King & Spalding Posts Double-Digit Revenue Increase to $1.26B

The firm's profit per equity partner jumped to almost $2.85 million as it expanded head count.

February 15, 2019 at 02:32 PM

6 minute read

The original version of this story was published on Daily Report

King & Spalding chairman Robert Hays.

King & Spalding chairman Robert Hays.

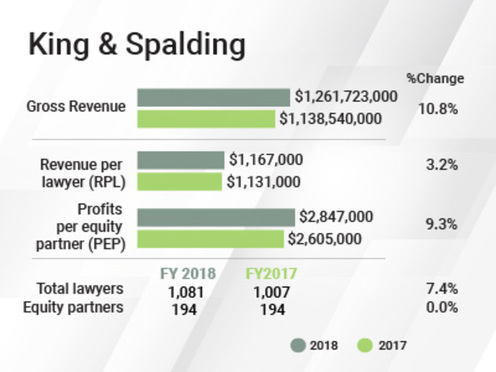

King & Spalding had another strong year, posting an almost 11 percent revenue increase to $1.26 billion and a 9.3 percent increase in net income to $551.9 million.

That followed 2017 revenue growth of 7.7 percent and net income growth of 4.3 percent.

“It was a solid year for the firm—even good,” said King & Spalding chairman Robert Hays, adding that the firm exceeded budget. “We have been committed to growing both the top and bottom lines, and we were able to do that last year at about a double-digit growth rate.”

That resulted in a boost to profit per equity partner to nearly $2.85 million—up from almost $2.61 million in 2017. Revenue per lawyer increased from $1.13 million to nearly $1.17 million.

“We also benefited a good bit from the expanding economy,” Hays said. “Our client base—and new clients—had a greater demand for legal services because of an improving economy. There was more demand for what we are doing and more people to do it.

“We continue to see strong demand, but I don't expect it to go on indefinitely,” he added. “We do believe there will be a slowing or downturn, but when, I don't know. I think it is not wise for the industry or people to ignore that reality.”

King & Spalding raised rates in line with the industry, at a bit over 3 percent, Hays said. Expenses were also up—notably for associate compensation after the associate salary hikes that started in New York in June last year—as well as increased technology and health care costs.

The firm also increased its head count, adding a net of 74 lawyers, for a total lawyer head count of 1,081. While the equity partner count stayed constant at 194 in 2018, the firm added a net of 14 income partners for an increase to 218. By contrast, in 2017 the firm's overall lawyer and partner head counts had remained flat, increasing by a net of only two lawyers from the prior year.

The Talent

King & Spalding added 54 lateral partners last year—a record number—and elected 30 new partners internally. “We are committed to growing—and being profitable by growth and not by cutting ourselves to success,” Hays said, noting that the firm has already added 13 lateral partners this year.

The firm's most high-profile lateral hire was former Deputy Attorney General Sally Yates, who joined its Atlanta headquarters in May. It also landed outgoing Atlanta U.S. Attorney John Horn, both for the special matters group. Also in Atlanta, King & Spalding recruited two securities litigators, Lisa Bugni and Jessica Corley from its rival down the block, Alston & Bird.

That said, New York remained a major focus for talent recruitment last year, with 15 lateral partner hires in its office there—one-quarter of the new-partner recruits. That included private equity partner Jonathan Melmed, who focuses on energy infrastructure deals, with a team that includes partner Enrico Granata and four other lawyers from Morrison & Foerster. Melmed is heading King & Spalding's global private equity team.

Also in New York, the firm landed a duo of pharmaceutical patent litigators, Gerald Flattmann and Evan Diamond, from Paul Hastings.

There were partner departures, as well. In Atlanta, David Meadows, who handles complex business disputes, left for Troutman Sanders. Two tobacco litigators also left: Frank Bayuk decamped for Jones Day, and Bethany Schneider started a plaintiffs firm, Schneider Law. Drew Dropkin became the assistant general counsel for the Public Company Accounting Oversight Board and securities litigator Matthew Baughman joined the DOJ as the director of the Task Force on Market Integrity and Consumer Fraud. Appellate partner Merritt McAlister became a law professor at the University of Florida, and Gibbs Fryer joined real estate investor TC US Partners.

The Work

King & Spalding handled several transactions, including quite a few financing deals, worth more than $1 billion. Energy and health care were two big industries for its deal work last year.

It advised offshore driller Transocean on its $2.7 billion cash and stock acquisition of Ocean Rig UDW and represented Brookfield Infrastructure Group on the $1.1 billion acquisition from AT&T of 31 data centers in 10 countries.

In London, it represented Life Company Consolidation Group in its £1.8 billion ($2.4 billion) purchase of Britain's oldest mutual life insurance company, The Equitable Life Assurance Society.

In Atlanta, King & Spalding represented Piedmont Healthcare on its acquisition of Columbus Regional Health System, which was represented by Alston & Bird.

The firm handled a string of financing transactions based on the securitization of restaurant companies' franchise assets, including Taco Bell, Wingstop and Jamba Juice, in the fast-growing asset-backed or esoteric securitization market, which can be a lower cost way for companies to borrow money.

In international arbitration, King & Spalding scored a big victory at the Hague for client Chevron in its 26-year dispute with Ecuador over clean-up costs for pollution and damage that its drilling operations caused to the country's rainforests. The Hague's Permanent Court of Arbitration ruled that an Ecuadorian judge's $9.5 billion ruling against Chevron was fraudulent and should not be recognized internationally. Courts in the United States, Canada, Brazil and elsewhere where Chevron has assets have rejected Ecuador's attempts to collect.

King & Spalding also won a $2.2 billion award from the World Bank's International Centre for the Settlement of Investment Disputes for its client Union Fenosa Gas, a Spanish-Italian joint venture, from Egypt. Union Fenosa Gas operates an LNG export terminal in Egypt and claimed the state-owned gas company was not sending enough gas its way.

It continues to represent Atlanta-based Equifax in its extensive data-breach litigation resulting from the 2017 breach that affected more than 146 million consumers. In January, Chief Judge Thomas Thrash Jr. of the U.S. District Court for the Northern District of Georgia ruled that a string of consolidated lawsuits by both consumers and financial institutions may go forward.

On the pro bono front, almost 70 King & Spalding personnel across multiple offices helped more than 100 “Dreamers”—undocumented immigrants who arrived in the United States as children—with their renewal applications for the Deferred Action for Children Arrivals program and performed an investigation for Cook County, Illinois' State's Attorney's Office over rates paid to outside counsel.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute readTrending Stories

- 1Doug Emhoff, Husband of Former VP Harris, Lands at Willkie

- 2LexisNexis Announces Public Availability of Personalized AI Assistant Protégé

- 3Some Thoughts on What It Takes to Connect With Millennial Jurors

- 4Artificial Wisdom or Automated Folly? Practical Considerations for Arbitration Practitioners to Address the AI Conundrum

- 5The New Global M&A Kings All Have Something in Common

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250