Revenue, Profits on the Rise for Transatlantic Hogan Lovells

With revenue up but head count slightly down, CEO Steve Immelt said the firm had a strong year across key regions.

February 25, 2019 at 08:00 AM

6 minute read

Steve Immelt. (Photo: Diego M. Radzinschi/ALM)

Steve Immelt. (Photo: Diego M. Radzinschi/ALM)

A year after the firm first cracked the $2 billion threshold, Hogan Lovells continued to see revenues and profits increase in 2018.

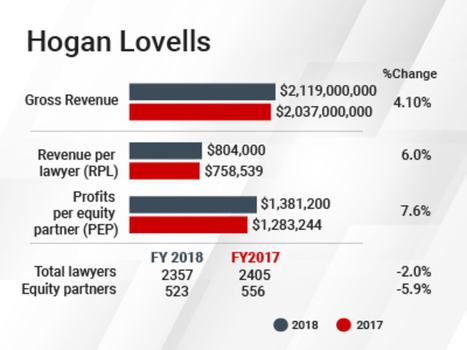

The firm's total global revenue grew 4 percent to $2.119 billion, while profits per equity partner climbed 7.6 percent to $1.38 million. Washington, D.C.-based CEO Steve Immelt said the firm was most focused on growing revenues per lawyer, a figure that rose 6 percent to $804,000.

“If you do that right, our profits per equity partner will continue to rise,” he said.

Immelt asserted that nearly nine years after the transatlantic merger of Hogan & Hartson with London-based Lovells, the full benefit of the firm's global platform was becoming clear to current and potential clients.

Immelt asserted that nearly nine years after the transatlantic merger of Hogan & Hartson with London-based Lovells, the full benefit of the firm's global platform was becoming clear to current and potential clients.

“We've begun to have so many more opportunities to demonstrate to clients what our platform can do,” he said. “That leads to more high-value work and cross-border work, and that explains our trajectory.”

Hogan Lovells increased rates over the course of the year, in excess of 3 percent. But for increasingly sophisticated clients, price sensitivity extends beyond rates, and the firm has invested to expand its pricing team from New York into Europe and Asia, he said. That's served to make all sides more comfortable with the ultimate cost of services.

“We find that if you get the pricing approach right at the outset, and you manage the job correctly, those conversations are easy to have because you've already been in a pretty constant dialogue with the client about what's going on,” Immelt said.

The firm also joined the rush of peers boosting associate salaries in 2018.

“It's a cost of the business. All sorts of costs change,” Immelt said. “We compete for the best talent in the market, and that means that we have to pay commensurate with what best can earn.”

The number of total lawyers at the firm dipped slightly, declining 2 percent to 2,357, while a drop in equity partners, at 5.9 percent to 523, was slightly more pronounced.

Immelt attributed the latter decline to the wider demographics of law firms, where a growing number of baby boomers are reaching the end of their careers and retiring. The firm promoted 31 new partners at the start of 2018 and added 18 partners as laterals over the course of the year.

“My view is that every one of those people have the potential to become equity partners,” he said.

Key new additions to the firm last year included a three bankruptcy lawyer team that joined in Los Angeles in May from Jones Day led by Rick Wynne; four London partners in the areas of international trade, data privacy, energy and construction; and litigation partner Antonia Croke and M&A partner Stephanie Tang in Hong Kong.

The firm did close offices in Rio de Janeiro and Caracas in 2018, consolidating its Brazil presence in Sao Paulo and exiting Venezuela entirely.

Immelt said that Hogan Lovells' global regulatory practice was a standout in 2018. The firm saw significant work connected to global privacy issues, including the EU's General Data Protection Regulation. It represented Equifax on some of the regulatory enforcement work stemming from the largest and highest-profile data breach in U.S. history.

At the intersection between regulatory and the equally bustling international trade practice, the firm represented ZTE on its criminal plea agreement with the U.S. Department of Justice and related settlement agreements with the Commerce Department and the Treasury Department arising from violations of sanctions and export controls. Other regulatory practices, including Food and Drug Administration work and competition, were also busy.

Immelt said that demand for corporate work was also high, pointing to the firm's representation of Walmart in its $16 billion purchase of a 77 percent stake in Indian e-commerce site Flipkart. He said the tech-focused transaction involving a U.S. investor going into Asia was typical of the deals the firm was now seeing.

Other major matters on the corporate side involved Dell's $25 billion recapitalization and Celgene's $9 billion acquisition of Juno Therapeutics.

Litigation, on the other hand, has been more of a challenge, Immelt said, pointing to intense competition and rate pressure.

“You really have to be focused on the disputes where people really feel there's a lot at stake,” he said. “We've continued to evolve our litigation practice so that it's focused on larger class actions and data breach matters, for example.”

Immelt said the firm's revenues were well-balanced regionally, with the firm's continental European practice having a “terrific” year, along with a strong London performance in spite of the uncertainties surrounding Brexit. Much of that is last-minute banking and regulation work, as players catch up on the growing prospect of a “no-deal” exit from the European Union.

He added that the firm is well-hedged between its strength in London and on the continent.

“As people move banking functions to Paris or Frankfurt, we're right there,” he said.

And London is one of the cities where the firm is specifically looking to add corporate capabilities, along with New York, Houston and Boston, where the firm opened an office in 2017.

“We think there will continue to be English-law driven deals and having a strong corporate department in London is part of our strategy going forward,” Immelt said.

The firm is in the midst of substantial investments in its working spaces, and partners are expected to have some “skin in the game.” Offices in Washington, Houston, Denver and Miami have already been renovated, the firm will move into new spaces in London and New York this summer, and London renovations are also planned.

“There's been a really significant capital outlay in the last three years as part of the cycle of upgrading our space and modernizing our space, to be much more efficient in how we use it,” Immelt said. “Office sizes have shrunk, and there's more opportunities for open plan work. As a business, it's going to require capital, and I think our partners understand that.”

Read More:

What Hogan Lovells Did Right (and Wrong) in Its Founding Tie-Up

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Alston & Bird Adds M&A, Private Equity Team From McDermott in New York

4 minute read

Veteran Federal Trade Law Enforcer Joins King & Spalding in Washington

4 minute read

Houston Trial Lawyer Mary-Olga Lovett Leaves King & Spalding to Open Boutique

3 minute readTrending Stories

- 1Vinson & Elkins Expands Environmental Team with Chair of Texas Commission on Environmental Quality

- 2From Courtrooms to Conversations: The Unexpected Joys of Podcasting as a Lawyer

- 3'A More Nuanced Issue': NJ Supreme Court Considers Appellate Rules for Personal Injury Judgments

- 4Drake Sues UMG for Defamation Over Promotion of False Claims of Pedophilia

- 5Quinn Emanuel Files Countersuit Against DOJ in Row Over Premerger Reporting

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250