Profits and Revenue Soar at Nixon Peabody

As its revenue surpassed a half-billion dollars for the first time, Nixon Peabody's profits per partner surged to $1.5 million.

February 13, 2019 at 03:50 PM

4 minute read

Andrew I. Glincher, CEO and managing partner with Nixon Peabody.

Andrew I. Glincher, CEO and managing partner with Nixon Peabody.

Driven by a strong year in its transactional practice and some high-profile litigation matters, Nixon Peabody reported double-digit percentage increases in revenue and profit in 2018 over the prior year—including a more than 35 percent jump in partner profits.

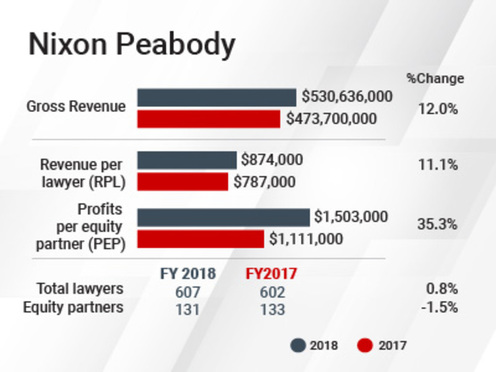

The firm, which has the largest of 17 offices in Boston, posted gross revenue of more than $530.6 million in the 2018 fiscal year, a 12 percent uptick over 2017. With 607 lawyers at Nixon Peabody, the firm's top line results amounted to revenue per lawyer of $874,000—an 11.1 percent increase compared with the prior year's RPL results of $787,000.

“2018 was a banner year for us; we were up in a major way,” said Nixon Peabody CEO and managing partner Andrew Glincher.

The strong gains in 2018's revenue came alongside sizable bumps in the firm's net income, which rose 33 percent to $196.9 million. Profits per equity partner (PEP) were also buoyed. The average Nixon Peabody equity partner earned more than $1.5 million in profits in 2018, some 35.2 percent more than the $1.11 million PEP figure the firm reported in 2017.

The strong gains in 2018's revenue came alongside sizable bumps in the firm's net income, which rose 33 percent to $196.9 million. Profits per equity partner (PEP) were also buoyed. The average Nixon Peabody equity partner earned more than $1.5 million in profits in 2018, some 35.2 percent more than the $1.11 million PEP figure the firm reported in 2017.

Those PEP changes coincided with a slight decrease in the firm's equity partnership, which shrunk to 131 in 2018 from the 133 equity partners the firm had in 2017. The dip in equity partner head count was offset by an increase of 3 non-equity partners; non-equity compensation at Nixon Peabody totaled $60.88 million in 2017.

Overall, the firm's head count grew slightly in 2018, increasing from 602 lawyers to 607 lawyers. Nixon Peabody made four lateral partner hires across various U.S. offices in 2018—adding real estate lawyer David Allswang in Chicago, labor and employment lawyer Benjamin Kim in Los Angeles, public finance lawyer Roderick Devlin in New York and corporate lawyer Lior Zorea in San Francisco.

The firm kept those lawyers busy with a range of transactional and litigation work. On the deals side, which Glincher said was particularly strong in 2018, Nixon Peabody represented alcohol maker Constellation Brands Inc. in connection with a $4 billion investment in Canadian medical marijuana company Canopy Growth Corp.

The firm also had a role advising payroll processing company Paychex Inc. in a $1.2 billion acquisition of human resources services company Oasis Outsourcing Acquisition Corp. Nixon Peabody's public finance group, which lateral hire Devlin joined, represented New York's Triborough Bridge and Tunnel Authority in connection with a municipal bond issuance.

“Our transactional practice has been through the roof,” said Glincher, explaining that beyond the major deals over a billion dollars, the firm also had an active year in smaller, mid-market transactions.

On the litigation side, highlights included a defense win for Daher-Socata Aerospace after a three-week trial in a widely publicized $15 million negligence lawsuit against the French aircraft manufacturer. The firm also found success in contingency fee litigation, which Glincher said is a recurring but relatively minor part of the firm's business. Such cases typically amount to about 1 percent of the firm's revenue; in 2018, the firm earned about $20 million from contingency cases compared with the total gross revenue of $530.6 million.

Beyond the firm's work efforts and financial results, Glincher said diversity was another key focus for Nixon Peabody over the past year. Some 60 percent of the firm's new partner class for 2019 come from diverse backgrounds, and in 2018 the firm became certified under the Mansfield Rule. The rule specifies that at least 30 percent of the candidate pool for leadership or governance positions at a law firm are comprised of women and minorities.

Glincher said the firm's focus on diversity, as well as a commitment to promoting health and well-being among Nixon Peabody lawyers and employees, all serve to make the firm a dynamic and attractive workplace. That sort of focus, Glincher added, helps draw in the kind of top legal talent that Nixon Peabody looks for, especially amid an environment in which “the competition for great talent is as great as the competition for great clients.”

“It just makes us a much better organization,” he said “All of these things have made for a very dynamic environment.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

- 1Departing Attorneys Sue Their Former Law Firm

- 2Pa. High Court: Concrete Proof Not Needed to Weigh Grounds for Preliminary Injunction Order

- 3'Something Else Is Coming': DOGE Established, but With Limited Scope

- 4Polsinelli Picks Up Corporate Health Care Partner From Greenberg Traurig in LA

- 5Kirkland Lands in Phila., but Rate Pressure May Limit the High-Flying Firm's Growth Prospects

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250