DLA Piper Boosted Revenues, Profits Again in 2018

The firm's investments in global integration are paying off, said global co-CEO and Americas co-chairman Jay Rains.

March 05, 2019 at 05:00 AM

5 minute read

Photo: Diego M. Radzinschi/ALM

Photo: Diego M. Radzinschi/ALM

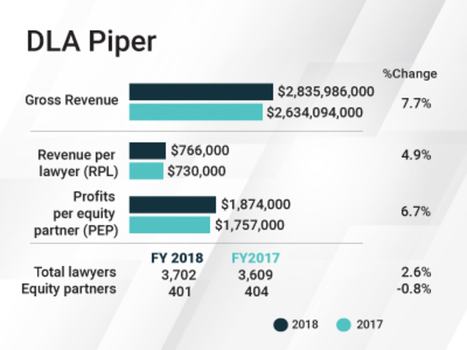

DLA Piper saw its revenue increase by 7.7 percent to $2.84 billion in 2018, while profits per equity partner grew 6.7 percent to $1.87 million.

This made for the second straight year of growth for the global firm, after a 2017 that featured a 7 percent increase in revenue and a 6 percent boost in PEP.

Head count was up slightly, rising 2.6 percent to 3,702 and revenue per lawyer climbed almost 5 percent. The equity partnership dipped slightly under 1 percent, while the total number of partners climbed 3.4 percent to 1,246.

Jay Rains, DLA Piper's global co-CEO and Americas co-chairman, attributed last year's strong performance both to an improving global legal market and to the firm's recent investments in building a worldwide presence.

“There's always a lag between when you are achieving something and when you see the results,” Rains said. “We've been preaching a global integrated strategy to our clients for some time.”

London-based global co-CEO Simon Levine noted that regulatory work was strong across the firm's global footprint in 2018, driven in part by the European Union's General Data Protection Regulation. His London colleague, global co-chairman Andrew Darwin, flagged the firm's global litigation work, emanating from London into Europe and the Middle East.

London-based global co-CEO Simon Levine noted that regulatory work was strong across the firm's global footprint in 2018, driven in part by the European Union's General Data Protection Regulation. His London colleague, global co-chairman Andrew Darwin, flagged the firm's global litigation work, emanating from London into Europe and the Middle East.

On the transactional side, the firm is serving as regulatory counsel representing T-Mobile US Inc. and Deutsche Telekom AG in their still unfolding merger with Sprint Corp. It's also representing T-Mobile in national security matters related to the transaction, which received approval from the Committee on Foreign Investment in the United States in December.

'Upmarket' Aims

Rains pointed to strength in the upper middle market segment of private equity transactions, emphasizing that M&A work drives other services. He also said that tech and IP work has been bustling and that 2018 marked a breakthrough for the firm's global investigations practice.

“You can feel the firm moving further and further way from commodity practices,” global co-chairman and Americas co-chairman Roger Meltzer summarized. “Law firms have two choices now: you can sit where you are in terms of commodity practices or you can move upmarket. We have decided to move hard upmarket, and we have been successful in doing that.”

One significant addition for DLA Piper in 2018 was the March addition of a six-member team from Jackson Walker in Austin that represents institutional investors in connection with their alternative investments. That's part of a significant investment in Texas that also included a slew of Dallas hires earlier in the year from Dentons and Hunton Andrews Kurth.

“We haven't had a year where laterals have hit the ground running in the U.S. better than last year,” Raines said.

Meltzer added that the T-Mobile work was being handled by a group of laterals that came aboard in 2016 from Wiley Rein. “Those kind of matters and engagements create significant brand equity and make the firm a magnet for people who feel they can't get to where they want to get to at their firms of origin,” he said.

Levine contends that appeal goes beyond just lawyers, pointing to the firm's current efforts to hire a chief marketing officer for the international side of its operations.

“You look at some of the candidates, and where they come from—some from industry, others from traditional law firms. They see us as much more exciting, with our use of technology and innovation, and less hierarchical,” he said.

DLA Piper also slightly expanded its international footprint in 2018. It opened a Dublin office to take advantage of the city's growing importance in life sciences, technology and financial services. It brought on formerly independent Argentine firm Cabanellas Etchebarne Kelly to round out its expansion efforts in Latin America. It also absorbed Danish firm Delacour, a 60-lawyer operation with offices in Copenhagen and Aarhus. These moves followed sizable 2017 growth in Africa.

“The reality is that if you look at what our footprint is now, Latin America, Africa and the Nordics are very different regions that are strategically important to our clients,” Levine said. “I don't think there's a load more places that we would go.”

Rains agreed, but said that the firm has ambitions to continue to grow in key markets in the U.S., such as California, Texas and New York, and globally in London and Germany.

Looking ahead to 2019, the firm carries over $10 million in debt, but the leadership team says they are investing heavily in innovation. Examples include a partnership with Imperial College in London, where the university's data sciences faculty is working with the firm's data to help improve client-service delivery, and joint ventures with major tech companies to assess how the firm should be investing in new technology.

“We are going to spend the money that we need to spend to be leaders in innovation,” Meltzer said.

And the firm's leadership, including the usually guarded Meltzer, has high expectations for the coming year as a whole.

“I was a big believer, and we hedged against it operationally and generationally, that the second half of 2019 and 2020 could start to see a recession that would hurt us,” he said. “I don't see that. I am cautiously optimistic.”

Correction: An earlier version of this story misstated the origin of the attorneys handling the T-Mobile work. The error has been corrected.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Three Akin Sports Lawyers Jump to Employment Firm Littler Mendelson

Brownstein Adds Former Interior Secretary, Offering 'Strategic Counsel' During New Trump Term

2 minute read

Trending Stories

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250