Nelson Mullins' Tie-Up Boosts Revenue While Partner Profits Dip

The firm's acquisition of a 150-lawyer Florida firm increased its size by almost a third, while the combination contributed to a decline in profits per equity partner.

February 22, 2019 at 12:53 PM

7 minute read

The original version of this story was published on Daily Report

James K. Lehman, managing partner, Nelson Mullins Riley & Scarborough (Courtesy photo)

James K. Lehman, managing partner, Nelson Mullins Riley & Scarborough (Courtesy photo)It was a milestone expansion year in 2018 for Nelson, Mullins, Riley & Scarborough, which acquired 150-lawyer Florida firm Broad and Cassel on Aug. 1 after launching a Baltimore office with an 11-partner team from Miles & Stockbridge.

Those additions extended the South Carolina-based firm's footprint along the Eastern Seaboard from Boston all the way to Miami and increased its size by almost one-third, to more than 700 lawyers.

“I think the year will be as significant in the future as when we opened the Atlanta office in 1992,” said Nelson Mullins' managing partner, Jim Lehman.

The Atlanta office was Nelson Mullins' first foray outside of its South Carolina base when it opened with five lawyers from an established local firm of the era, Trotter, Smith & Jacobs. Now with about 150 lawyers, Atlanta is largest of the super-regional firm's 25 offices.

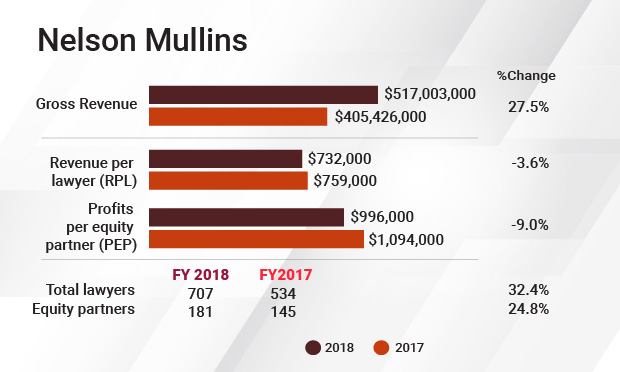

With the additions in 2018, lawyer head count jumped by 32 percent to 707 lawyers, and revenue went up 27.5 percent to $517 million. Revenue per lawyer dipped by 3.6 percent ($27,000) to $732,000, which Lehman attributed to time spent on integration and differences in economics for Nelson Mullins and Broad and Cassel. He described the firms as “very compatible but not exactly the same.”

“It takes a while as you integrate to get everyone moving together,” he said. “When you grow by 30 percent, it's a lot for everyone to process. It's been very positive, but it's also a lot of work.”

Nelson Mullins increased its equity partner head count by 25 percent, adding a net of 36 equity partners to 181. It increased its total partner head count by 27 percent, with a net addition of 86 partners, rising to 404.

Nelson Mullins increased its equity partner head count by 25 percent, adding a net of 36 equity partners to 181. It increased its total partner head count by 27 percent, with a net addition of 86 partners, rising to 404.

Net income grew at a lesser rate, by 14.1 percent, to $180.51 million. As a result, profits per equity partner dropped 9 percent to $996,000—slightly below the $1 million PEP threshold that Nelson Mullins crossed in 2017 with PEP of $1.094 million.

When the merger was announced, Lehman told The Daily Report that Nelson Mullins' PEP was higher than Broad and Cassel's, but RPL and rates were compatible. While the combination pushed down PEP, average partner compensation—a metric that provides a snapshot of compensation to partners, both equity and nonequity—did not change much, declining by only 1 percent from $677,000 to $670,000.

“We decided this is a good long-term investment,” Lehman said, noting that the dip in PEP generally didn't affect partners' actual income. He said he expects RPL and PEP to increase as the firms integrate.

Nelson Mullins raised rates modestly, Lehman said, between the industry norm of three and 4 percent. “We continue to believe that our cost structure gives us a competitive advantage when setting rates,” he said.

On the expense side, overall overhead was about the same, Lehman said, but he acknowledged that the associate salary increase that started in New York last June caused extra expense for Nelson Mullins, as for many firms. “The cost for talent is going up, but we do not see it eroding the margins significantly at this point,” he said.

Like many in the legal industry, Lehman said he and his partners consider a recession to be likely this year or in 2020. “But we have not seen any signs of that yet,” he said.

“We're planning for us to have some slowdown in the next 24 months, so we're being cautious about our lateral hiring and expenditures,” he added. “We anticipate that there will be a bump in the road. It's inevitable at some point—the economy is a lot bigger than we are.”

'Broader Reach'

The Broad and Cassel combination deepened Nelson Mullins' real estate, health care and white-collar defense practices while extending its reach into Florida, where Broad and Cassel had 10 offices with a concentration in South Florida.

“The new reach in the real estate and health care worlds with Broad and Cassel is coming about how I had hoped,” Lehman said.

The deal was motivated, he said, by “broader reach and better service” for clients—those from Nelson Mullins who do work in Florida and those from Broad and Cassel who have expanded nationally.

In particular, Broad and Cassel had a national health care compliance practice that represents providers and payers, while Nelson Mullins had an extensive health care transactional practice. Combined, the firms have 50 lawyers in the group.

Separately from the Broad and Cassel combination, Nelson Mullins added 30 lateral partners, of whom 13 were in Baltimore. (The Baltimore team, led by trial lawyer Michael Brown and corporate partner Timothy Hodge Jr., its local managing partner, now totals 24 lawyers.)

The other 17 new lateral partners were across the platform, Lehman said, including a Los Angeles office that opened in 2017 and another in Denver that launched in 2016.

The firm added two lateral partners in Atlanta: former federal prosecutor Nekia Hackworth Jones in its white-collar defense practice and corporate attorney Larry Shackelford, who has a community bank and financial services practice.

The Work

On the corporate side, Lehman said Nelson Mullins lawyers advised on 95 deals totaling more than $4.5 billion in 2018.

The firm handled four of the 20 largest bank mergers in the U.S., totaling $6.3 billion in equity transaction value, according to S&P Global Market Intelligence and Sandler O'Neill + Partners. For instance, with Wachtell, Lipton, Rosen & Katz, the firm represented Chemical Financial Corp. in its $3.5 billion merger with TCF Financial Corp. and it represented Florida community bank CenterState Bank in its $850.4 million acquisition of Alabama's National Commerce Corp.

Nelson Mullins advised Entertainment Studios on its $300 million purchase of The Weather Channel's parent company The Weather Group, as well as Snap TV in its sale of a 75 percent equity interest to Miami-based Hemisphere Media Group.

On the litigation front, Nelson Mullins handled major products liability matters for several clients. Michael Brown's defense of Johnson & Johnson in talc cases resulted in a hung jury in May in South Carolina, and he is currently handling a talc trial for J&J in Alameda, California, that started Jan. 7.

Nelson Mullins is national trial counsel for Bard in its IVC blood filter litigation. Richard North won a defense verdict in a bellwether case for multidistrict litigation consolidated in Phoenix. He tried cases resulting in a $3.6 million verdict in March and a defense win in June for the medical device maker.

The firm represents e-cigarette maker LG in suits over exploding batteries as well as numerous automakers in disputes with dealerships.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute readTrending Stories

- 1Doug Emhoff, Husband of Former VP Harris, Lands at Willkie

- 2LexisNexis Announces Public Availability of Personalized AI Assistant Protégé

- 3Some Thoughts on What It Takes to Connect With Millennial Jurors

- 4Artificial Wisdom or Automated Folly? Practical Considerations for Arbitration Practitioners to Address the AI Conundrum

- 5The New Global M&A Kings All Have Something in Common

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250