Reed Smith Grows Revenue and Profits, Citing Strong Demand

The firm saw revenue grow 5 percent, while profits per equity partner increased by 7 percent.

February 20, 2019 at 08:00 AM

6 minute read

The original version of this story was published on The Legal Intelligencer

Photo: Diego M. Radzinschi/ALM

Photo: Diego M. Radzinschi/ALM

Reed Smith saw revenue and profit growth accelerate slightly in a strong 2018 market, as it invested in diversifying its business model.

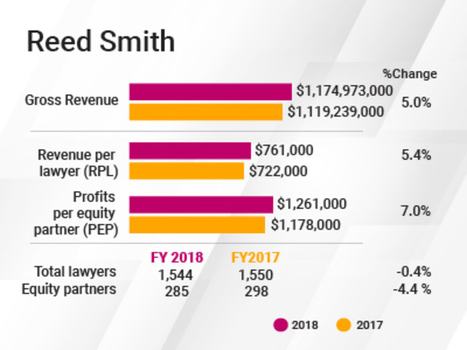

The international firm, which was founded in Pittsburgh, saw revenue increase by 5 percent, to $1.175 billion, in 2018. Revenue per lawyer increased roughly in proportion, growing 5.4 percent to $761,000.

Global managing partner Alexander Thomas said Reed Smith benefited from strong demand in 2018. “We had a very high level of sophisticated work coming into the law firm, and our lawyers were working very hard,” he said.

Global managing partner Alexander Thomas said Reed Smith benefited from strong demand in 2018. “We had a very high level of sophisticated work coming into the law firm, and our lawyers were working very hard,” he said.

Net income was up 2.6 percent, reaching $359.7 million. And the firm saw profits per equity partner (PEP) increase on lower equity partner head count, rising 7 percent to $1.26 million.

The number of equity partners at the firm decreased by 4.4 percent, to 285, but it wasn't just the equity partner tier that contracted. The firm had 3.2 percent fewer nonequity partners as well, at 361.

The firm's rates increased in line with the market, Thomas said. On the expense side, the firm didn't make any noteworthy cuts to its expenses, he said, noting that generally “we run a tight ship from a cost perspective.”

But one expense that grew was associate salaries. Reed Smith initially said in June that it was not planning to give associates raises, citing “the interests of clients.” But, Thomas said, when the wave of associate raises began over the summer, the firm was already in the middle of an “associate life initiative,” in which it evaluated compensation among other aspects of associate life.

As part of that process, he said, the firm announced increased compensation and an enhanced bonus system for associates in August. U.S. associate starting salaries are now $150,000 in Pittsburgh, Richmond, Virginia, and Miami; $160,000 in Philadelphia, Princeton, New Jersey, and Wilmington, Delaware; and $180,000 in the firm's New York, Chicago, Washington, D.C., Virginia, Texas and California offices.

Overall lawyer head count at Reed Smith was nearly flat from 2017 to 2018, at 1,544.

“We made some really important hires. And on the other side of the coin we had some lawyers leave the firm,” Thomas said. “The ins and outs of the industry aren't unique to any one firm.”

The “outs” included a group of lawyers, largely from Philadelphia, who left Reed Smith for Holland & Knight last year, beginning in July. Thomas said that group's departure did not negatively impact the firm's financial performance, and that productivity was up in the second half of the year.

Reed Smith also opened an office in Austin, bringing on a health care-focused group from Norton Rose Fulbright. Thomas said the recent additions to the life sciences and health practice have been “tremendously successful.”

With regard to its geographic footprint, Thomas said Reed Smith has focused strategically on five industry sectors: life sciences and health, financial services, energy and natural resources, transportation, and media and entertainment.

“Our geographic strategy is synced up with our plan to be the global relationship law firm of choice in those five sectors,” he said. “We make decisions about where we want to be on the back of that strategy.”

To that end, he said, the firm added lawyers last year in Washington, D.C., Los Angeles, London and Singapore, in addition to opening its Austin location.

Thomas also noted the 2017 addition of a group of lawyers in Europe from King & Wood Mallesons, and said that resulted in increased productivity in Europe and, specifically, in London.

London accounts for just under 20 percent of the firm's total revenue, Thomas said, but he declined to give exact numbers, saying the firm no longer breaks out financial performance by geographic location. In 2017, the firm reported London revenue of $189.7 million, which was 16.9 percent of total gross revenue.

Also in the U.K. last year, Reed Smith launched a legal and business services function based in Leeds, about two hours outside of London. Thomas said the firm opened the new location “with the objective of creating even better and more efficiencies,” drawing on its experience of creating a Global Customer Centre in Pittsburgh 15 years before.

This initiative, called “Reed Smith Global Solutions,” will continue to be an area of focus in 2019, Thomas said. The firm will also be investing it its legal technology subsidiary, GravityStack, he said, which launched last year.

He said the firm will also continue to devote attention to its client value team, which consists of around 16 professionals, and improved pricing options.

“You've seen the natural growth in law departments of people who are answering the question, 'How do we assess efficiency and value?'” Thomas said, so Reed Smith has aimed “to have that corresponding set of talent in the law firm.”

With that in mind, the firm is taking note of the client relationships in which its client value team is most involved, he said, and tracking financial performance on those engagements. “We analyze the heck out of that,” he said. The firm's realization rate improved from 2017 to 2018, he said, and that is “tied directly” to the client value team.

As for other expectations in the coming year, Thomas said, the firm's investment choices were intended to help it withstand any economic turmoil that may come. “We feel diversified and well-hedged if the economy takes a turn for the worse,” he said.

Read More

Reed Smith Grows Revenue, Profits as Head Count Stays Flat

Reed Smith Enters the Legal Technology Market With GravityStack Subsidiary

Reed Smith Raids Norton Rose for Life Sciences/Health Care Team, Adds Austin Office

Reed Smith Launches Tech Program for Select Summer Associates

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

- 1Departing Attorneys Sue Their Former Law Firm

- 2Pa. High Court: Concrete Proof Not Needed to Weigh Grounds for Preliminary Injunction Order

- 3'Something Else Is Coming': DOGE Established, but With Limited Scope

- 4Polsinelli Picks Up Corporate Health Care Partner From Greenberg Traurig in LA

- 5Kirkland Lands in Phila., but Rate Pressure May Limit the High-Flying Firm's Growth Prospects

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250