Partner Profits Outpace Revenue at Bracewell in 'Outstanding' 2018

Bracewell hit $300 million in revenue in 2018, while profits per equity partner jumped by 11.3 percent to $1.45 million.

February 25, 2019 at 11:20 AM

4 minute read

The original version of this story was published on Texas Lawyer

Gregory Bopp, Bracewell managing partner.

Gregory Bopp, Bracewell managing partner.

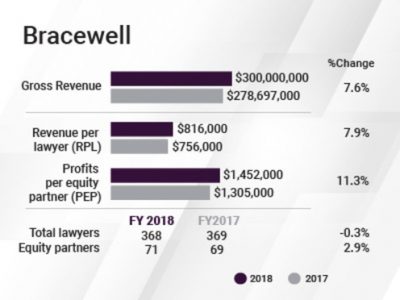

Gross revenue improved by a healthy 7.6 percent at Bracewell in 2018, but profits per equity partner (PEP) were even better, increasing by a noteworthy 11.3 percent.

“2018 was an outstanding year for Bracewell across the entire firm,” said Gregory Bopp, the Houston-based firm's managing partner.

Firmwide revenue hit $300 million in 2018, up from $278.7 million in 2017, and revenue per lawyer came in at $816,000, up 7.9 percent compared with $756,000 the year before.

Net income jumped by 14.5 percent, to $103.1 million compared with $90.1 million the year before, leading to PEP of $1.45 million in 2018, up from $1.31 million in 2017.

Bopp said the firm's energy, infrastructure and finance practices were at “full throttle” during 2018, and other areas including technology, litigation and regulatory also posted very good years.

The firm's makeup was largely the same size in 2018 as the year before, with 368 lawyers, just one less than 2017 when measured on a full-time equivalent basis. The firm had 71 equity partners, just two more than in 2017.

The firm's makeup was largely the same size in 2018 as the year before, with 368 lawyers, just one less than 2017 when measured on a full-time equivalent basis. The firm had 71 equity partners, just two more than in 2017.

However, despite being close to the same size as in the prior year, profits at Bracewell improved in a big way in 2018.

“For us, our strategy is very simple—to build on our strengths in the sectors we are known for,” Bopp said, explaining the boost in the firm's bottom line. That means focusing on the energy, finance, technology and infrastructure sectors, he said, while regulatory and litigation are also important.

“It's just high-quality work—complex transactions, complex disputes for large institutional clients, private equity firms, large financial institutions. It was a great year and I expect it to continue,” he said.

On the transactional side, Bopp said, Bracewell worked on more than a dozen midstream infrastructure projects in the Permian Basin, including its representation of Kinder Morgan on the Gulf Coast Express Pipeline Project and the Permian Highway Pipeline Project. The firm also represented Apache Corp. in transactions related to creation of Altus Midstream Co., and Phillips 66 in the Grey Oak Pipeline project and the South Texas Gateway Terminal joint venture.

Bopp said the firm's renewables, project finance and private equity practices were “as busy as they've ever been,” fueled by infrastructure development in North America.

He said the firm's litigators successfully defended HTC Corp. from a trademark infringement suit tried in federal court in Virginia, and successfully defended Pier 1 Imports Inc. in a securities class action in the Northern District of Texas .

Also, Bopp notes, in a high-profile matter, New York partner Barbara Jones was appointed special master to conduct a privilege review of items seized last year from the home and office of Michael Cohen, President Donald Trump's former attorney. Jones also was tapped to help review the disciplinary policies of the New York City Police Department.

Bopp said the firm's London office, which is purely focused on the energy sector, had an outstanding year, and lawyers worked on significant upstream transactions in Africa, the Middle East and in the North Sea area.

London was one of the locations Bracewell targeted for lateral hiring in 2018. The firm brought on 10 lateral partners during 2018, including a pair of project finance partners from Pillsbury Winthrop Shaw Pittman in New York.

As for 2019, Bopp said the year started well, and demand is strong. “It's looking good,” he said.

Read More:

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

- 1Pa. High Court: Concrete Proof Not Needed to Weigh Grounds for Preliminary Injunction Order

- 2'Something Else Is Coming': DOGE Established, but With Limited Scope

- 3Polsinelli Picks Up Corporate Health Care Partner From Greenberg Traurig in LA

- 4Kirkland Lands in Phila., but Rate Pressure May Limit the High-Flying Firm's Growth Prospects

- 5Davis Wright Tremaine Turns to Gen AI To Teach Its Associates Legal Writing

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250