Gibson Dunn Posts Double-Digit Revenue Gain in 23rd Straight Year of Growth

"We look for sustained performance, not just wonderful years," said chairman Ken Doran.

February 21, 2019 at 04:11 PM

5 minute read

Gibson, Dunn & Crutcher's offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

Gibson, Dunn & Crutcher's offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

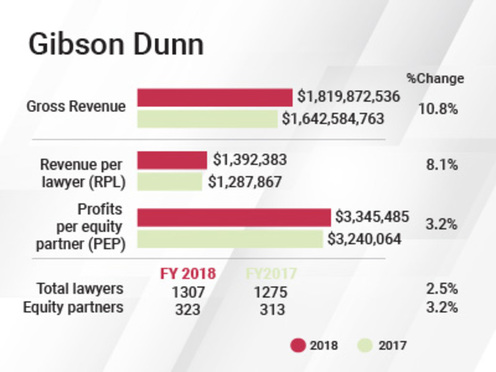

Gibson, Dunn & Crutcher has posted its 23rd straight year of revenue growth, taking in more than $1.8 billion in 2018. It was also the firm's 22nd consecutive year of profitability, with net income reaching almost $1.1 billion.

Along with the near 11 percent growth in revenue, the firm also lifted its profits per equity partner by 3.2 percent to $3.35 million.

“We look for sustained performance, not just wonderful years,” Gibson Dunn chairman and managing partner Kenneth Doran said of the firm's steady upward trajectory.

He attributed much of the strong growth to recent investments, including moves into Frankfurt in 2016 and Houston in 2017, as well as to a partnership that has expanded through promotions and lateral hires.

He attributed much of the strong growth to recent investments, including moves into Frankfurt in 2016 and Houston in 2017, as well as to a partnership that has expanded through promotions and lateral hires.

Last year the firm saw a net increase of 10 equity partners and nine nonequity partners, with the overall number of partners growing to 378, a 5.3 percent increase.

One highlight was the firm's acquisition of a four-lawyer corporate and private equity team from Kirkland & Ellis that came aboard in May, led by Washington, D.C., partner George Stamas. The firm also added veteran U.S. Supreme Court advocate Allyson Ho in Dallas from Morgan, Lewis & Bockius, after her husband left the firm for a seat on Fifth Circuit. In Palo Alto, California, Gibson brought on IP deal maker Carrie LeRoy from White & Case and securities litigator Michael Celio from Keker Van Nest. The firm also picked up multiple lawyers in Hong Kong and London, including Mayer Brown's former global corporate and securities practice co-leader, Jeremy Kenley.

With regard to the firm's performance in 2018, Doran pointed to impressive results across the board. “Litigation was strong, corporate was even stronger, up 17 percent,” he said.

On the litigation side, significant matters included the ongoing representation of Facebook in all civil litigation arising out of reports of alleged misuse of user data by Cambridge Analytica, and a U.S. Supreme Court victory that opened the door for legal sports betting in New Jersey and throughout the United States.

Noteworthy transactional work included advising Concho Resources in the $9.5 billion acquisition of oil and gas company RSP Permian, guiding Toyota in a $1 billion investment in Southeast Asian ride-hailing app Grab Holdings Inc., and representing PepsiCo in its $3.2 billion acquisition of SodaStream International.

“The growth was exciting because it was so built into the firm across practice areas and across geographies,” Doran said of his firm's overall 2018 performance. “It's part of a long trend that has withstood many, many big upsets in the global economy, from the bursting of the dot-com bubble, through 9/11 and the Great Recession.”

Doran pointed to capital markets work as one area that was flagging, but he suggested that was due to wider trends in the global market, notably uncertainties stemming from Brexit.

“In London we've done quite well,” he said, “but people are concerned about what might happen to business transactions and real estate values. It could have a chilling effect on people's long-term bets.”

Houston, the firm's newest office, performed especially well in its first full year, Doran emphasized, thanks to the overall strength of the Texas market and the bounty of energy work that the firm was connecting to existing offices in Dallas, Denver and New York, where the focus is on renewables.

“We're in the early days, but it's a very competitive market,” he said. “The established Texas firms and most of the stronger U.S. firms are there in one way or another.”

Doran said that no immediate expansions or new practices were on the horizon, but noted Gibson Dunn was open to adding the right talent, particularly on the corporate side. A future merger is also highly unlikely.

“If there were a unique opportunity I've never seen—a smallish boutique that would be helpful to get us into new practice or new markets—I'd consider it,” he said. “But I've never seen such a firm, so there's been no discussion.”

Doran reported market-specific rate increases that exceeded 3 percent in 2018. The use of alternative fee arrangements is also on the rise, if only modestly.

“If we can be creative and align our clients interests with ours, it's only for the better,” he said. “In terms of requests for proposals, it's almost always asked about and we're happy to talk about it.”

But often it's the client, not the firm, that ultimately elects to rely on the traditional billable hours format.

Expenses also climbed from the associate salary increase that went into effect July 1, combined with special bonuses paid out later that month. These ultimately came out of partners profits.

“It's the cost of doing business,” Doran said. “There's no ability or effort to off-lay it elsewhere.”

The firm is well positioned for the coming year, he added, pointing to its lack of debt and its firm foundation of capital. Contribution requirements have remained steady over the last decade.

“We're well positioned for 2019, which will be another super competitive and challenging year, as 2020 will be,” Doran said. “But we've got the right team and the right focus, so I'm optimistic.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

'Ridiculously Busy': Several Law Firms Position Themselves as Go-To Experts on Trump’s Executive Orders

5 minute read

Holland & Knight Hires Former Davis Wright Tremaine Managing Partner in Seattle

3 minute read

Am Law 200 Firms Announce Wave of D.C. Hires in White-Collar, Antitrust, Litigation Practices

3 minute read

Paul Hastings Hires Music Industry Practice Chair From Willkie in Los Angeles

Trending Stories

- 15th Circuit Considers Challenge to Louisiana's Ten Commandments Law

- 2Crocs Accused of Padding Revenue With Channel-Stuffing HEYDUDE Shoes

- 3E-discovery Practitioners Are Racing to Adapt to Social Media’s Evolving Landscape

- 4The Law Firm Disrupted: For Office Policies, Big Law Has Its Ear to the Market, Not to Trump

- 5FTC Finalizes Child Online Privacy Rule Updates, But Ferguson Eyes Further Changes

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250