Law Firm Leaderships' Biggest Challenge: Equality Of Outcome

Aggressive poaching in the market is forcing leadership to contend with the delicate balance of equality, culture and compensation in their firms.

September 11, 2018 at 09:01 AM

10 minute read

The original version of this story was published on Law.com

Law firm leadership has plenty to keep them up at night: technology gobbling up the bottom of the leverage pyramid, flat market demand, tectonic cultural shifts, ever-expanding skill set demands and more. Traditionally, I've found that developing new business and generating client loyalty is top-of-mind in strategy sessions, but more and more I am hearing that there is a new specter that looms largest for many and in particular the “elites”: the gain/loss of major rainmakers.

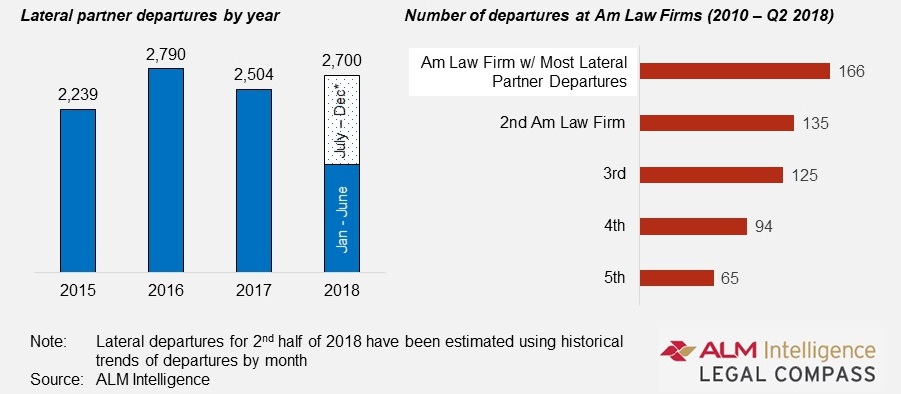

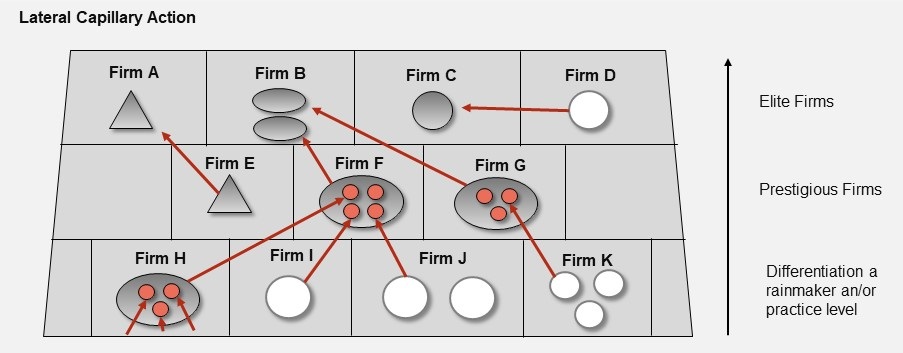

In an article posted on August 15th, we discussed the newly aggressive capillary action that is destabilizing the legal market and changing the way that the business of law is conducted. As a result of this, many leaders are no longer focused just on business development but are also trying to figure out how to continue making money and structure their firms in a way that allows them to spend the requisite money to pay top talent.

What Is Actually on Leaderships' Mind?

This ever-more-liquid lateral market is creating tremendous tension for leadership. How do they keep people happy when the previous view that “we're all partners” and “equal” stands in the face of today's reality: some people are more “equal” than others and the market is putting its money where its mouth is. The $64,000 question has become, can a firm continue to have all of the pleasures of autonomy and a partnership-like atmosphere and culture, while maintaining a compensation structure that keeps the best people on the team? This requires some unbundling:

Compensation: Big paydays are setting a whole new standard in attorney compensation. And to keep up, many firms need to be able to “free up” enough money to compensate – to market standards, not just internal standard – those that are essential to their firm's profitability and brand. This is a tall order if (a) your culture leans toward being a collective rather than a confederation and (b) you have a transparent compensation model.

Culture: If you've been built upon, and lean heavily toward, a true “partnership” mindset and there is a very small spread among your partners' compensation, it is a massive challenge turning that corner whereby (at least) the vast majority of the partnership will agree to moving some of their compensation into the pockets of someone else – particularly a newcomer. This can be easier if the firm's brand and reputational capital is so strong that (a) it materially helps rainmakers bring in business and/or (b) clients of the firm are comfortable with being institutionalized.

Reputational Capital: From a cultural and procedural standpoint, firms with really great brands bring in, institutionalize and keep, business without a heavy need for rainmaker-level influence. In fact, based on my conversations, when the top firms roll out new bill rates each year, less than 10% of clients give pushback in any way; 90% just keep paying! So, it isn't hard to see how cash flow will remain (quite) positive with this kind of client loyalty. But, the loss of major partners will directly impact client retention as (i) some move with those mobile partners, and (ii) it creates very poor optics that leave firms – particularly those with lesser reputational capital – vulnerable to delayed onset client depletion.

Clients: For any law firm, lateral movement spooks clients, including firms at the top of the food chain; media coverage of lateral movement REALLY spooks clients. Undifferentiated firms, in particular, are poorly positioned to attract and retain clients through their brand, alone, and so are very dependent on rainmakers' reputational capital to do so.

Rainmakers: All things being equal, rainmakers want an acceptable (and ideally, optimized) recipe of (i) top dollar for their book, (ii) actively and appropriately supportive partners and practice portfolios, (iii) the best firm brand that they can join, and (iv) a clear/defined/strong strategy for the future. When one of these nodes becomes upset or disrupted, either directly or indirectly, this is where wandering eyes can come into play.

Disruption: In the current market, huge lateral compensation packages are disrupting the equilibrium of the top firms, creating vacuums in them that are being filled by top talent either lateral to, or just below, them in the hierarchy of firms. This brings us back to the beginning: compensation and capillary action.

So, the heaviest yoke on the mind of leadership is, what is the best way to balance these points in a way that keeps the firm happily chugging forward into the future without losing their own people?

What will be the outcome?

Insider rumblings tell me that some long-historied firms will go away in the next 5-10 years. There are some firms that once were considered “elite”, but today are considered “top-tier” – a step below their former ranking – and are struggling to define themselves while setting a viable path forward. This has left them ripe for rainmaker transfers – which we are seeing – and thereby, destabilization. Some may be able to pull it off – Cadwalader, as an example, seems to be doing better after some internal indigestion. Some may merge – OMM and A&O for example. Some may go out of business.

A barometer for this slow decline in general strength may be the NY market's real estate management companies, which, I believe, are quite in tune with the macros of the market. Recent conversations I've had tell me that the major management companies are openly stating that they are no longer factoring law firms into their RE strategies. As landlords, they actually expect that current lessors will at best reduce their footprints when possible, at worst will vacate, and that there won't be any new entrants to the market.

So, What Should Leadership Do?

How does one stop the cascading effect of a further-destabilizing market from hitting them? This requires a much deeper discussion, but shooting from the hip:

One approach might be to cull the partnership, focus efforts into specific regions/practices/sectors so as to better dominate a niche and potentially create actual differentiation. In an interview I did with Bob Dell, the former Global Chair and Managing Partner of Latham & Watkins for Forbes, he had this to say about an undifferentiated firm seeking differentiation:

“In confronting this 'new normal,' I think you have to look very hard at, 'What are we really good at?' And maybe take a handful of practices and say, “Here's where we're going to focus our energy; focus our hiring; focus our marketing; focus our strategic client relations; and try to demonstrate to clients that we are true specialists in these areas, and that's where we add value to the relationship,' and see how effective we can be at that.”

This would be ideal, but as we all know, dramatic changes like this to a practice portfolio's structure are easier said than done. There is significant risk that by reducing and/or majorly changing anything within the firm – population, footprint, expenditure, investment, recruitment, etc. – it will further destabilize due to (i) the market's ingrained belief that change only comes when negative pressures demand it, and as a result of this belief, (ii) the internal and external perceptions of, “if the firm is changing, it must be failing.” Very few firms will have the strength/ability to directly and quickly take that track, which will ultimately leave them ripe for the picking. Though, some firms have made dramatic changes to their portfolio structure and are still alive to tell the tale – Husch Blackwell, for instance.

Beyond that, from a long-term perspective we are looking at a number of factors that will need to be introduced and integrated into the overarching legal culture and infrastructure:

First, if you are strict lockstep – and I mean strict lockstep; not “we are lockstep”, but in reality, there are some super-partners drawing above the model – shift your model further down the collective-confederated spectrum. There aren't many of these firms left, and in the continually pressurized market, there is good reason for that. Cravath's recent departures aren't aberrations; they are cracks in the dike. And if you are struggling to figure out how to make it work, give Brad Karp a call at Paul Weiss for some direction – they figured it out. Why reinvent the wheel?

Also, opacity in the compensation model will very likely become a norm at some point. Compensation is a weird thing: the actual number rarely causes as much angst as the comparison of that number with one's neighbors. No doubt that the relative nature of compensation satisfaction has not only kept many a' leader up at night come year end, but also has hindered many a' firms' abilities to build with the laterals that they truly want. Don't get me wrong – this is going to be a massive growing pain. But for the firms that are able to accomplish it, there will be significantly more room for leadership to move and respond to the market.

A norm that will need to be integrated into BigLaw culture – much to the chagrin of many – is the notion that all attorneys are not equal, and that's OK. Equality of opportunity is a necessary attribute if a firm is to be successful; equality of outcome is a road to failure. I tread lightly in this sociopolitical climate; so, to be direct, women, minorities, LGBTQ attorneys and any other protected class need to be afforded the same level of access to those opportunities – clients demand it, it is socially responsible and the practicality of diversity of thought and experience builds a better firm. At the same time, all partners should be measured by, and appropriately compensated for, their contribution to the firm's bottom line.

Without clients that pay you for your services, you will fail. And the processes, resources, and immensely complex ecosystem of human capital necessary for acquiring and keeping clients are vast, expensive and difficult to come by. When a firm gets the alchemy right in the way of a particular partner or group, protect them. You can do this by (i) being brutally honest with your partnership about who and/or what brings that money in and its primacy in your firm's values hierarchy, and (ii) making provisions within the compensation model and infrastructure that clearly and explicitly praise and compensate specific actions, skillsets and businesses that accomplish this.

Lastly, diversify. I can hear the groans about the aforementioned departure from equality of outcome: “If we cater to a handful of partners, we might become serfs in a feudal caste system.” The antidote to this is an appropriate level of diversification across your practice portfolio, your client base, and your partnership cohorts. Shifts – particularly dramatic shifts – can tip a narrow boat. But the absence of an overdependence on any particular person/s, client/s and/or practice/s offers the stability and flexibility necessary to maneuver in a shifting market. Of course, this will take time and is not a silver bullet. But, provided that you expect to be around in another 20 years, long-term plans should be made, and a well-diversified platform will leave your firm in a strong position to accomplish all of the above and to better control its destiny.

David J. Parnell is an author and speaker, co-founder of the Legal Institute for Forward Thinking and founder of legal search and placement boutique True North Partner Management.

More information on the ALM Intelligence Fellows Program can be found here

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Taking the Best' of Both Firms, Ballard Spahr and Lane Powell Officially Merge

6 minute read

New Year, New Am Law 100: Challenges Await These Newly Merged Law Firms

7 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250