higashiyama also joined from Baker & Hostetler's local office.

Nelson Mullins launched a Baltimore office in February—its 18th—with 11 partners from Baltimore-based Miles & Stockbridge. The group includes a nine-partner litigation team led by veteran trial lawyer Michael Brown and two corporate partners, Timothy Hodge Jr., who is the office's managing partner, and Colleen Kline, who co-chaired Miles & Stockbridge's corporate and securities practice.

In other lateral moves, Nelson Mullins expanded its white-collar practice last year. E. Bart Daniel, a former U.S. Attorney for South Carolina, closed up his own shop in Charleston to co-head the white collar and government investigations practice. The firm recruited Sam Rosenthal, a former federal prosecutor in New Jersey and official in the Department of Justice's criminal division, from Squire Patton Boggs and Tom Ferrigno, a former chief counsel for the Securities and Exchange Commission's Enforcement Division, from Brown Rudnick. Both are based in Washington. In Atlanta, Nekia Hackworth Jones rejoined the firm from the Department of Justice, where she headed the financial fraud enforcement task force.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Holland & Knight Promotes 42 Lawyers to Partner, Prioritizing Corporate Practices

3 minute read

Wachtell Helps Miami Dolphins Secure One of NFL’s First Private Equity Deals

3 minute read

830 Brickell is Open After Two-Year Delay That Led to Winston & Strawn Pulling Lease

3 minute readTrending Stories

- 1BOI Reports: What Business Owners and Attorneys Should Know

- 2SurePoint Acquires Legal Practice Management Company ZenCase

- 3Day Pitney Announces Partner Elevations

- 4The New Rules of AI: Part 2—Designing and Implementing Governance Programs

- 5Plaintiffs Attorneys Awarded $113K on $1 Judgment in Noise Ordinance Dispute

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250