Mintz Levin Sees Another Record Year in Revenue, Profits

Managing partner Robert Bodian said the firm's system for sharing origination credit among partners has helped spur its success.

March 30, 2018 at 05:25 PM

4 minute read

The original version of this story was published on New York Law Journal

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo/Photo: Rick Kopstein/NYLJ

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo/Photo: Rick Kopstein/NYLJ

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo had another record year in revenue and profits, boosted in part by a new credit-sharing system for partner compensation, according to the firm's leader.

The record financial results follow a busy year of partner moves both to and from the Boston-founded firm.

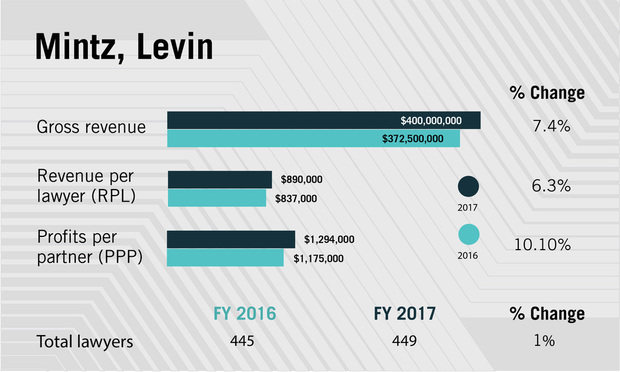

Mintz Levin's gross revenue grew 7.4 percent to $400 million; revenue per lawyer rose 6.3 percent to $890,000; and profits per equity partner rose about 10 percent to almost $1.3 million, according to preliminary projections for the fiscal year ending March 31. The firm's expenses increased, but not as much as revenue, said managing partner Robert Bodian.

At the same time, total lawyer head count stayed level at 449 attorneys, and the firm kept its equity ranks steady at 69 partners.

Bodian said 2017 was Mintz Levin's third year in a row of record profit and revenue growth. Over the last three years, the firm's profits per partner have jumped 35 percent, with revenue up by nearly 30 percent, he said.

Bodian said 2017 was Mintz Levin's third year in a row of record profit and revenue growth. Over the last three years, the firm's profits per partner have jumped 35 percent, with revenue up by nearly 30 percent, he said.

Bodian pointed to the firm's work in the life sciences industry for pharmaceutical and health care companies as a key driver of growth. That includes corporate, litigation, intellectual property and employment, he said.

For instance, Mintz Levin is advising a consortium of investors led by TPG Capital and Welsh, Carson, Anderson & Stowe in their acquisition of Kindred Healthcare Inc., a deal valued at about $4.1 billion.

Representing drug manufacturers Kowa Pharmaceutical Co. Ltd. and Nissan Chemical Industries in Hatch-Waxman litigation, Mintz Levin has gone up against generic manufacturers relating to a statin called Livalo.

Sharing Credit

Bodian said the firm has been buoyed by its system for sharing origination credit among partners. “It definitely plays a role,” he said. “Over the last several years, the firm has become highly collaborative and our credit system reflects that.”

Under the credit system developed by Bodian and implemented in 2015, no one partner gets 100 percent of an origination credit. The attorney who “gets the call” will be eligible for up to 75 percent of the initial production credit for a new client. To encourage team efforts and ensure there is no disincentive for bringing the right attorneys to participate in pitches, the firm said, 25 percent of the initial production credit is either shared with a colleague who helps secure the business or is reserved for the firm when only one attorney receives the initial credit.

Also under the new arrangement, partners who “help grow the client relationship” can receive origination credit for new business developed for the client, Bodian said. This can include billable and nonbillable time, including getting to know the client and the client's business at social events, Bodian said.

“Getting more work from clients you already have is far easier than getting new clients,” Bodian said. “It's a better way of doing business.”

Bodian said sharing credit 50-50 has become more common since the new system was implemented.

While Bodian is aware of some firms that have sunset provisions for origination credit, he said Mintz Levin's system wasn't modeled from any other firm.

Tracking Moves

Meanwhile, Mintz Levin has seen a healthy volume of lateral movement, both in and out, in the last year. Mintz Levin brought in partners from Herrick Feinstein, Sedgwick and others in 2017.

Some partners left for Nelson Mullins Riley & Scarborough, Pillsbury Winthrop Shaw Pittman, and Troutman Sanders.

Bodian said some of the departures were voluntary, while others were not. He pointed to programs at the firm in which underperforming lawyers are eased out of the partnership. One program, for those who have had a long tenure and significant contributions to the firm, allows partners to leave within two years. For underproductive partners who have shorter tenures, they can transition out within a few months to a year or longer, Bodian said. “That's been done quietly over time,” he said.

He said none of the voluntary departures was due to the origination credit system. “I think the partnership has embraced it,” he said of the system.

While Mintz Levin is interested in acquiring groups of lawyers in California and New York, the firm has not joined the merger mania affecting others in the Am Law 200. “We're always evaluating possibilities, but we're not presently looking at anything,“ Bodian said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Paul Hastings, Recruiting From Davis Polk, Adds Capital Markets Attorney

3 minute read

Goodwin Procter Relocates to Renewable-Powered Office in San Francisco’s Financial District

Greenberg Traurig Combines Digital Infrastructure and Real Estate Groups, Anticipating Uptick in Demand

4 minute readTrending Stories

- 1SurePoint Acquires Legal Practice Management Company ZenCase

- 2Day Pitney Announces Partner Elevations

- 3The New Rules of AI: Part 2—Designing and Implementing Governance Programs

- 4Plaintiffs Attorneys Awarded $113K on $1 Judgment in Noise Ordinance Dispute

- 5As Litigation Finance Industry Matures, Links With Insurance Tighten

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250