Baker Botts Again Posts Weaker Revenue, Profits, on Fewer Contingency Fees

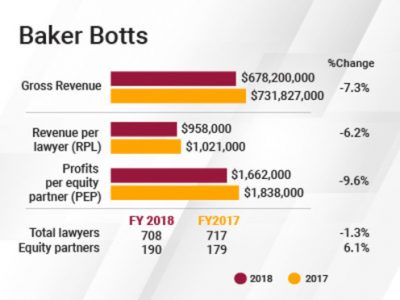

Gross revenue for Baker Botts dropped 7.3 percent to $678.2 million, and profits per equity partner fell 9.6 percent to $1.66 million.

March 01, 2019 at 02:22 PM

4 minute read

The original version of this story was published on Texas Lawyer

Baker Botts. Diego M. Radzinschi/ALM

Baker Botts. Diego M. Radzinschi/ALM

Baker Botts saw its revenue and profitability take sizable hits in 2018, the firm's second consecutive year of declining financials.

But Andrew Baker, the firm's Houston-based managing partner who will cede that position in a month, said, “the numbers don't tell the story.”

Gross revenue for Baker Botts dropped 7.3 percent to $678.2 million in 2018 compared with $731.8 million in 2017. And revenue per lawyer (RPL) was down 6.2 percent to $958,000, compared with $1.021 million the year before.

Profits per equity partner (PEP) came in at $1.66 million, a 9.6 percent dip from $1.84 million the year before. Net income was $315.9 million, down 4.1 percent compared with $329.3 million in 2017.

Baker said the firm's 2018 financials appear poor because they are compared with 2017, when the firm had significant contingency fee revenue. And the declines in 2017, he said, came after the firm saw record-setting contingency fee revenue in 2016.

“The lion's share, the huge majority of it was the absence of contingency fees,” Baker said about the Houston-based firm's numbers in 2018. “Our partners got unprecedented amounts in '17 and '16. That didn't repeat in 2018. It doesn't mean our business is weaker by its absence,” he said.

“The lion's share, the huge majority of it was the absence of contingency fees,” Baker said about the Houston-based firm's numbers in 2018. “Our partners got unprecedented amounts in '17 and '16. That didn't repeat in 2018. It doesn't mean our business is weaker by its absence,” he said.

Baker said that if “tens of millions” of contingency fees are taken out of the 2017 numbers, 2018 would be a “just below flat” year in comparison. He said 2018 gross revenue would have been slightly less than flat, and PEP would have been up by 1.5-to-2 percent, instead of down by 9.6 percent.

Baker also said 2018 revenue was impacted by a large amount of uncollected receivables that carried over into this year. He said collections in January were “the best in the 179-year-old history of the firm,” and February was excellent, too.

Baker said Baker Botts' revenue in technology and energy were roughly equivalent in 2018. He said work surrounding the technology, media and telecom sector poured in, and the intellectual property and IP litigation practices in particular were busy. The firm's environmental lawyers were very busy, he said.

Corporate work was up, too, Baker said, although the firm experienced some weakness in energy capital markets. Additionally, the firm's antitrust practice, which is global, had a very strong year, he said.

Baker Botts was slightly smaller in 2018 than 2017, with 708 lawyers in 2018 on a full-time equivalent basis, down 1.3 percent when compared with 717 the year before. But the firm had 6.1 percent more equity partners, 190 on an FTE basis, compared with 179 the year before.

Baker said the firm is purposely increasing its equity partner ranks.

“We are doing it as a sign of confidence,” he said.

In 2018, Baker Botts added 19 lateral partners and promoted 12 lawyers to partner, according to Baker. He said 60 percent of the new partners are located outside of Texas, including 19 on the East and West Coasts, which indicates the firm's investment in the future. Among the lateral hires were lawyers in Brussels, London, Riyadh, New York and Washington, D.C., as well as Houston.

On April 1, Palo Alto partner John Martin will succeed Baker, who faces mandatory retirement at the end of the year.

Baker Botts has long differentiated itself as a technology and energy firm and will continue to do so, Martin said in a recent interview. The firm will continue to build strength in Texas, he said, even as it targets growth in London and on the East and West coasts.

Read More:

Baker Botts Posts Big Drop in Revenue and Income in 2017 Following Year of Big Contingency Fees

With Texas Legacy, New West Coast MP, What Does Baker Botts' Future Hold?

Baker Botts Hires Senior Hogan Lovells Partner in Brussels; Ramps Up London Growth Plans

Baker Botts Nabs Herbert Smith Freehills Partner in Saudi Arabia

Kirkland Capital Markets Pro Jumps to Baker Botts in Houston

Baker Botts Grabs Four Corporate Partners From Vinson & Elkins on East Coast

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

KPMG's Bid to Practice Law in U.S. on Indefinite Hold, as Arizona Justices Exercise Caution

Orrick Hires Longtime Weil Partner as New Head of Antitrust Litigation

Sidley Adds Ex-DOJ Criminal Division Deputy Leader, Paul Hastings Adds REIT Partner, in Latest DC Hiring

3 minute readTrending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250