Akin Gump Grows Revenue, but Profits Stay Flat

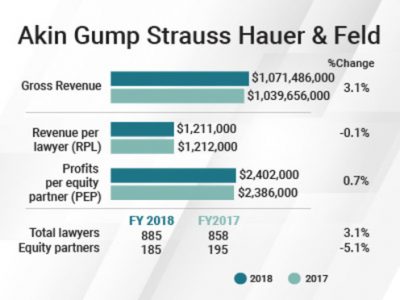

Revenue at Akin Gump Strauss Hauer & Feld grew by 3.1 percent in 2018, directly in-line with head count growth, as other metrics came in flat.

February 25, 2019 at 07:47 PM

5 minute read

The original version of this story was published on Texas Lawyer

Akin Gump Strauss Hauer & Feld.

Akin Gump Strauss Hauer & Feld.

Despite posting record gross revenue for the sixth straight year, Akin Gump Strauss Hauer & Feld saw other key metrics come in flat in 2018.

The Texas-founded Am Law 100 firm posted gross revenue of $1.07 billion in 2018, up 3.1 percent from 2017, when it was $1.04 billion. That gross revenue growth was almost directly in-line with head count growth. As a result, revenue per lawyer, at $1.21 million, was essentially flat, down 0.1 percent in 2018 from the year before.

Profits per equity partner (PEP), at $2.4 million, showed an increase of 0.7 percent from 2017, even as the equity partner tier shrank. The firm's net income, at $445.3 million, declined by 4.1 percent in 2018, compared with 2017, when it was $464.4 million.

Still, Kim Koopersmith, the firm's chair since 2013, said the firm was “pleased” with its 2018 performance.

“We crossed the billion-dollar mark in 2017 and we were really happy to have built on that. It's six straight years of revenue growth,” Koopersmith said.

“We did take 2018 and view it as a year for investing,” she added. “We did that with a build-out of two of our largest offices in Dallas and in Washington, D.C., and made a major push on the IT front.”

“We did take 2018 and view it as a year for investing,” she added. “We did that with a build-out of two of our largest offices in Dallas and in Washington, D.C., and made a major push on the IT front.”

Koopersmith said several practices were very busy during 2018 including trade, funds and financial restructuring. In particular, Koopersmith said the firm's London office, where practices include financial restructuring, financial transactions, competition and trade disputes, had a “truly spectacular year” in all disciplines. Revenue in London was up almost 30 percent in 2018 compared with 2017, she said.

Firmwide, the financial restructuring practice “built to some pretty incredible momentum” in 2018, she said, with the firm handling debtor or creditor work in the restructuring of companies including FirstEnergy, iHeartMedia, Seadrill, Noble Group, Sears Holdings and Nine West Holdings.

On the corporate side, Koopersmith said the firm represented WMIH in its merger with Nationstar Mortgage Holdings; CenterPoint Energy in its $8.5 billion acquisition of Vectren Corp.; and Diamondback Energy in its $9.2 billion acquisition of Energen.

And, Koopersmith said, Akin Gump's trade practice provides the firm with a significant advantage in the marketplace.

“It's hard to overstate issues relating to sanctions, tariffs, export controls. You just think of the world we are currently living in,” she said, adding that the firm's international trade practice has traditionally been focused in Washington, but is now robust in London, Hong Kong and on the West Coast.

She added that the London trade team is well positioned to deal with sanctions issues relating to Russia and Iran affecting multinational corporations.

The firm's funds practice, representing clients such as private equity companies and hedge funds, was strong around the globe in 2018 and that work is continuing, according to Koopersmith.

Early in 2018, two big pieces of litigation came to a “pretty rapid conclusion,” she noted, but Akin Gump did refill the pipeline by the end of the year.

Additionally, Koopersmith said, the number of pro bono hours worked at Akin Gump increased by nearly 15 percent in 2018. “This continues to be what I see as a defining element of our culture,” she said.

On the expense side, the firm raised associate salaries at midyear, following the lead of Cravath, Swaine & Moore. It also invested in IT infrastructure “to take us through what we think are important changes in how law firms interact with their clients.”

Akin Gump made a number of notable hires in 2018, including a finance team in Hartford, Connecticut, and London; a class action defense group in San Francisco and Philadelphia, and a group of policy lawyers in Washington, D.C.

The firm had 885 lawyers on a full-time equivalent basis in 2018, up 3.1 percent from 858 in 2017, but the number of equity partners declined by 5.1 percent, with 185 in 2018 compared with 195 the year before. Koopersmith said that reduction in equity partners is due to retirements and some lateral moves.

Going forward, Koopersmith said she expects continued growth in London, Houston, Washington, D.C., and New York. The firm has 21 offices, with 20 percent of its lawyers located outside the United States.

Akin Gump is bullish on 2019, based on activity during the first few weeks of the year, Koopersmith said.

“We definitely saw a very strong January in terms of revenue,” she said, noting that she also likes the way the firm's strengths align with timely issues in areas such as policy and white-collar crime defense. “I like the hand of practices we have,” she said.

Correction: An earlier version of this article misstated the number of offices Akin Gump has.

Read More:

On Upward Trajectory, Akin Gump Invests in Regulation, Policy

Akin Gump Lands Trans-Atlantic Restructuring and Debt Finance Group From Morgan Lewis

Former Drinker Biddle Class Action Vice Chair Michael Stortz Joins 5-Partner Move to Akin Gump

Akin Gump Is Second Big Texas Firm to Hike Associate Pay

Akin Gump Adds Top GOP Congressional Aides on Tax Legislation

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

- 1'Something Else Is Coming': DOGE Established, but With Limited Scope

- 2Polsinelli Picks Up Corporate Health Care Partner From Greenberg Traurig in LA

- 3Kirkland Lands in Phila., but Rate Pressure May Limit the High-Flying Firm's Growth Prospects

- 4Davis Wright Tremaine Turns to Gen AI To Teach Its Associates Legal Writing

- 5'Battle of the Experts': Bridgeport Jury Awards Defense Verdict to Stamford Hospital

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250