O'Melveny Posts Record Income, Profit Growth in 2018

"The firm hit on all cylinders in the last year," said New York-based chair Bradley Butwin.

February 28, 2019 at 05:03 PM

5 minute read

O''Melveny & Myers' offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

O''Melveny & Myers' offices in Washington, D.C. (Photo: Diego M. Radzinschi/ALM)

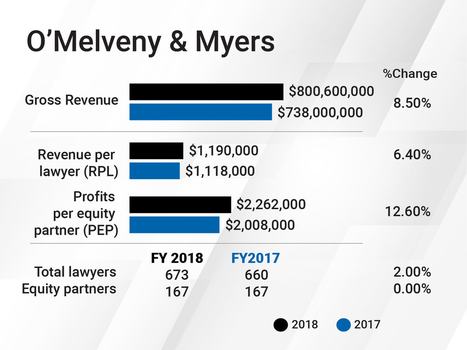

O'Melveny & Myers saw record increases in profits per equity partner (PEP) and net income in 2018, with both figures growing at over 12 percent.

Gross revenue increased by 8.5 percent, climbing just past the $800 million mark, up from $738 million the previous year. The firm's revenue per lawyer hit $1.19 million, up 6.4 percent, while a 12.6 percent increase to PEP brought that figure to $2.262 million.

Net income grew at a similar rate, hitting $377.8 million.

Bradley Butwin of O'Melveny & Myers. (Courtesy photo)

Bradley Butwin of O'Melveny & Myers. (Courtesy photo)“The firm hit on all cylinders in the last year,” said New York-based chair Bradley Butwin. He noted that O'Melveny's share value, a crucial internal metric that determines how individual partners are compensated, climbed a record 17 percent and has increased 46 percent over the last four years.

“The financial performance was primarily driven by increased demand, not by rate increases or cost controls,” Butwin said.

Head count at the 15-office firm was stable over the course of 2018, with the total number of attorneys growing by 2 percent to 673. The firm, which says it is structured as a single-tier partnership, reported 178 partners, two fewer than the previous year.

O'Melveny's growth in 2018 was broad based, across a wide range of departments and industries. Butwin said it was a strong year for the firm's staple practices—trials, health care and life sciences, investigations, antitrust, cybersecurity and data security, and restructuring—that have delivered for a number of years in a row.

In the antitrust arena, partner Daniel Petrocelli delivered a major trial victory for AT&T in the U.S. Department of Justice's challenge to its historic $85.4 billion merger with Time Warner. The bankruptcy practice guided the government of Puerto Rico through its restructuring over $70 billion in public sector debt and $50 billion in pension obligations, and it's advising California on the bankruptcy of PG&E, the state's largest utility. The firm also has a key role in Johnson's & Johnson's defense against investigations and litigation stemming from the opioid crisis.

Other practices have seen more recent demand increases. The wider economy has seen a boom in fundraising for infrastructure, and in 2018, O'Melveny's clients secured leading roles in a $10 billion plan to redevelop and modernize New York's JFK Airport.

Other practices have seen more recent demand increases. The wider economy has seen a boom in fundraising for infrastructure, and in 2018, O'Melveny's clients secured leading roles in a $10 billion plan to redevelop and modernize New York's JFK Airport.

The firm's entertainment, sports and media practice is also surging. O'Melveny represented David Tepper in his NFL record $2.275 billion purchase of the Carolina Panthers. It's also representing Twentieth Century Fox in ongoing litigation against Netflix over the latter's poaching of Fox executives.

The #MeToo era has also kept O'Melveny lawyers busy. In 2018, the firm won a court victory for Harvard in a widely covered Title IX case involving allegations of campus sexual assault and advised the University of Southern California's Board of Directors on an investigation of alleged sexual harassment.

“We've always had a big practice representing colleges and universities, but, until the past two years, that didn't involve as many harassment claims,” Butwin said. This work has also fostered collaboration between the firm's white-collar and investigations practice and its labor and employment practice.

Butwin wouldn't point to a practice area that lagged in 2018, but he did recognize clients' growing sensitivity to prices.

“It's not a particular practice of ours that is under pressure, it's recognizing the imperative to partner with clients and give them what they need,” he said. “We tend to be very bold in fixed-fee areas, not just for cases but for entire portfolios of work. We get rewarded for being efficient, and the client gets certainty.”

Butwin added that this allows the firms to build dedicated teams that understand the clients' business because of the repeat work, associates gain a better read of these companies' operations and burnish their own chances for promotion, and his own projections and budgeting increase in certainty.

With regard to traditional billing, O'Melveny increased rates in 2018, at a clip Butwin said was “relatively modest compared to other firms.”

The firm added talent in a number of areas in the last year, including the addition of a three-member private equity team in Century City from Stradling Yocca Carlson & Rauth, veteran Supreme Court advocate and Stanford Law professor Jeffrey Fisher in Silicon Valley, and Hong Kong-based dealmaker Li Han.

Butwin also teased a “huge” upcoming hire on the horizon of a public sector veteran with experience in government investigations and cybersecurity: “We are fortunate to attract those who are at top of the game in terms of government service.”

Nearly 80 percent of the firm's nine newly partners promoted for 2019 are either women, people of color, or LGBT lawyers. “It's not just about promoting people, it's getting them to the point that they're able to cross the line,” Butwin said.

While O'Melveny has been the subject of a string of reports putting the firm in merger talks with Magic Circle firm Allen & Overy over the last year, Butwin asserted that firm was content with its footprint and size and had no expansion plans in the offing.

The firm's inventory going into 2019 was up 18 percent, and it carries no debt.

“As you can see from our financials and our client-related results, we're very focused on serving our clients and our firm, and we're looking forward to a strong year in 2019,” Butwin said.

Read More

'People get cold feet' – The Latest on A&O and O'Melveny's Merger Talks

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

- 1Pa. High Court: Concrete Proof Not Needed to Weigh Grounds for Preliminary Injunction Order

- 2'Something Else Is Coming': DOGE Established, but With Limited Scope

- 3Polsinelli Picks Up Corporate Health Care Partner From Greenberg Traurig in LA

- 4Kirkland Lands in Phila., but Rate Pressure May Limit the High-Flying Firm's Growth Prospects

- 5Davis Wright Tremaine Turns to Gen AI To Teach Its Associates Legal Writing

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250