Why This GC of a $25B Company Has Migrated Work Away From the Largest, Most Elite Firms

DXC Technology general counsel Bill Deckelman reacts to the GC Thought Leaders Experiment findings on performance of the largest, most pedigreed firms and what he has found from moving work away from those firms.

December 19, 2018 at 09:04 PM

7 minute read

Bill Deckelman, Executive Vice President, General Counsel and Secretary of DXC Technology, in Tysons, VA. April 19, 2018.

Bill Deckelman, Executive Vice President, General Counsel and Secretary of DXC Technology, in Tysons, VA. April 19, 2018.

As one of the GCs who signed last year's open letter to the legal community, I would like to provide my thoughts on a recent finding coming out of this project, relating to the performance of the most influential and branded law firms. As the authors from AdvanceLaw note:

We write today with what may become the most controversial finding of the GC Thought Leaders Experiment. Based on in-house evaluations of over 1,400 legal matters, the largest and most established law firms lag the rest of the Am Law 200 in delivering high quality client service. There are exceptions, but this overall finding holds, and it is statistically significant.

Here is the whole article, which I know has been getting a lot of buzz in both in-house and law firm circles—it's certainly a powerful statement to be making.

I'll start with the caveat that this is about average performance, and that there are exceptions. That's consistent with my own experience too: some firms and lawyers, regardless of size or pedigree, perform better than others. (And this is part of AdvanceLaw's attraction to us GCs—we work with the A-Teams.)

That said, this finding is truly remarkable. We're in a market where the law firms that are the most lauded and receive the lion's share of important work, perform—on average—worse than competitor firms on everything that clients care about. What is going on here?

For context, during my first 15 years out of 20 as a GC, I subscribed to the conventional wisdom that the most esteemed, branded firms were the place to go for top service—to receive what the authors of the above article call “white-glove treatment.” I disproportionately hired these firms. But over the last five or so years, I've started migrating work, in part because I was witnessing more service missteps than before. At the high prices we were paying, this felt inexcusable. I'm referring, for example, to times my relationship partner didn't have our back, and didn't (or couldn't) address problems created by other partners at the firm. And this is for large clients—DXC Technology, for example, is a $25 billion global company with more than its fair share of legal work.

My view isn't that the top lawyers at these firms aren't knowledgeable or that they don't understand how to serve clients. It's that they're stretched thin, and can't be as attentive to my (or any single GC's) work as they used to be. This is the case because many of these firms achieved high partner profitability through increased staffing leverage. We're essentially paying for more junior lawyers, and when we get senior partners on the phone, they're often a step removed from the facts.

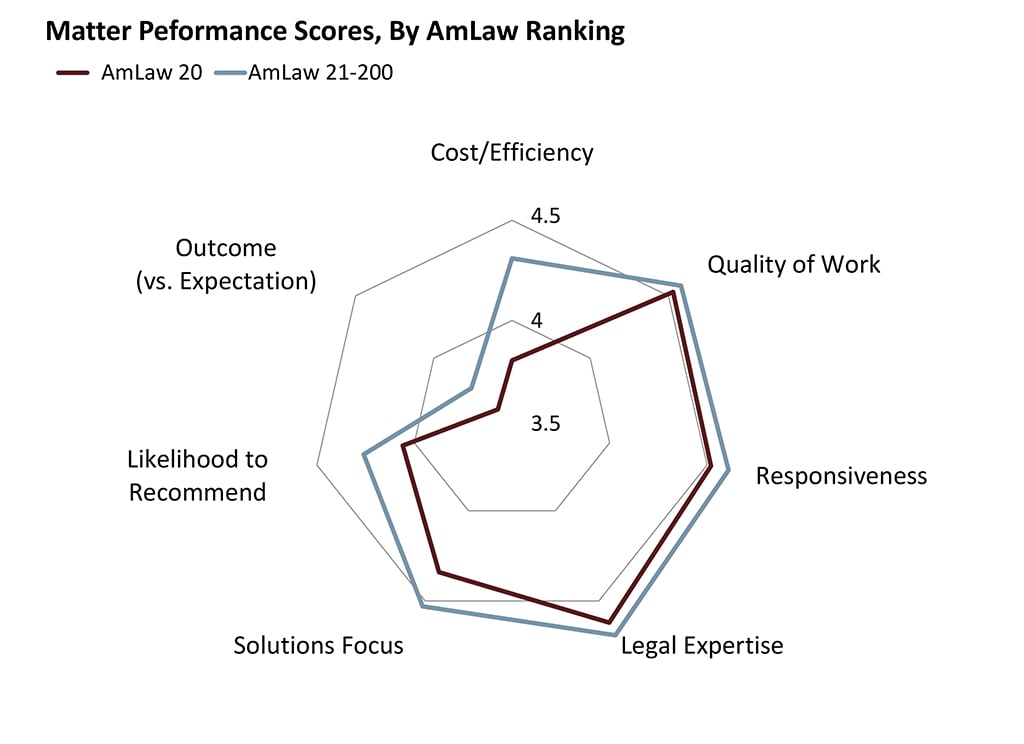

We can see in the article's “spider graph”—included below—how the Am Law 20 provide lower responsiveness, solutions focus, quality of work, efficiency, expertise, and the like, as compared to other firms in the Am Law 200 (most of which charge a lot less).

These results may also be a function of reduced client leverage: if a law firm is bringing in $3 billion a year, they can afford to risk losing a client. Overall, the firms at the top are running a different kind of firm than in the past, and it's led to real pain for clients.

I don't blame the firms (at least not much)—they are simply maximizing profits. The root of the problem is that we clients go to the well with certain firms because we're making buying decisions based on the firm's reputation for service quality 15 or 20 years ago; and we're willing to tolerate inefficiency or occasional service lapses. Sure, we may complain, but not much else happens, and law firms know this. It's hard for us to sever personal connections, and we don't know what a new firm will deliver.

In fact, when forced to replace one of these firms, we GCs often choose a different highly esteemed firm; so these firms know they'll get their fair share of new work, even if occasionally replaced. This is the case because no one second guesses our choosing an “elite” firm when something goes wrong.

So over the past five years I've been retaining more firms outside the Am Law 20 and Magic Circle for high-stakes legal work, and I'm getting better service quality than I expected. I had expected less because I hadn't appreciated how much the law firm model had changed, and I assumed service quality must be worse than at the firms on the top. I think a lot of us are assuming that, and collectively we're rewarding firms that are set up in a way that is likely to disappoint.

Two years ago, we took an even more significant step, stacking the deck in favor of law firms in the Am Law 50 to 200, and Silver Circle firms rather than Magic Circle firms. We parted ways with several incumbents and created a panel of eager, more innovative law firms. And we put in place protocols to drive new matters to these firms, knowing that otherwise we'd never overcome the default of retaining the biggest and most esteemed firms for important work. (In case this is of interest, the details are in this Modern Counsel article.)

The results so far have been great. These new firms have been impressing us on quality, expertise, efficiency, and all the things we're measuring, on major work. (Most important to me, by the way—and consistent with the article I've been referencing—is a focus on solutions.) I believe the difference I'm noticing comes down to two things: how these firms are structured (I get more senior partner attention, and they're affordable); and the fact that a lot of top legal talent has migrated across firms over the years. And there is the client leverage issue: the largest firms don't need to be as eager.

I think to make the legal industry work—and it sounds obvious putting it this way—clients need to send work to firms that can deliver what we actually want. At the end of the day, it's about supply and demand, and right now the supply side is sending the wrong signals. I understand why this happens, but I think it's time for us to evolve our thinking and change our collective approach. I hope this data helps us re-think our counsel selection decisions and not presume that what was true 15 years ago is still the case today.

To echo something I've heard Firoz Dattu (AdvanceLaw's founder) say, if clients make decisions based on actual performance, the entire industry is better off, law firms included. We'll eliminate complacency, as no firm will have a lock on our work based on historical legacy, unless the performance is there. And it's not about hurting elite firms—they will adapt and get better too; the whole of the market will improve. And that's a vision I can get behind.

Bill Deckelman is executive vice president, general counsel and secretary of DXC Technology. Bill was named the most innovative GC in North America by the Financial Times in 2017, and earlier in 2018 the DXC legal department was the recipient of an ACC Value Champion award.

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Greenberg Traurig Litigation Co-Chair Returning After Three Years as US Attorney

3 minute read

Blank Rome Snags Two Labor and Employment Partners From Stevens & Lee

4 minute read

12-Partner Team 'Surprises' Atlanta Firm’s Leaders With Exit to Launch New Reed Smith Office

4 minute read

After Breakaway From FisherBroyles, Pierson Ferdinand Bills $75M in First Year

5 minute readTrending Stories

- 1Settlement Allows Spouses of U.S. Citizens to Reopen Removal Proceedings

- 2CFPB Resolves Flurry of Enforcement Actions in Biden's Final Week

- 3Judge Orders SoCal Edison to Preserve Evidence Relating to Los Angeles Wildfires

- 4Legal Community Luminaries Honored at New York State Bar Association’s Annual Meeting

- 5The Week in Data Jan. 21: A Look at Legal Industry Trends by the Numbers

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250