Debunking the Consolidation Myth

If you thought law firms have been consolidating through merger, think again.

May 22, 2018 at 09:40 AM

8 minute read

A mistaken and dangerous belief pervades much thinking about the U.S. legal market: that it is consolidating as larger firms grow more quickly than the market by taking share from their smaller rivals. A thoughtful look at the numbers reveals that no such consolidation is happening. This is an important correction to the prevailing wisdom. The mistaken perception of consolidation drives firms to bulk up—by merging, acquiring and hiring laterally—to avoid being at a competitive disadvantage. Such moves are high-risk, disruptive distractions for leaders whose attention is better focused elsewhere. Despite the intense effort involved, they create no strategic advantage. Wise partner groups and firm leaders will see past the prevailing dogma and focus instead on optimizing the performance of organically growing businesses.

Dive into the Am Law 200 data and personalize it based on your firm, peers and trends. Learn More

Dive into the Am Law 200 data and personalize it based on your firm, peers and trends. Learn MoreConsolidation Is Simply Not Happening

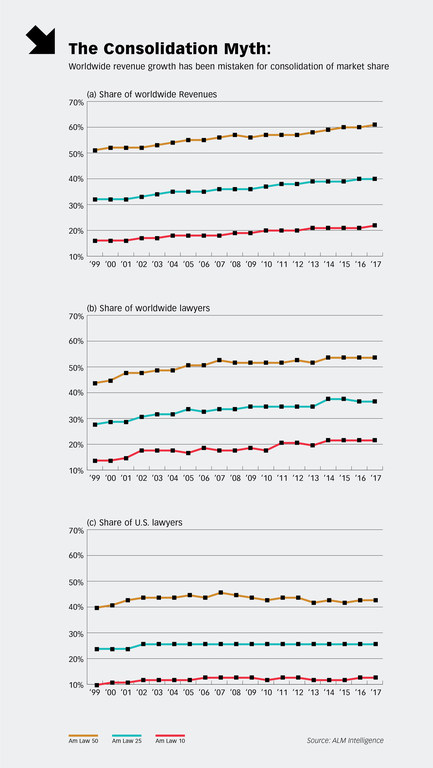

Let's start with the data. The graph below shows the share of worldwide Am Law 200 revenue that has accrued to the Am Law 10, Am Law 25, and Am Law 50 (respectively, the largest 10, 25 and 50 Am Law firms) over the last 20 years. The data shows that the shares of these groupings grew by 5, 8 and 10 percent, respectively. Surely this is consolidation? No, not at all.

The graphs mix two completely different things: (1) the domestic revenues of all Am Law firms and (2) revenues from the disparate set of international markets in which individual Am Law firms chose to compete to varying degrees (or not at all). What the revenue graph shows is merely that larger firms grew worldwide revenues more quickly than did smaller firms, but there is nothing to say they did so by taking share from smaller rivals and thus are realizing a competitive advantage from their greater scale.

To get an accurate view of consolidation, we have to look separately at the U.S. and international positions of the Am Law firm groupings. While we don't have discrete U.S. and international revenue data, we do have numbers of lawyers by market, a close parallel. The middle graph shows the shares of total Am Law 200 lawyers working worldwide at the different Am Law groupings. The lawyer shares of the Am Law 10, 25 and 50 have grown by 8, 10 and 10 percent, respectively, over the last 20 years. These “lawyer share” gains are comparable to the “revenue share” gains, affirming the validity of looking at consolidation through the lens of share of lawyers.

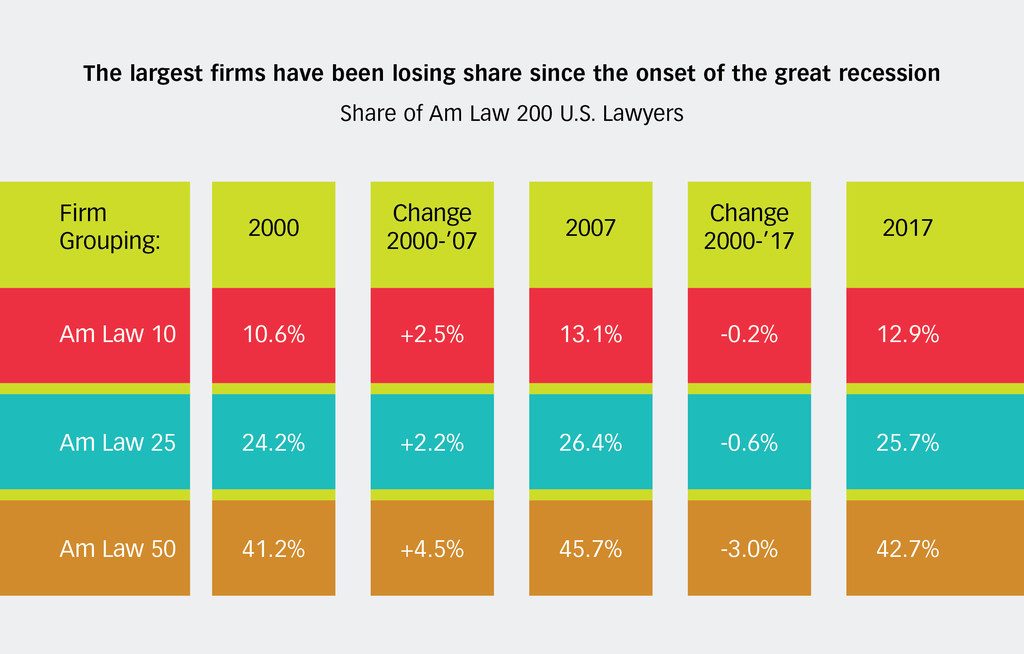

The third graph looks only at the share of U.S.-based lawyers for the same Am Law 10, 25 and 50 groupings. Here, a different picture emerges. The 20-year share gain by the various groupings is a modest 2 percent. However, even this overstates the share gain, as it is an average across two very different business cycles—that of the boom between the legal world peaks of 2000 and 2007, and that of the Great Recession and subsequent “new normal” of 2007 through 2017.

By separating the share gains by Am Law grouping for these two cycles, we can get a better understanding. Focusing on the more recent 2007 to 2017 cycle, Am Law 10 firms roughly held share, the Am Law 25 slipped slightly, and the Am Law 50 lost 3 percent. Thus, the data is clear: There is no consolidation among the Am Law 50; indeed, the Am Law 50 have lost share to firms below the top 50 over the past decade, the inverse of consolidation.

The Pushback

We've gotten a lot of pushback on this analysis. A typical first reaction has been to question the validity of the data. In particular, the analysis seems at odds with the high volume of law firm mergers we read about. There are several counterpoints. Most of the mergers one reads about are of very small firms. Some of the larger mergers have proven spectacularly unstable (Dewey LeBoeuf and Bingham McCutchen, for example), so there is no sustained consolidation. Many combinations are de facto takeovers of struggling firms that have been shrinking, so that the merger (at most) stems a fragmentation trend. Almost all firms shed lawyers after combining, diluting any consolidation effect. And, lastly, most firms grow organically, so that, over time, the benchmark against which a consolidating entity should be compared is constantly rising.

Dive into the Am Law 200 data and personalize it based on your firm, peers and trends. Learn More

Dive into the Am Law 200 data and personalize it based on your firm, peers and trends. Learn MoreAnother argument has been that we shouldn't separate out international revenues in looking at share. We don't agree. Consider this analogy: Imagine that last year three companies each produced and sold 100 widgets into a U.S. widget market sized at 1,000 widgets per annum. As together they sold 300 widgets, the combined market share of these three companies was 30 percent (300 divided by 1,000); a large number of smaller companies held the remaining 70 percent of the market. This year, everything is the same as last year, except that, in addition, one of the top three companies enters the German market and sells 50 widgets there. So, for this year, the big three companies sold 350 widgets between them and U.S. companies in total sold 1,050 widgets. Did the combined market share of the top three companies increase from 30 to 33 percent (350 divided by 1,050)? Did the three larger companies take share from the smaller ones? Clearly not. The only accurate statement one can make is that domestic shares were unchanged while one player entered a new international market (their share of which we don't know).

It is the same with the Am Law 200: the market share of the larger firms has not increased; larger firms have not taken share from their smaller compatriots. There simply is no consolidation. Rather, some larger firms have expanded overseas more quickly than have their smaller rivals.

Yet another reaction has been that the data understates the importance of having a strong international platform to the competitiveness of a firm's domestic business. But it doesn't. If the expanded international presence were creating an advantage in the domestic market, then we'd see this reflected in share gain domestically—the firms that grow internationally would be gaining share domestically, too. This is not happening. Indeed, over the last decade the very opposite is occurring: International growth is coming with domestic share loss—a risky tradeoff, as most practices are more profitable domestically than internationally.

A last counterargument we've heard is that all markets consolidate, hence law must, too. But not all markets consolidate; they only do so when there is benefit to either the buyer or the seller from a large-scale provider. Typically, the root of this benefit is economies of scale in the providers' production processes. Commodity chemicals is an example of such a market. Markets where rivals focus on specific segments or seek to compete through differentiation rather than on cost tend to remain fragmented. Haute couture is an example of such a market. Law is less like commodity chemicals and more like haute couture. It's an amalgam of distinct services offered by very different providers in settings that have widely varying balances of power between buyers and sellers. Law exhibits no economies of scale. The notion that law must consolidate is simplistic and misleading.

The Groundless Growth Imperative

Consolidation is not happening. The imperative for law firms to grow is groundless. Smaller firms that don't expand internationally are not losing share; in fact, they've gained share through the Great Recession. The data could not be clearer. And yet we know that this simple truth will be ignored. Facts are an ineffective counterweight to long-held belief. It's too bad. Running a U.S.-centered, organically growing law firm well is a strategy with enormous validity and tremendous potential for strong profit growth.

Hugh A. Simons is formerly a senior partner and executive committee member at The Boston Consulting Group and chief operating officer at Ropes & Gray. He welcomes readers' reactions at [email protected].

Nicholas Bruch is a senior analyst at ALM Legal Intelligence. His experience includes advising law firms and law departments in developing and developed markets on issues related to strategy, business development, market intelligence and operations. His email is [email protected].

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Adding 'Credibility' to the Pitch: The Cross-Selling Work After Mergers, Office Openings

5 minute read

Law Firms Are 'Struggling' With Partner Pay Segmentation, as Top Rainmakers Bring In More Revenue

5 minute read

Will a Market Dominated by Small- to Mid-Cap Deals Give Rise to a Dark Horse US Firm in China?

Trending Stories

- 1Gunderson Dettmer Opens Atlanta Office With 3 Partners From Morris Manning

- 2Decision of the Day: Court Holds Accident with Post Driver Was 'Bizarre Occurrence,' Dismisses Action Brought Under Labor Law §240

- 3Judge Recommends Disbarment for Attorney Who Plotted to Hack Judge's Email, Phone

- 4Two Wilkinson Stekloff Associates Among Victims of DC Plane Crash

- 5Two More Victims Alleged in New Sean Combs Sex Trafficking Indictment

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250