White & Case Breaks $2 Billion in Revenue as Profit Growth Continues

Since implementing a strategic five-year plan in 2015, the firm's gross revenue has climbed 35 percent in just three years.

February 11, 2019 at 08:00 AM

4 minute read

White & Case chairman Hugh Verrier.

White & Case chairman Hugh Verrier.

More than halfway into an ambitious five-year growth plan, White & Case has crossed the $2 billion mark in annual revenue for the first time.

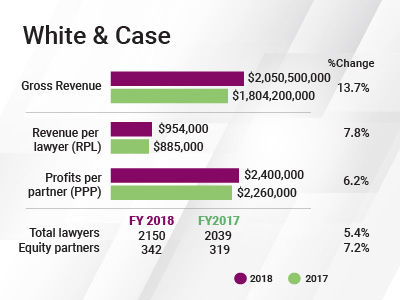

Gross revenue grew $246 million in 2018 to $2.05 billion, a 13.7 percent increase from the prior year, according to preliminary ALM reporting. Revenue per lawyer jumped 7.8 percent to $954,000, and profits per equity partner increased 6.2 percent to $2.4 million.

The figures represent the eighth straight year of profit growth for the international firm.

Thanks in part to new office openings in the U.S., White & Case's head count jumped 5.4 percent to 2,150 attorneys across the firm's 44 offices worldwide. The number of equity partners grew 7.2 percent, from 319 to 342 in 2018, and the nonequity partnership also increased in size, growing 5 percent last year to 188 lawyers.

Thanks in part to new office openings in the U.S., White & Case's head count jumped 5.4 percent to 2,150 attorneys across the firm's 44 offices worldwide. The number of equity partners grew 7.2 percent, from 319 to 342 in 2018, and the nonequity partnership also increased in size, growing 5 percent last year to 188 lawyers.

“Another year of very strong growth, especially in the U.S. with thriving new offices in Houston and Chicago and record results across the board” is how White & Case chairman Hugh Verrier summed up the firm's performance last year.

Verrier took over leadership of the firm in 2007, and in 2015 he was re-elected to his third term as chairman. He will be up for re-election in September.

While 2018 was a robust year for the overall global economy, Verrier said White & Case's financial performance last year had direct roots in the firm's five-year strategy.

After maintaining a relatively flat head count in the years following the global recession, the firm determined in 2015 to increase its bench strength in New York and London, with a target of 500 lawyers in those cities by 2020. The strategy also called for targeted growth in M&A, private equity, capital markets, and disputes practices.

Thanks to strong performances in these practice areas and others, Verrier said White & Case has already surpassed some of its key financial goals two years ahead of its 2020 target.

The M&A and corporate practice handled more than $380 billion in transactions work last year, which included representation of SodaStream International Ltd. in its $3.2 billion sale to PepsiCo Inc. The firm's capital market's practice represented Avast in its $816 million initial public offering, the largest-ever software IPO on the London Stock Exchange, and worked with commodities trader Noble Group Ltd.'s management team in its $3.5 billion debt-for-equity cross-border restructuring.

Verrier also cited strong results for the firm's financial restructuring and insolvency practice and its project development and finance practice, the latter of which was bolstered by its expansion in Australia and the opening of its Houston office.

Last February the firm added Vinson & Elkins oil and gas partner James “Jay” Cuclis, Andrew Kurth Kenyon partners Charlie Ofner and Christopher Richardson, and Saul Daniel, an England-qualified partner who previously practiced in the firm's London office, to open in Houston.

The Texas outpost has since expanded to around 30 lawyers, with lateral additions that include Kirkland & Ellis partner Chad McCormick, Akin Gump Strauss Hauer & Feld partner Steven Otillar, Paul Hastings partner Steven Tredennick and King & Spalding's David Strickland and Jorge Mattamouros.

The Chicago office has also expanded rapidly since opening last summer, boasting a head count of about 25 lawyers following a series of lateral additions from Greenberg Traurig and DLA Piper, and a 13-lawyer group from the Chicago office of national real estate firm Pircher, Nichols & Meeks.

Other notable 2018 laterals included Kirkland & Ellis capital markets partner Gilles Teerlinck and JPMorgan Chase & Co. executive director and assistant general counsel Julia Smithers Excell in London, and longtime U.S. Securities and Exchange Commission attorney Era Anagnosti in Washington, D.C.

The firm also opened an office in Tashkent, Uzbekistan, early last year.

Verrier said that White & Case is “not slowing down investing in key lateral partners.” But given signs of a potential economic downturn on the horizon, he said the firm will exercise some caution on overall head count growth.

One of the goals of White & Case's five-year plan that it has yet to meet is surpassing $1 million in revenue per lawyer. But Verrier said he's confident that the firm is close.

“I think we can do it this year,” he said.

READ MORE:

White & Case Makes Its Case for 'Audacious' Growth Plan

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute readTrending Stories

- 1Treasury GC Returns to Davis Polk to Co-Chair White-Collar Defense and Investigations Practice

- 2Decision of the Day: JFK to Paris Stowaway's Bail Revocation Explained

- 3Doug Emhoff, Husband of Former VP Harris, Lands at Willkie

- 4LexisNexis Announces Public Availability of Personalized AI Assistant Protégé

- 5Some Thoughts on What It Takes to Connect With Millennial Jurors

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250