Partner Profits Pass $1M at Duane Morris as Growth Streak Continues

Gross revenue at the Philadelphia-based firm was up 5.5 percent, as profits per equity partner passed the $1 million mark for the first time.

February 27, 2019 at 11:31 AM

5 minute read

The original version of this story was published on The Legal Intelligencer

Photo: J. Albert Diaz/ALM

Photo: J. Albert Diaz/ALM

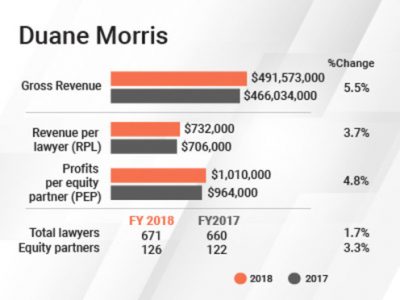

Duane Morris saw revenue and profits grow in 2018, as the firm surpassed the $1 million mark in profits per equity partner for the first time.

Gross revenue at the Philadelphia-based firm was up 5.5 percent, reaching $491.6 million in 2018, compared with $466 million in 2017. Revenue per lawyer was up 3.7 percent, increasing from $706,000 in 2017 to $732,000 in 2018, as head count grew slightly.

PEP increased by 4.8 percent, from $964,000 in 2017 to $1.01 million in 2018. Net income grew by 8.8 percent, to $127.45 million.

Nearly three-quarters of Am Law 100 firms had PEP of $1 million or more in 2017. But among firms that were founded in Pennsylvania, only three were in that club last year: Dechert; Morgan, Lewis & Bockius; and Reed Smith.

“We didn't back into that number by de-equitizing partners. We did it our way, just by being disciplined,” firm chairman Matthew Taylor said.

Taylor, who became the chairman at the beginning of 2018, said it was the 10th straight year of growth for Duane Morris, and it was important to him to continue that pattern in his first year leading the firm.

Taylor, who became the chairman at the beginning of 2018, said it was the 10th straight year of growth for Duane Morris, and it was important to him to continue that pattern in his first year leading the firm.

“We're seeing the strength and power of our platform,” he said, adding that 28 percent of revenue came from “cross-office, cross-practice group” engagements.

Looking at the firm's international offices, he said, London is “in a very steady state,” and had one of its best years in 2018. The Asian offices, Taylor said, grew revenue by about 10 percent last year, as Singapore and Vietnam had particularly strong performances.

Both the trial group and corporate practices were strong in 2018, Taylor said, noting a few significant matters. And no practices were particularly weak, he said, noting that bankruptcy and reorganization work began to pick up in the second half of the year.

On the litigation side, the firm is representing Otto Bock HealthCare in an ongoing matter before the Federal Trade Commission regarding the company's acquisition of FIH Group Holdings, which makes prosthetics. And it represented Dicerna Pharmaceuticals in a trade secrets case that settled in April.

Taylor also highlighted a couple of large corporate matters the firm handled, including a $2.5 billion credit facility for Quanta Services, and a $950 million credit facility for Diamond Offshore Drilling.

In terms of head count, the firm changed little from 2017 to 2018. Total head count was up 1.7 percent, to 671 lawyers. The partnership as a whole was almost identical in size, but the firm added a net four equity partners, reaching 126 total, while the number of nonequity partners decreased by six, to 220.

The firm brought on several groups of lawyers across the country throughout the year. They included seven IP attorneys from Vedder Price in May, a corporate insurance partner and IP partner who joined the firm's young Austin office in January, and a pair of litigation partners in California from now-shuttered Sedgwick. In Philadelphia, the firm added a health care lawyer who came from an in-house position at health system Ascension.

But the firm also lost an eight-lawyer IP team that joined California firm Rimon in September, as well as litigation partner Miguel Pozo, a onetime in-house lawyer for Mercedes-Benz.

Bullish but Conservative

Taylor said Duane Morris raised rates by about 3.5 percent.

Alternative fee arrangements have become more popular each year, he noted. The firm has a dedicated group of pricing analysts on its finance and accounting team, Taylor said, to respond quickly when clients or prospective clients are looking for an idea of how much a particular matter will cost at Duane Morris.

“We're becoming better project managers,” Taylor said. “Realization rates have gotten higher and higher because of good project management.”

As for its own budget, he said, Duane Morris is typically conservative in spending, and that held true in 2018, but the firm did not make any additional cuts in 2018 to increase profits. On the contrary, the firm grew its marketing and business development budget and spent more on technology, he said.

When a wave of associate salary increases hit the market, Duane Morris was “measured and responsive,” Taylor said. The firm is currently working on finalizing changes to its associate compensation structure, he said, and while it was watching the trends over the summer, it did not make a move immediately.

In the year ahead, Taylor said, Duane Morris will aim to continue growth in the markets where it already has a presence. It may look to open in Dallas, he said, which would be a testament to the firm's successful growth in Houston and Austin in recent years. The firm will also look to grow in Northern California, he said.

Still, he said, the firm has no debt, and will continue that way. While the firm remains optimistic about its growth trajectory, he said, it will not be caught off guard if the economy takes a turn.

“We're bullish, but we always set a conservative budget,” Taylor said. “We're always prepared to be nimble.”

Read More:

Duane Morris Adds Trial Lawyer Trio in Austin, IP Partner in London

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

- 1Pa. High Court: Concrete Proof Not Needed to Weigh Grounds for Preliminary Injunction Order

- 2'Something Else Is Coming': DOGE Established, but With Limited Scope

- 3Polsinelli Picks Up Corporate Health Care Partner From Greenberg Traurig in LA

- 4Kirkland Lands in Phila., but Rate Pressure May Limit the High-Flying Firm's Growth Prospects

- 5Davis Wright Tremaine Turns to Gen AI To Teach Its Associates Legal Writing

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250