Proskauer Nears $1B Revenue Mark as It Posts New Profit Highs

The firm saw gross revenue grow by 9.8 percent, while profits per equity partner jumped 12.4 percent.

February 13, 2019 at 06:52 PM

5 minute read

Proskauer Rose. Photo: Monika Kozak/ALM

Proskauer Rose. Photo: Monika Kozak/ALM

Proskauer Rose continued its steady financial growth in 2018, as the New York firm hit a new high mark for revenue.

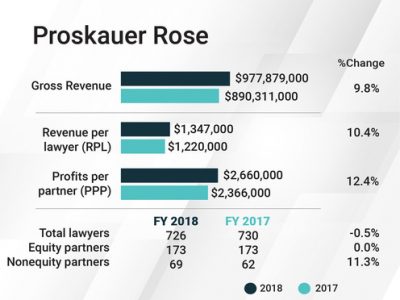

Gross revenue at the firm grew 9.8 percent to $977.9 million last year, up from $890.3 million in 2017. Revenue per lawyer also increased by 10.4 percent to $1.35 million, while profits per equity partner (PEP) jumped 12.4 percent to $2.66 million in 2018.

As its financial metrics increased, head count at Proskauer remained relatively flat, decreasing by 0.5 percent to 726 attorneys across the firm. Its equity ranks stayed the same as in 2017 at 173 partners, while its nonequity partner tier grew 11.3 percent to 69 attorneys.

“We were essentially the same size firm as we were the year before so that was entirely organic growth,” said Proskauer chairman Joseph Leccese, who took over the reins of firm leadership in 2010.

Proskauer's corporate and litigation groups, which both saw double-digit revenue increases in 2018, led the way for the financial growth at the firm last year, Leccese said. But he quickly pointed out that there was shared success across all the platforms of the firm, noting strong performances by its transactional practices like its private funds investment, M&A and bankruptcy practices.

“You don't have a double-digit increase in revenues and profits without having most of your strong assets performing extremely well, and I think that's what we had last year,” Leccese said.

“You don't have a double-digit increase in revenues and profits without having most of your strong assets performing extremely well, and I think that's what we had last year,” Leccese said.

Since 2017, Proskauer's bankruptcy team has served as leading outside counsel to the Financial Oversight and Management Board for Puerto Rico in its ongoing bankruptcy and restructuring proceedings. The group also represented unsecured claimholders in nuclear services company Westinghouse Electric Co.'s Chapter 11 bankruptcy proceedings, as well as its subsequent sale to Brookfield Asset Management Inc. for $4.6 billion.

The firm represented longtime client Celgene Corp. in its $9 billion acquisition of Juno Therapeutics Inc. It also counseled the senior executives and employee shareholders of Sky Betting a& Gaming in its $4.7 billion sale to Stars Group Inc., creating the largest online gaming company.

Leccese led a team that represented the National Football League's Carolina Panthers, along with William “Billy” Moore of North Carolina firm Moore & Van Allen, in its $2.2 billion all-cash sale to billionaire hedge fund manager David Tepper in May.

Proskauer also nabbed roles in high-profile litigation last year.

The firm was lead trial counsel for Johnson & Johnson on two of its products liability trial victories related to its talc-based products. It also successfully represented the band U2 in its copyright lawsuit over its 1991 hit “The Fly,” and Thousand Oaks, California-based biopharmaceutical company Amgen Inc. in its patent infringement battle against Roche subsidiary Genentech Inc. over the anticancer medicine Avastin.

“The general model we've had for years is to be highly diversified and not overly dependent upon any one line of business or any one client,” Leccese said of the firm's overall strategy.

“Last year was a great year for many of us in the profession, but we also want to have a model that will weather the next downturn or slow period.”

The firm also made several key hires to shore up its core practices.

In Washington, D.C., Proskauer added longtime Dechert corporate and capital markets partner William Tuttle, as well as former U.S. Securities and Exchange Commission counsel Samuel Waldon, and Waldon's former SEC colleague Karen Garnett, who had served as associate director of the agency's corporation finance division.

Proskauer also added tax partner Jeremy Naylor from Cooley to its private funds group and tax department in New York. In Boston, the firm welcomed back tax partner Scott Jones in July, four months after he left to start up Kirkland & Ellis' tax practice in Beantown.

In Los Angeles, transactional partners Don Melamed and Albert Stemp joined from O'Melveny & Myers and Hogan Lovells, respectively. In June, the firm added commercial litigation partner Jonathan Weiss from Kirkland & Ellis.

Despite these additions, the firm did see some of its partners decamp, including the former head of Washington, D.C., labor and employment practice Connie Bertram, who filed a $50 million gender discrimination lawsuit against the firm last summer. Proskauer denied Bertram's allegations. Bertram and Proskauer eventually resolved the lawsuit in August and one month later Bertram joined Polsinelli.

Leccese declined to comment about the lawsuit.

Proskauer's fiscal year closed Oct. 31 and just three-and-a-half months into its next cycle, the firm is already seeing its 2018 performance carry into 2019, Leccese said. And with this momentum, the firm will surely continue to reach new highs in the coming year, he added.

“We are very optimistic about this year,” Leccese said. “We will certainly break the billion-dollar cash-collected barrier, and our profits per partner we expect will continue to go up.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute readTrending Stories

- 1Doug Emhoff, Husband of Former VP Harris, Lands at Willkie

- 2LexisNexis Announces Public Availability of Personalized AI Assistant Protégé

- 3Some Thoughts on What It Takes to Connect With Millennial Jurors

- 4Artificial Wisdom or Automated Folly? Practical Considerations for Arbitration Practitioners to Address the AI Conundrum

- 5The New Global M&A Kings All Have Something in Common

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250