The Second Hundred Are Stuck in the Middle

The Second Hundred serve the same demanding clients as the Am Law 100 and are asked to deliver the same sophisticated legal advice, but with limited resources it's harder to get ahead.

May 22, 2018 at 09:45 AM

9 minute read

Being in the middle has never been easy. The middle child, the middle manager, the midsize company—all come saddled with a litany of burdens from not being big enough to do something to being big enough not to do something. The middle is large enough to create expectations, yet not large enough to deploy vast resources in pursuit of a mission. It demands juggling priorities, enduring sacrifices and making sometimes difficult choices. The middle is where we find the Am Law Second Hundred.

Dive into the Am Law 200 data and personalize it based on your firm, peers and trends. Learn More

Dive into the Am Law 200 data and personalize it based on your firm, peers and trends. Learn MoreThe Am Law Second Hundred serve the same demanding, high-profile clients as their brethren in the Am Law 100. They are being called upon to deliver sophisticated legal advice and employ top-tier talent. And now they are being asked to respond to client calls for increased efficiency, innovation and diversity, all while facing competitive pressures such as an influx of in-house counsel roles and the rise of alternative service providers.

Yet, unlike the Am Law 100, the Second Hundred rarely have access to the same financial resources. They have, by definition, smaller revenue streams and fewer lawyers. Their brands, reliant in most professional service firms on the number of providers, extend only as far as their geographic footprint or perhaps one or two nationally renowned niches. And their resources—the dollars and time available to invest in “discretionary” business pursuits such as project management training, business development coaching or innovative technology—are stretched thin. Further compounding this reality for more than a few are firm leaders doing double duty as practicing lawyers and overly democratic cultures where consensus rules. The struggle is real.

But in 2017, five of the 10 fastest-growing law firms are part of the Second Hundred, as are three of the top 10 firms ranked by revenue per lawyer and profits per lawyer. Three of the top performers are newcomers, catapulting themselves into the Am Law 200 rankings with oversized boosts to their top line. One-year growth in performance, though, does not make a true competitor. Longer-term trends paint an equally and perhaps more interesting story.

Increasing Cost Per Lawyer May Be a Good Thing

An analysis of revenue growth since 2012 reveals five of the top 20 fastest-growing law firms are part of this year's Second Hundred, and nine of the top 20 were in the latter half of the Am Law 200 at the beginning of the timeframe. Despite the challenges they've faced, including scarcer resources and external market pressures, these firms have managed to outpace their larger peers. Many have made bold moves, taken chances and aggressively pursued growth strategies to push themselves into stronger competitive positions.

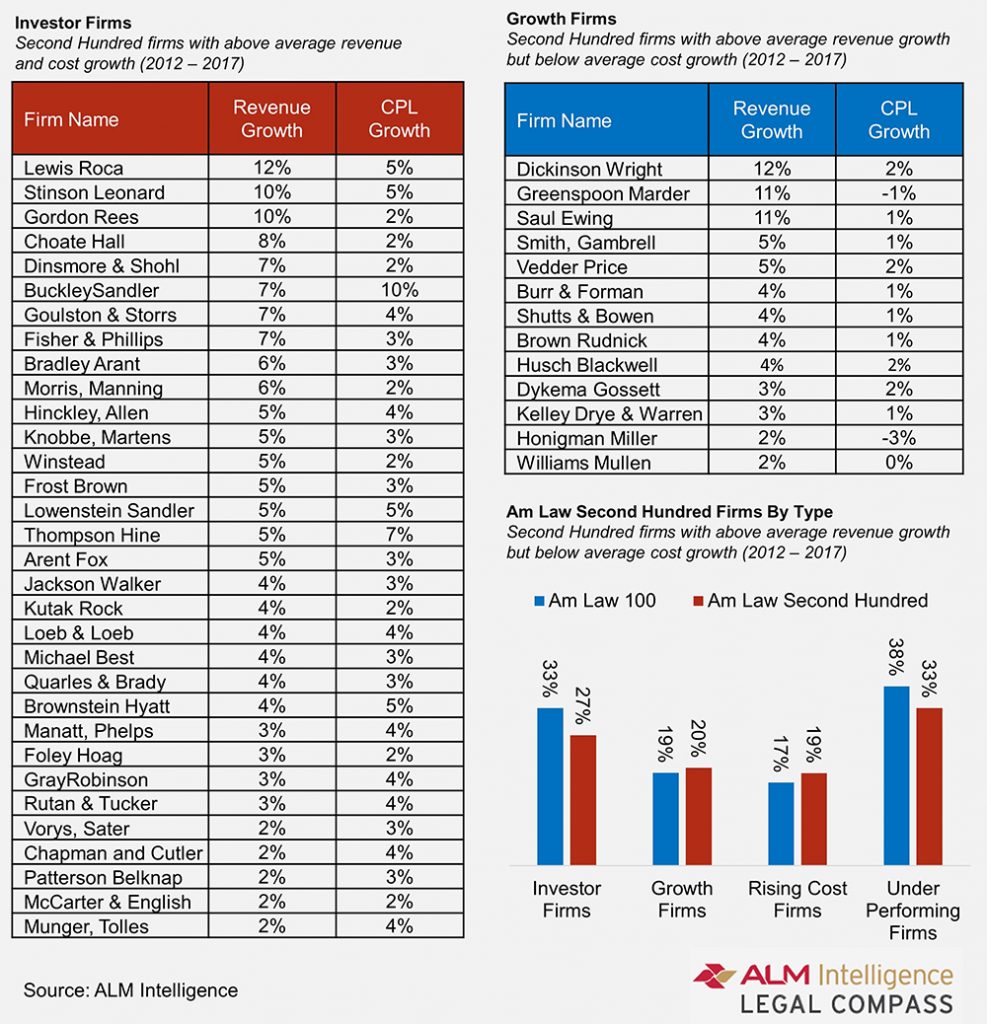

One common thread connecting many of the faster-growing firms is an accompanying increase in cost per lawyer (CPL). In other words, these firms are investing in growth. Specifically, six of the nine top-growth firms from the 2012 Second Hundred have CPL increases above the average for their peers (peers being defined by Am Law 100 and Second Hundred, separately), as do 13 of the top 20 fastest-growing firms overall. A handful are the product of mergers (such as Stinson Leonard Street, Polsinelli) while others are carving out distinct niches or advancing unique strategies (such as Fragomen, Del Rey, Bernsen & Loewy; Fenwick & West; and Nelson Mullins Riley & Scarborough).

In 2017, Thomson Reuters' Legal Executive Institute published its Dynamic Law Firms Study, finding, among other things, that the most successful law firms were investing in growth. Their report cited investments in marketing and business development and technology as among the most common. Looking more broadly at the Am Law 200 data set, it is evident the investments are numerous and varied—and some are more successful than others.

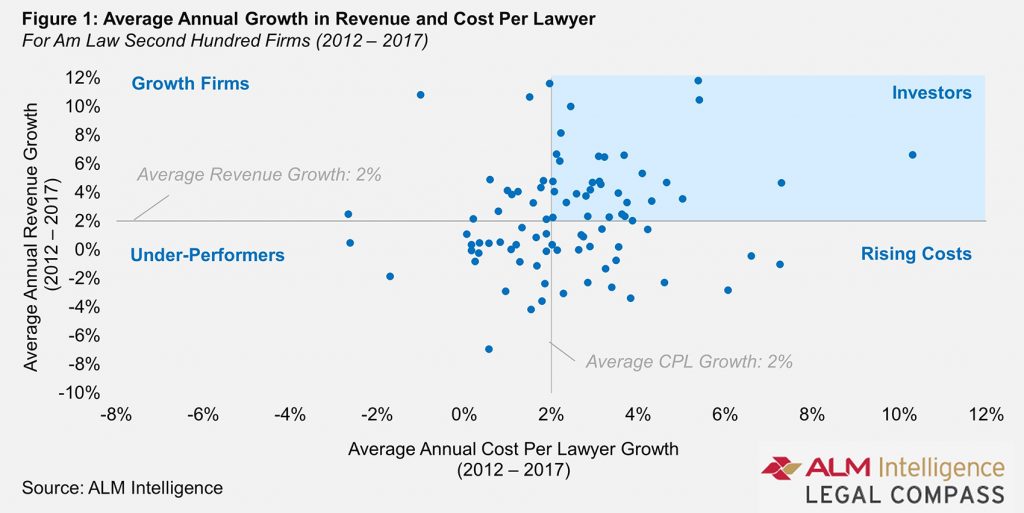

The below quadrant chart plots each of the Second Hundred based on trends in their revenue growth and CPL since 2012. The horizontal and vertical lines dividing the matrix represent the average compound annual growth rates for the Second Hundred in each of these key metrics from 2012 to 2017. In the upper right quadrant are those firms investing in growth—firms whose CPL is climbing, as is their market share (or revenue). Twenty-seven percent of the Second Hundred analyzed land here.

The firms in the upper right, investors, are forgoing some profit disbursement in favor of supporting firm growth through such activities as talent development, geographic expansion, technology, new practice areas, project management and pricing programs. Several are doubling down on industry, practice or regionally targeted growth strategies. Despite their decision to invest and, in turn, lift their costs, however, this group enjoys profit per equity partner increases over the same timeframe that are twice the Second Hundred average—and in keeping with those in the upper left.

In the upper left are firms enjoying growth without rising costs. Some of these firms are those that boast market dominance, helping them to maintain a competitive advantage without increasing costs. Others are leveraging intelligence wisely to make more impactful investments. And still others are reaping the rewards of earlier investments, made prior to the most recent five-year period analyzed.

Dive into the Am Law 200 data and personalize it based on your firm, peers and trends. Learn More

Dive into the Am Law 200 data and personalize it based on your firm, peers and trends. Learn MoreOn the bottom right, we find firms with increasing costs and below-average revenue growth. These firms fall into one of two camps: those recently initiating growth strategies that have yet to pay off, and those that have invested in failed strategies (giving firms the benefit of the doubt that costs are being actively monitored and managed). In this latter category, more often than not, are law firms whose inability to make difficult decisions or prioritize their investments leaves them with several moderately successful or unsuccessful initiatives. These firms have, on average, the lowest 2017 profit margins and profits per lawyer of the Second Hundred. One in five firms falls into this quadrant.

All too often, law firms engage simultaneously in too many investments, choosing to hedge their bets or make everyone happy rather than risk a larger failure. The reasons for this are many and varied, most frequently including a lack of data to support one option over another, a consensus-based (committee) management style or weak leadership. The results, however, are similar. Dispersed energy and effort yielding tepid results.

“Essentialism: The Disciplined Pursuit of Less,” a book by Greg McKeown, has a wonderful illustration of this phenomenon. It depicts two small circles side by side. The one on the left has about a dozen arrows in opposing directions. The circle, representing the organization, does not progress meaningfully in any direction. Conversely, the circle on the right has a single, lengthy arrow extending upward. Concentrated investment of time and money in a single path drives the firm further faster. The trick, of course, is determining which of the many options is the priority.

Finally, in the bottom left quadrant sits the majority of the Second Hundred (and, worth noting, the majority of the Am Law 100 as well). Thirty-two percent of the Second Hundred have experienced below-average revenue growth and declining CPL since 2012. Again, these firms typically fall into two categories. One group houses those firms that have consciously and decidedly opted for a “shrink to grow” strategy, doubling down on a small number of areas (practice, geographic or otherwise) where the firm has or hopes to gain a distinct competitive advantage. Others are simply struggling. Whether as the result of poor financial management, a culture of complacency or competitive pressures, some of these firms are falling behind.

It's worth noting that nearly one in four of the firms in this quadrant—the underperformers—hails from the Southwest region. This region (including Texas, Arizona and Colorado) has been especially subject to an influx of newcomers in the past decade and many—though not all—of the incumbents have suffered under competitive pressures. Several of the firms in this quadrant will no longer exist as independent entities next year.

Now more than ever, law firm leaders are the key to the future. The increasingly volatile year-over-year performance across the entire Am Law 200 demonstrates the instability of the market. It is a clear sign of change. How each firm anticipates and responds to this change will determine its success.

As Hugh A. Simons and Nicholas Bruch recently concluded in their analysis of the Am Law 100, management will help to shape long-term performance. This analysis of the Second Hundred corroborates this finding and takes it one step further. It is not just about managing existing metrics and resources. It is about leadership. Leadership to guide cultural shifts, leadership to make difficult decisions, leadership to drive change and leadership to define—and invest in—the right priorities. The future is in the hands of the leaders of the Second Hundred.

Marcie Borgal Shunk

Marcie Borgal ShunkMarcie Borgal Shunk, founder and consultant with The Tilt Institute, facilitates must-have discussions with executives in legal and specializes in helping law firm leaders make better, data-driven business decisions.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Strategic Pricing: Setting the Billable Hour at the Intersection of Psychology, Feedback and Growth

'Rethink Everything' or 'Optimize What's Working'? The Right Law Firm Strategy

7 minute readTrending Stories

- 1With New Civil Jury Selection Rule, Litigants Should Carefully Weigh Waiver Risks

- 2Young Lawyers Become Old(er) Lawyers

- 3Caught In the In Between: A Legal Roadmap for the Sandwich Generation

- 4Top 10 Developments, Lessons, and Reminders of 2024

- 5Gift and Estate Tax Opportunities and Potential Traps in 2025 for Our New York High Net Worth Clients

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250