Dickinson Wright Reports Gains in Revenue and Profit

The firm said one of the firm's strongest-performing practice areas in the past year has been intellectual property, an area in which it has made a critical investment.

February 26, 2019 at 03:39 PM

3 minute read

Michael Hammer, chairman of Dickinson Wright.

Michael Hammer, chairman of Dickinson Wright.

Dickinson Wright reported major gains in revenue and profits in fiscal year 2018 compared to the year before, driven largely by demand for intellectual property and general corporate legal work.

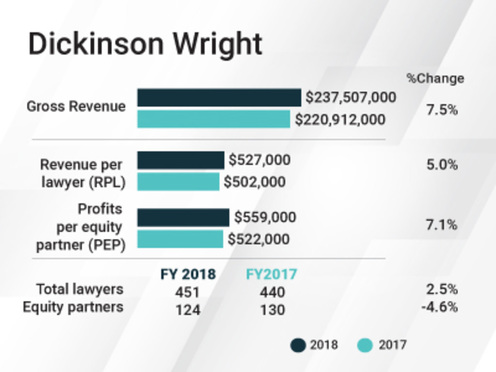

Gross revenue for fiscal 2018 reached $237.5 million—a 7.5 percent increase from the $220.9 million reported the year before. Revenue per lawyer rose 5 percent to $527,000 from $502,000, and profits per equity partner increased 7.1 percent to $559,000—up from $522,000 the previous year.

The firm's PEP rose as the number of equity partners fell 4.6 percent—from 130 to 124. The number of nonequity partners increased from 135 to 143, and the overall head count rose from 440 to 451.

Michael Hammer, CEO of Dickinson Wright, said that the higher profits per equity partner are not simply a function of having fewer equity partners among whom to distribute work.

“Demand for our services, in terms of billable hours, was up significantly. We are pretty happy with the jump in productivity, and that, to us, was the main driver,” Hammer said.

The firm raised rates about 2.2 percent in fiscal 2018, he said.

Dickinson Wright Financials

Dickinson Wright FinancialsOne of the firm's strongest-performing practice areas in the past year was IP, an area in which the firm has made a critical investment, Hammer said. Firmwide, Dickinson Wright has 81 IP attorneys, and Hammer said their services have been in great demand in the United States and Canada, particularly in “hard science” sectors such as electrical engineering, mechanical engineering and computer science. The opening of an office in Silicon Valley in April 2018 helped target the latter sector, in particular.

On the flip side, Hammer noted that the firm's restructuring practice had a relatively slow year. ”Bankruptcy continues to be down. We can find work in that area, but it's a little hit-or-miss,” Hammer said.

While the firm is interested in picking up talented laterals, Hammer said that Dickinson Wright has not been in any talks concerning a possible “merger of equals” in the last few years.

“We have been generally looking to grow, where we can maintain our independence and the platform we've developed here,” he said. “There isn't anything in the works in terms of a large merger at this point, though there are a number of discussions with individuals.”

Hammer emphasized Dickinson Wright's active use of alternative fee arrangements, particularly in IP, where such arrangements often come into play when filing for or upholding a patent for clients before the U.S. Patent and Trademark Office. When an IP matter escalates to a dispute between two parties over who holds a valid claim, alternative fee arrangements tend not be as widely used.

“When you have two companies fighting about IP, the matter goes out of alternative fee arrangements and becomes billable-hour, high-stakes litigation,” Hammer said.

On the cybersecurity front, Hammer described a firmwide effort to provide attorneys with the tools and software needed to avert and counter any threats to data privacy. Like many if not all large law firms these days, Dickinson Wright takes the matter extremely seriously, he said.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute readTrending Stories

- 1Treasury GC Returns to Davis Polk to Co-Chair White-Collar Defense and Investigations Practice

- 2Decision of the Day: JFK to Paris Stowaway's Bail Revocation Explained

- 3Doug Emhoff, Husband of Former VP Harris, Lands at Willkie

- 4LexisNexis Announces Public Availability of Personalized AI Assistant Protégé

- 5Some Thoughts on What It Takes to Connect With Millennial Jurors

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250