Are Wall Street Firms Built to Handle Today's Financial Services Industry?

Three emerging trends in the financial sector have created a new competitive landscape for traditional capital markets-oriented firms.

August 19, 2018 at 06:00 AM

13 minute read

Amid all the sound and fury about imminent disruption in legal markets, there is always one vaguely defined group assumed to be largely exempt from the coming maelstrom: the venerable and venerated white-shoe elites of Wall Street.

An air of permanence clings about these names, bolstered by the twin mystique of prestige and pedigree. It is perhaps fitting that Wall Street is named for the defensive wall that once guarded the shores of New Amsterdam before New York came to be. In much the same way, many of Wall Street's most elite law firms trace their roots back to a time that predates living memory. Their perennial prosperity, relatively undeterred by the shockwaves of the Great Recession, only reinforces the perception of unassailability.

To follow a conversation on this subject between ALM Intelligence senior analyst Nicholas Bruch and The American Lawyer editor-in-chief Gina Passarella beginning Aug. 28, register here:

In 2018, just how much of that perception is grounded in reality? How much of it is steeped in our cultural habit of unconscious mythmaking about the fabulously successful?

As financial markets undergo rapid technological changes and regulatory turmoil, the competitive landscape for high-end legal work in transactions and capital markets is also shifting. To examine whether the successes of Wall Street's storied past are likely to extend into an increasingly uncertain future, we revisit the key market conditions that fueled the rise of Big Law's wealthiest incumbents and analyze three emerging megatrends in the financial sector.

The Rise of the Wall Street Elite: Financial Innovations Demanded Novel Lawyering

The birth of the modern American financial markets can be traced as far back as the late 19th century, when monopolistic consolidation in railways, steel, oil and mining created unprecedented demand for capital investment. It is no accident that the oldest of the Wall Street law firms established themselves around the same time. To this day, many have maintained a stronghold on the most complex work in M&A transactions and capital markets. How? By being the first to fulfill a vital function in their clients' pursuit of a strategic leap forward.

In a seminal example, Sullivan & Cromwell first developed the concept of the holding company in the 1890s, allowing Edison General Electric and U.S. Steel to sidestep existing antitrust law and integrate horizontally. The firm continued its rise to prominence by facilitating investment of European capital into American transcontinental railroads and the Panama Canal.

Over time, new models of corporate competition continued to emerge, directing M&A activity accordingly. As the financiers of Wall Street prospered, so did New York's most prestigious law firms. Throughout the 1970s and '80s, however, the fate of Wall Street took a singular turn as a few key developments conspired to create a decade of bonanza for New York's wealthiest bankers and lawyers.

In 1979, Fed monetary policy shifted toward a fixed money supply and floating interest rates. Interest-rate fluctuations led to greater price volatility in the secondary market for fixed-income products. Wall Street financiers went on to underwrite more debt and create new securities and derivatives to make secondary market trading more efficient. Many of these financial innovations in the bond market required new laws to be passed in Congress, existing laws to be reinterpreted and new debt instruments to be designed—all driving growing demand for specialized legal expertise.

Aggregate borrowing in the United States underwent unbridled growth. In 1977, the combined debt of American governments, corporations and consumers totaled $323 billion. Just eight years later, that figure was at $7 trillion. New bond issuances went through the roof, thanks to innovations in mortgage-backed securities led by Salomon Brothers and the explosion of high-yield junk bonds led by Michael Milken at Drexel Burnham.

Between 1977 and 1986, the mortgage bond holdings of U.S. thrifts exploded from $13 billion to $150 billion. Cadwalader, Wickersham & Taft and Cleary Gottlieb Steen & Hamilton essentially functioned as laboratories, churning out new securitization methods for mortgage- and asset-backed securities as well as complex derivative products. Between 1984 and 1989, Cadwalader more than doubled its gross revenues while Cleary nearly tripled its top line.

Meanwhile, new junk bond issuance went from less than $900 million in 1981 to $12 billion in 1987. This turned out to be especially helpful to Wall Street law firms because Milken's junk bonds bankrolled the wave of hostile takeovers by corporate raiders throughout the '80s, opening a floodgate of transactional work. Cahill Gordon & Reindel became the transactional adviser of choice for Drexel Burnham; by 1989, Cahill reported a profit margin of 59 percent, second only to Wachtell, Lipton Rosen & Katz's staggering 71 percent.

The rise of the takeover and leveraged buyouts also created immensely lucrative second-order effects for law firms, driving M&A and securities litigation work. In addition, seemingly endless demand for new work sprang up to help raid-proof corporations by various legal means, like the famed poison pill defense developed by Marty Lipton at Wachtell. Also in the 1980s, legal work around companies' increased appetite for debt spiked, as did work on golden parachute contracts.

Wall Street law firms rode these waves in the financial markets to miraculous levels of growth and profit. With the exception of Cravath, all of the Wall Street firms nearly doubled in size from 1978 to 1988; the majority grew their top lines and net income by a multiple between 2 and 3. As a group, they would never again enjoy such an unblemished run.

Life Beyond the 'Great Reset': Three Megatrends Swirl Around Wall Street

Wall Street “capital markets” firms are often headquartered in a global financial center, have deep relationships with a major bank, and have preferred access to the most intrinsically lucrative, high-margin practices.

In the '70s and '80s, this description fit a sizable group of New York firms. In 2018, the definition still fits, but less comfortably; the underlying competitive logic still holds sway, but the gloss of apex primacy is beginning to look a bit faded.

Our research and analysis identified three trends that conspire to erode the hegemony of the Wall Street law firm:

Structural changes to the banking industry stemming from consolidation.

In the '80s, a lengthy list of investment banks headquartered in New York controlled most M&A and capital markets activity on Wall Street. In 2018, most of those names have been washed away by multiple waves of consolidation. A few banks collapsed spectacularly, most notable of these being Drexel Burnham and Lehman Brothers, but most have been absorbed in some manner: Bear Stearns into JPMorgan Chase, Dean Witter into Morgan Stanley, First Boston into Credit Suisse, Salomon Brothers into Citigroup.

Only a handful of bulge brackets remain, operating globally as full-service investment banks, with a significant portion headquartered outside the U.S. In tandem with consolidation, banks have largely gone public; compared to the carefree excesses of the '80s, investment banks are now subject to much more rigorous scrutiny by shareholders and regulators alike. The impact on law firms is nuanced but real. One result of consolidation is intensified pressure to manage costs across the enterprise; with growing size, banks are better positioned than ever to exploit economies of scale.

Case in point: earlier this year, JPMorgan Chase, Bank of America and Citigroup, which collectively arranged 20% of all bond issuances globally in 2017, agreed to jointly develop a new technology platform to streamline the disjointed bond issuance process for underwriters and asset managers. This proactive measure to displace the decades-old reliance on phone, e-mail and the chat feature on the Bloomberg Terminal is representative of a newfound focus on value and efficiency. This follows a 2015 announcement by Axiom Law of a multi-year $73 million deal with a global bank to process master trade agreements and to streamline the back-office operations needed to maintain compliance.

In short, the established client base of the “capital markets” law firm has shrunk in number and adopted buying preferences that are leaner and more value-conscious than ever before. The surviving banks now seek to make strategic investments into systemic solutions for proactive risk management and cost avoidance. Bulge brackets aren't likely to begin bargain shopping for high-consequence representation in the front office, but the newfound focus on value is real.

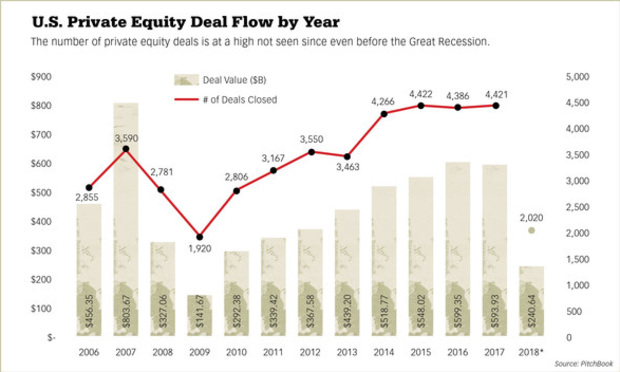

The rise of private equity and venture capital and the decline of public capital markets. The leveraged buyout of the '80s served as a precursor to the rise of private equity in the '90s. Between 2000 and 2016, the number of private equity firms around the world tripled, while assets under management exploded from just under $600 billion in 2000 to $2.8 trillion as of June 2017. Venture capital has also nearly doubled since the Great Recession, with $524 billion in assets as of June 2017.

In contrast, the public markets show a decline: as a result of delisting, mergers and fewer initial public offerings, the number of publicly listed companies has fallen by more than half since 1996. This leaves law firms competing more intensely for fewer marquee clients in fewer megadeals, often engineered by players other than major investment banks.

While the old guard of New York still enjoy preferred access to marquee assignments to represent banks as underwriters, lenders or bookrunners, they lack the same type of preferred access to the new class of investors and financiers poised to dominate the most vital sectors and regions of the global economy.

The scope of capital market flows now extends far beyond New York's borders. Old-line Wall Street firms now face fierce competition on all sides and from outside their ranks: from ascendant global powerhouses like Kirkland & Ellis and Latham & Watkins, both aggressively targeting private equity; Silicon Valley strongholds with closer ties to VCs and the high-tech sector, like Wilson Sonsini Goodrich & Rosati, Cooley, and Fenwick & West; and an emergent class of more competitively priced globals vying for share in Asia.

Regulatory upheaval and innovation in the financial sector.

Regulatory burden is a favored complaint of big business across all sectors. The conservative think tank Competitive Enterprise Institute reports that the government issued over 80,000 pages of rules in 2015 and CEI estimates the total cost of compliance at $1.9 trillion. There is no question that the post-crisis financial reforms have dampened Wall Street's profits. JPMorgan Chase has hired over 8,000 compliance professionals since the 2008 crisis, and Deloitte estimates that the operating costs spent on compliance by financial service institutions increased by 60% between 2008 and 2016.

Under the Trump Administration, deregulation is de rigueur once again, creating opportunity for both banks and law firms alike. However, cyclical changes in regulatory regime represent only one lever in the growing complexity around financial services. Even if Dodd-Frank reforms were repealed entirely or rolled back significantly, banks are unlikely to wholly dismantle their compliance infrastructures, which consist not only of people but also process-driven systems as well as proprietary data, knowledge networks and accumulated investments in regtech and fintech.

A more likely scenario is a value-oriented bifurcation of regulatory work: high-stakes assignments to leading firms for premium rates and the continuing build-out of internal capabilities to operationalize day-to-day compliance and to service high-volume enforcement and litigation needs.

In 2018, financial innovation tends to apply emerging technology to new mechanics and channels to move capital through the financial system. Algorithmic trading, “dark pools,” and cryptocurrency are all examples of new frontiers where regulators and legislators lag in articulating safeguards around a rapidly changing financial sector. While their broad impacts on the economy are uncertain, such innovations are likely to provide a steady flow of grist for new controls and ongoing showdowns with regulators—and more canny lawyering by expert specialists.

Wachtell; Sullivan & Cromwell; Paul, Weiss, Rifkind, Wharton & Garrison; Debevoise & Plimpton; Davis Polk & Wardwell; and Cleary are all well positioned to compete for lucrative work in the regulatory space. However, competition for high-consequence, high-profile assignments will be fierce, varied and blindingly pedigreed from every direction. Depending on the specific opportunity, K Street stalwarts; litigation specialists; Kirkland; Skadden, Arps, Slate, Meagher & Flom; and Latham are all likely to put themselves in play.

Position Isn't Destiny, but Still an Advantage

These megatrends knit together to create a new competitive landscape for the old-line capital markets firms—but new doesn't mean bad. Analysis of backward-looking data shows most of the old-line elite are still fabulously prosperous.

But the slowdown of revenue per lawyer growth in the post-recession recovery and the rising intensity of competition suggest that in the future, the old guard of New York will experience at least relative levels of winning and losing.

In 2018, the old-line Wall Street firms still enjoy significant advantages to compete and win. What has changed since their heyday is that they must now actually compete, in arenas far-flung from New York and as diverse as Silicon Valley, Washington, D.C., and China. For all firms except Wachtell—sui generis in more ways than one—perpetual dominance across key metrics is no longer guaranteed simply by virtue of the poshest address in Big Law.

Jae Um is the founder of Six Parsecs and an ALM Intelligence fellow. Nicholas Bruch is a senior analyst with ALM Intelligence.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Haynes and Boone Expands in New York With 7-Lawyer Seward & Kissel Fund Finance, Securitization Team

3 minute read

Covington, Steptoe Form New Groups Amid Demand in Regulatory, Enforcement Space

4 minute read

Consumer Finance Law Enforcer Takes Private Practice Job at Morgan Lewis

Trending Stories

- 1CFPB Labor Union Files Twin Lawsuits Seeking to Prevent Agency's Closure

- 2Crypto Crime Down, Hacks Up: Lawyers Warned of 2025 Security Shake-Up

- 3Atlanta Calling: National Law Firms Flock to a ‘Hotbed for Talented Lawyers’

- 4Privacy Suit Targets Education Department Over Disclosure of Student Financial Data to DOGE

- 5Colwell Law Group Founder Has Died in Skiing Accident

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250