Smith Gambrell Increased Revenue in 2017 as It Expanded in Europe and U.S.

The firm reported solid gains in revenue, but the investments in European locations and U.S. expansion kept profit flat.

April 05, 2018 at 04:34 PM

5 minute read

The original version of this story was published on Daily Report

Atlanta

Atlanta

Smith Gambrell & Russell expanded its national and international footprint in 2017 while steadily increasing revenue.

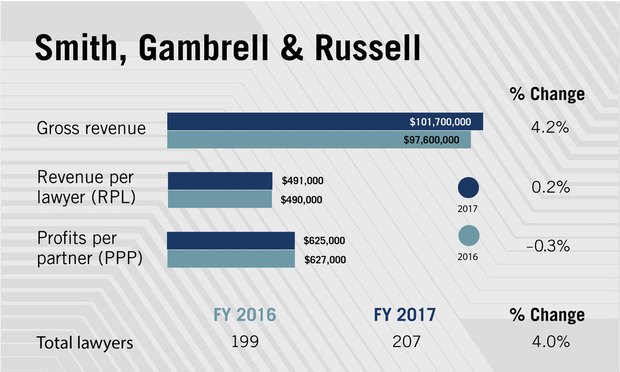

The Atlanta-based firm reported a 4.2 percent revenue increase to $101.7 million after similar growth the prior year. A net head count increase of eight lawyers, for an average annual total of 207 lawyers, kept revenue per lawyer (RPL) flat at $491,000.

Smith Gambrell's aggressive expansion, opening offices in the U.K. and Germany and significantly adding to its New York office, kept net income flat as well, at $32.5 million, for profit per partner (PPP) of $625,000.

“We remained faithful to what we are trying to do strategically, building out an infrastructure that reaches far beyond the Georgia borders. We want to create our own platform that is national and international in scope to support our clients' needs,” said the firm's chairman, Stephen Forte.

The firm incurred no debt for its expansion into other markets, Forte noted. “It's coming out of our cash flow, so it does hit your short-term profits.”

The firm incurred no debt for its expansion into other markets, Forte noted. “It's coming out of our cash flow, so it does hit your short-term profits.”

Smith Gambrell ventured into Europe, opening London and Southhampton offices at the start of 2017 to expand its marquee aviation finance practice beyond the United States with three lawyers from U.K. firm Blake Morgan. Partner Ben Graham-Evans, who headed Blake Morgan's aviation group, opened the London office, while another partner, Mark Turnbull, opened the Southhampton office with associate Gareth Hawes. The U.K. aviation team has grown to six practitioners now.

The firm also opened a Munich office to support its long-established practice serving German companies for inbound transactional work, hiring Markus Bahmann from SSP Schiessl Rechtsanwaite.

And it continued to invest in its New York office, adding 10 lawyers through a combination with New York boutique Balber Pickard Maldonado & Van Der Tuin. Those lawyers handle litigation and real estate law and specialize in advising co-op and condo boards. It also hired three transactional lawyers from the U.K. firm Withers' New York office.

One of the firm's new Balber Pickard partners, Roger Juan Maldonado, will become the president of the New York City Bar Association next month, which Forte said adds to the firm's visibility in New York.

As Smith Gambrell marks its 125th anniversary this year, it continued expanding, opening a Los Angeles office on Jan. 1 through a combination with an 11-lawyer business boutique, Rodi Pollock Pettker Christian & Pramov. Forte said the California location—the firm's ninth office and first on the West Coast—will serve the firm's Asia-based clients, which include Kia Motors and Kumho Tire.

Forte said the midsize firm is not interested in a merger.

“Our expansion is a statement that that is not of interest to us. We are charting our own course,” he said. “We've shunned Big Law, despite having had many opportunities to become a part of it. We prefer our business model to someone else's that is really just interested in adding numbers to their throngs of lawyers.”

The firm still functions as a “true partnership that manages by inclusiveness and consensus-building,” Forte said, adding that it is a very different business model than Big Law provides.

The firm's strategy is to establish locations in gateway cities such as London, New York and Los Angeles, which is attractive to clients and supports sophisticated practices, he said.

Forte also said Smith Gambrell's expansion could continue this year, noting that the firm is looking at Texas and Chicago. “We see our practice areas as lending themselves to other major markets, particularly money centers,” he said.

The Work

Smith Gambrell's M&A practice stayed busy last year, Forte said.

In aviation finance, the firm represented Dublin-based Aergo Capital in its debut aircraft securitization deal, which received the 2017 “Aircraft Lessor Debt Deal of the Year-Europe” award from Global Transport Finance. Aergo issued $585 million in secured notes through METAL 2017-1 Ltd, backed by a portfolio of 26 aircraft in Indonesia, South Africa, Thailand and Pakistan.

The firm advised Atlanta-based Aaron's Inc. on the $140 million all-cash acquisition of its largest franchise, SEI, which owns 104 Aaron's stores in 11 states.

In another large transaction, it advised privately held staffing giant Adecco Group in its acquisition of BioBridges, a Boston-based staffing agency for the life sciences industry.

In an Asian deal, Smith Gambrell represented Hong Kong's NetDragon Websoft Holdings Ltd., an online gaming company, in its acquisition of L.A.-based JumpStart, which makes educational games for children.

On the litigation front, Smith Gambrell defeated class certification for Geico General Insurance Co. in a suit brought by VIP Auto Glass in the U.S. District Court for the Middle District of Florida over payments on auto-glass repair and replacements. The judge cited VIP Auto Glass's “contumacious and fraudulent” conduct in her order to dismiss with prejudice and award of attorneys' fees and costs to Geico.

In Atlanta, Smith Gambrell won a long-running dispute with its landlord, Cousins Properties, over a plan to place large, illuminated signage for another tenant, an accounting firm, atop its headquarters in the iconic Promenade building. An arbitration panel made up of Emmet Bondurant from Bondurant, Mixson & Elmore, F. Carlton King Jr. from Ford & Harrison and Senior Fulton County Superior Court Judge Philip Etheridge, ruled in December that the signage would violate Smith Gambrell's 2003 lease terms.

“We're happy it's over and that we're back to business as usual with our landlord,” Forte said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Holland & Knight Promotes 42 Lawyers to Partner, Prioritizing Corporate Practices

3 minute read

Wachtell Helps Miami Dolphins Secure One of NFL’s First Private Equity Deals

3 minute read

830 Brickell is Open After Two-Year Delay That Led to Winston & Strawn Pulling Lease

3 minute readTrending Stories

- 1Day Pitney Announces Partner Elevations

- 2The New Rules of AI: Part 2—Designing and Implementing Governance Programs

- 3Plaintiffs Attorneys Awarded $113K on $1 Judgment in Noise Ordinance Dispute

- 4As Litigation Finance Industry Matures, Links With Insurance Tighten

- 5The Gold Standard: Remembering Judge Jeffrey Alker Meyer

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250