Sidley Austin Sees Revenue, Profits Surge in Standout Year

The firm's revenue and profits per equity partner hit new heights in 2018—for the eighth straight year.

February 28, 2019 at 05:30 AM

6 minute read

Sidley Austin's Larry Barden.

Sidley Austin's Larry Barden.

Sidley Austin in 2018 posted arguably its strongest all-around financial performance in at least a decade, according to data from ALM Intelligence.

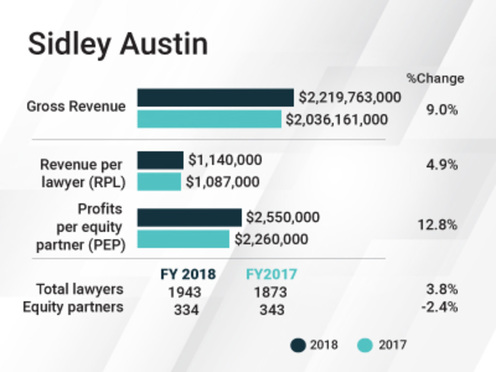

Revenue rose 9 percent to $2.2 billion and profits per equity partner spiked nearly 13 percent to $2.55 million, according to preliminary reporting by The American Lawyer. The firm's head count rose 3.75 percent to 1,943 lawyers, even as the number of equity partners shrunk by 2.4 percent to 334. Revenue per lawyer rose nearly 5 percent to $1.14 million.

Even for a firm that has grown revenue and profits per equity partner for eight years in a row, 2018 stands out as a banner year. The firm's year-over-year profits per equity partner growth rate of nearly 13 percent in 2018 was the highest since at least 2008, according to ALM data. The firm's year-over-year revenue growth rate in 2018 was bested in that time span only once, from 2013 to 2014.

Even for a firm that has grown revenue and profits per equity partner for eight years in a row, 2018 stands out as a banner year. The firm's year-over-year profits per equity partner growth rate of nearly 13 percent in 2018 was the highest since at least 2008, according to ALM data. The firm's year-over-year revenue growth rate in 2018 was bested in that time span only once, from 2013 to 2014.

Sidley billed a total of 3.083 million hours last year—up 5.4 percent from the prior year. That demand growth outstripped the 2.9 percent average billable hour growth at Am Law 50 firms reported by Citi Private Bank Group.

“We saw a pickup in momentum in the firm,” Larry Barden, chair of the firm's management committee, said in an interview. “It was a year in which we not only had some powerful financial results, but we saw the benefits of—and were able to continue to make—strategic investments in our core practices.”

Barden said a number of the firm's practices, industry groups and geographic regions saw billable hours grow at more than 20 percent. That included its mergers and acquisitions practice; industry groups including insurance, energy and capital markets; and its China offices.

U.S.-based offices including Boston, Houston, Dallas, New York and Northern California saw hours growth of more than 10 percent, Barden said.

Sidley's transactional department saw a significant boost in work in 2018, according to Mergermarket, which tracks law firms' work on transactions. The value of U.S.-based deals Sidley advised on in 2018, nearly $166 billion, was nearly double the amount the firm advised on in 2017. That growth shot Sidley up the rankings of U.S.-based advisers by deal value from No. 37 in 2017 to No. 14 last year. By number of U.S.-based deals last year, Sidley ranked No. 10, according to Mergermarket.

The firm's notable transactions included advising Pandora Media Inc. in its sale to Sirius XM Holdings for $3.5 billion; representing pharmaceutical company Roche Holdings in its acquisition of Ignyta Inc. for $1.7 billion; and representing asset manager Apollo Global Management in its $2.6 billion purchase of Aspen Insurance Holdings Ltd.

Sidley has focused on building out its private equity practice, which has experienced a number of lateral hires and departures in the past 18 months.

Matthew Rizzo, the firm's former private equity practice leader, left Sidley with another partner, Jessica Sheridan, for Willkie Farr & Gallagher in June 2018. In October, the firm added two high-powered private equity partners, Adam Weinstein and Tony Feuerstein, in New York from Akin Gump Strauss Hauer & Feld. The pair had a reported book of business around $30 million, the New York Law Journal reported at the time.

This year, the firm hired John Butler, who was previously at Davis Polk & Wardwell, as a partner in its mergers and acquisitions and private equity practice in New York. Meanwhile, the firm saw private equity partner Mark Thompson leave its London office to join Weil, Gotshal & Manges.

Barden said the firm's commitment to hiring talented private equity partners paid off in 2018.

“As people see the talent and experience we have in the area, it has led to more and more opportunities,” he said.

Sidley's structured finance practice also performed well in 2018, representing more underwriters of asset-backed and mortgage-backed securitizations than any other law firm, according to Asset-Backed Alert, which tracks those deals. The firm handled roughly 35 percent more of those types of deals in 2018 compared with the year prior.

This year, the firm hired structured finance partner Steven Kolyer from Clifford Chance. Mike Schmidtberger, chair of Sidley's executive committee, said the firm had invested in its structured finance practice even as that business line retrenched following the last recession.

“We never lost our momentum,” Schmidtberger said. “That allowed us to continue to attract talent in that space over the past few years, and it culminated in 2018 becoming something of a bellwether. But it didn't happen overnight. It was a long-term commitment to one of our core practices.”

The firm's litigation department, which Barden said accounted for roughly $800 million of the firm's 2018 revenue, also had significant victories. Most recently, its three-year representation of AT&T in its acquisition of Time Warner culminated this week in a victory for AT&T at the U.S. Court of Appeals for the D.C. Circuit, which ruled against a U.S. Justice Department challenge to the merger.

The year was not without hardship, however. In October, 42-year-old Los Angeles-based partner Gabriel MacConaill died of a suicide. MacConaill's wife, Joanna Litt, wrote an article about his death that discussed the stress of working in Big Law. The article has led to more public discussion of mental health issues in the profession.

“It is an issue for the profession as a whole, and it is an issue for other professions that are high-performance. And I think that while tragic, Gabe's loss has led to positive change in the industry and the profession,” Schmidtberger said. “And his wife's letter, I think, highlighted some of the most important elements, which are that issues of stress and well-being need to be brought out into the open.”

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

- 1'Something Else Is Coming': DOGE Established, but With Limited Scope

- 2Polsinelli Picks Up Corporate Health Care Partner From Greenberg Traurig in LA

- 3Kirkland Lands in Phila., but Rate Pressure May Limit the High-Flying Firm's Growth Prospects

- 4Davis Wright Tremaine Turns to Gen AI To Teach Its Associates Legal Writing

- 5'Battle of the Experts': Bridgeport Jury Awards Defense Verdict to Stamford Hospital

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250