Success in the Am Law 100 Is Being Driven by Management

Law firms, long thought to be bifurcating by size and profitability, have actually been separating based on something more simple over the past decade.

April 24, 2018 at 09:52 AM

10 minute read

Big Law has surpassed its pre-recession levels of profitability. Of the 100 firms in the new Am Law ranking, 78 reported 2017 profits per equity partner (PPP) levels that are higher (even adjusted for inflation) than their levels in 2007, the year before the Great Recession's onset, according to data from ALM Intelligence's Legal Compass.

Looking to buy the report or leverage the Am Law 100 data with powerful data visualizations and expert analysis? Access Premium Content

Looking to buy the report or leverage the Am Law 100 data with powerful data visualizations and expert analysis? Access Premium ContentWe compared the 2007 and 2017 performance metrics of these firms to identify those that have led this resurgence and how they've done it. Two observations from this comparison stand out. First, the notion that Big Law is bifurcating into haves and have-nots based on size or profitability is simply wrong; stronger (and weaker) performances are recorded by firms of all sizes and profitability levels. Second, responding to the market's new normal, many firms have managed their way to higher profits rather than simply letting the rising tide lift them. Only 20 of the 78 firms that raised PPP also grew revenue, lawyer head count and their partnership faster than the economy; the other 58 worked their way to higher PPP by combining equity partner reductions, higher leverage and lowered cost-per-lawyer.

These two observations are interrelated. The variability in performance across firm size and profitability mirrors the variation in the way firms manage lawyer numbers and costs. This variation in how managed a firm is has profound implications. More management creates higher profitability, which firms use to lure commercially powerful partners from less-profitable rivals. It suggests Big Law will bifurcate based not on size or profitability ranking but on the intensity of basic management. It's important that partners everywhere take this to heart: If partners want their firms to be secure and vital, they should look for profitability to rise, and thus cede greater management control to firm leaders.

As an aside, we should acknowledge that while PPP is important, especially as an indication of a firm's ability to attract and retain highly commercial partners, the available PPP data is imperfect. In particular, there can be noise in the definition of what constitutes an equity partner. However, a couple of current conditions argue that the data is accurate enough for valid analysis. First, as 2017 has been a strong year for many, we expect firms to have used the occasion to address any gap between audited and reported PPP. Second, while a minority of firms may have inflated PPP historically, they often keep the year-over-year percentage changes in the audited and reported numbers the same, as it makes internal partner communications easier. Thus, changes in PPP, which is the focus of this analysis, are accurate even if the reported absolute levels of PPP are overstated.

Variability, Not Stratification

The idea that the market is bifurcating, with those who are ahead getting further ahead and those who are behind falling further behind, has a solid basis in theory. Larger firms, for example, can be expected to have lower costs, which lead to both higher profits and greater flexibility on price in pursuit of gaining share; this sets up a virtuous loop of lowered cost, higher profit and growth. Robust as the theory is, though, its application to Big Law is roundly refuted by the data.

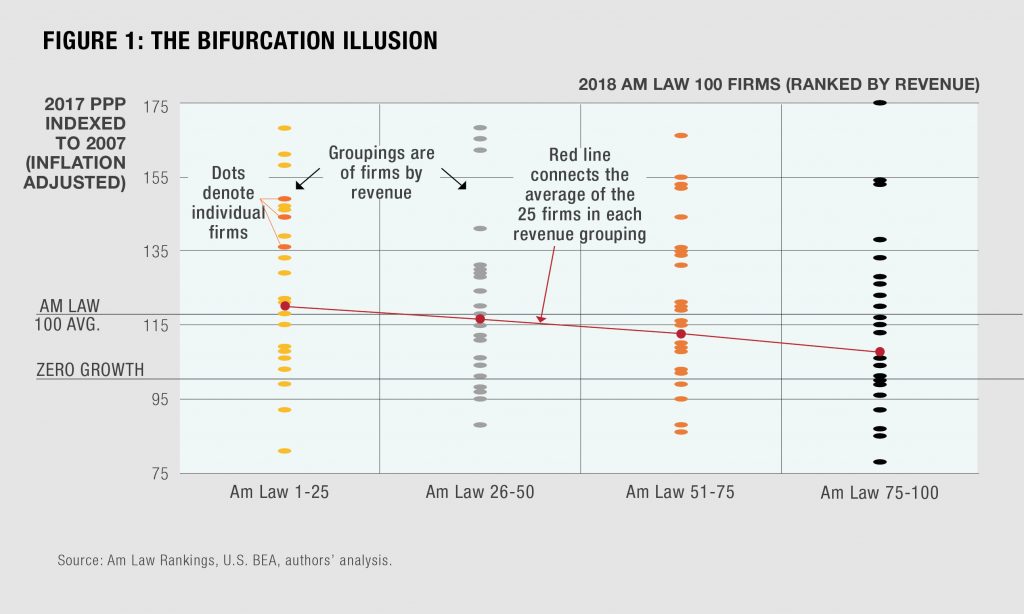

Figure 1 shows this year's Am Law 100 broken into quartiles by revenue and each firm's 2017 PPP indexed to that of 2007 (inflation adjusted). An index value of 100 means there has been no increase; an index value of 150 means there's been a 50 percent increase, etc.

The data shows that within each quartile there is wide variation of PPP growth. The red line crossing the quartile groupings connects the average of each quartile. This line does show a decline in average PPP growth from larger to smaller firms. Thus, in a precise sense, there is a decline in average performance with decreasing firm size; however, in any broader sense the statement is wholly inaccurate. The only accurate statement is that there is great variability of PPP performance across firms of all sizes. Incidentally, we see the same wide dispersion within groups when we segment by profitability, revenue per lawyer, firm strategy and other measures.

Why doesn't the theory fit? There are many reasons, not least of which is that Big Law is far from a monolithic market. Another important reason has to do with one of the theory's implicit assumptions, namely that all players in a market are maximizing profit. Not all law firm partnerships are profit-maximizing entities; rather, many balance profits with the psychic income partners get from collegiality, intrinsic joy of the work, contained performance pressures and satisfaction drawn from developing the next generation. The gap between what firms do based on these drivers and what they would do in a narrower pursuit of profitability separates individual firm performance from the expectations set by theory.

PPP Race: Management Trumps Growth

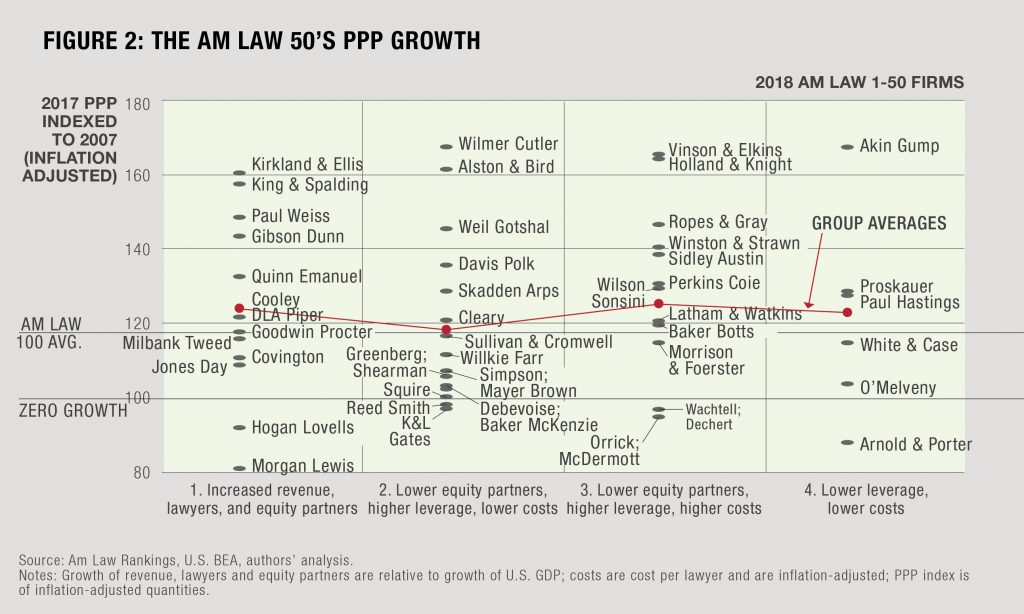

Figure 2 focuses on the PPP increases, and their drivers, for the Am Law 50. It breaks the firms into four groups by different performance levers and shows 2017 PPP indexed to 2007 for each firm by group.

Group 1: These firms have exhibited what might typically be considered strong performance characteristics. They have grown revenue, head count and their number of equity partners faster than the growth rate of the economy. The range of profitability outcomes for these firms suggests this pro-growth profile could be capturing two different types of firms: Those that have strong positions behind which they are investing, and those that are investing with the aim of building strong positions. It's hard to tell which is which from the outside. The top of this grouping are the perennial leaders among strong performers: Kirkland & Ellis, King & Spalding, Paul Weiss, Gibson Dunn and Quinn Emanuel. The grouping also shows that, with a pro-growth posture, PPP can contract if the growth of lawyers or equity partners exceeds the growth of revenue (inflation-adjusted), as it did for Hogan Lovells and Morgan Lewis.

Group 2: If Group 1 is defined by traditionally strong performance characteristics, Group 2 is its obverse. For these firms, the number of lawyers grew slower than the economy, leverage increased and cost-per-lawyer contracted in real (inflation-adjusted) terms. Interestingly, the ostensibly defensive performance characteristics of these firms have produced some stunning PPP gains, with the higher-performing firms, such as Wilmer Cutler, Alston & Bird and Weil Gotshal, equaling or surpassing their Group 1 counterparts. Again, the range of profitability outcomes suggests this profile fits two different types of firm: Those that retrenched to a strong core, and those that are struggling to find a strong core. Again, the two can't be distinguished from the outside. It is noteworthy that the group contains highly renowned firms such as Davis Polk and Skadden, the implication being that even the highest-quality firms have the wisdom to exercise traditional management levers to secure their standing among the world's high-profit elite. The group also includes some firms that, even with these actions, have struggled to increase PPP. The PPP performance of these firms would have been weaker had they not been managed as they were, so it would be harsh to decry the intent of their efforts.

Groups 3 and 4 can both be considered to have managed profitability through growth containment and a mix of other levers. They are alike in that, for both, the number of equity partners grew slower than the overall economy. They differ in how they approached the other two primary drivers of profitability improvement. Group 3 increased leverage but did not reduce cost per lawyer; Group 4 reduced cost per lawyer but did not increase leverage. Again, these firms' seemingly defensive performance characteristics have produced some stunning PPP gains. The groups comprise firms across myriad circumstances, from Wachtell (whose profitability is already stratospheric) to firms that seem to have managed themselves deliberately for profitability improvement, and on to those that have come under attack from others and are working to shore up their positions.

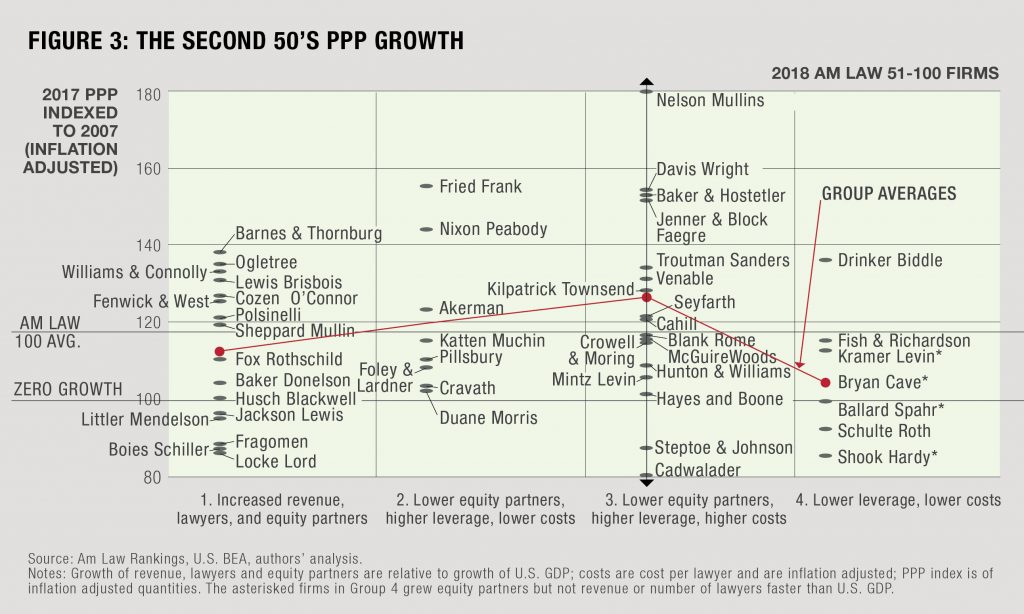

Looking across all four groups in Figure 2, we see that of the 25 firms in the Am Law 50 that recorded above-average growth in PPP, only seven did so through the historical pro-growth performance levers (these are the seven firms with above-average PPP growth in Group 1) while 18 did so through management levers (these are the firms with above-average PPP growth across Groups 2, 3 and 4). The inference is clear: Management has trumped growth as a route to higher PPP. (Figure 3 repeats the analysis for the firms ranked 51 through 100 by revenue and the same central observation holds: Only eight of the firms with above-average PPP growth got there through traditional pro-growth levers.)

How Much Is Management Willing to Manage?

The implications here are positive for Big Law. The industry has found its way back to strong profitability growth through discovering and exercising basic management levers. As the variability in performance across firms that have pulled different levers shows, their useful application is far from played out. Further, the data conveys particularly encouraging news for smaller and less profitable firms. Contrary to many a pundit's utterance, today's position is not destiny; firms from all starting points have proven they can manage their way to greater prosperity.

However, the data also suggests that the bifurcation of Big Law along a new fault line is emerging. Rather than a rupture zone defined by size or profitability, it is defined by the extent to which firms are prepared to manage the basics of lawyer numbers and cost. Historically, a certain détente prevailed. Firms neither managed their way to improved profitability assertively nor used stronger profitability unabashedly to extract lawyers from other firms, and Big Law enjoyed bountiful profitability broadly. Under pressure from commercially motivated partners since the Great Recession, though, several firms have broken ranks, managed their way to improved profitability and are proactively using the power of the purse to pull partners from rivals. The old order cannot be re-established. Firms will have to either manage themselves more deliberately to increase profitability or risk the loss of high-value partners to rivals who do so.

Leaders with whom we've spoken are aware of this dynamic. They feel constrained, however, by how much management their partners will bear. But the impetus should be working in the opposite direction: Partners should realize what is happening, demand their leaders take action and empower them with the concomitant managerial discretion.

Hugh A. Simons, PhD, is formerly a senior partner and executive committee member at The Boston Consulting Group and chief operating officer at Ropes & Gray. He welcomes readers' reactions at [email protected].

Nicholas Bruch is a senior analyst at ALM Legal Intelligence. His experience includes advising law firms and law departments in developing and developed markets on issues related to strategy, business development, market intelligence and operations.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Will a Market Dominated by Small- to Mid-Cap Deals Give Rise to a Dark Horse US Firm in China?

'Ridiculously Busy': Several Law Firms Position Themselves as Go-To Experts on Trump’s Executive Orders

5 minute readTrending Stories

- 1Judge Sides With Retail Display Company in Patent Dispute Against Campbell Soup, Grocery Stores

- 2Is It Time for Large UK Law Firms to Begin Taking Private Equity Investment?

- 3Federal Judge Pauses Trump Funding Freeze as Democratic AGs Launch Defensive Measure

- 4Class Action Litigator Tapped to Lead Shook, Hardy & Bacon's Houston Office

- 5Arizona Supreme Court Presses Pause on KPMG's Bid to Deliver Legal Services

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250