Fish & Richardson Grows Profits, Revenue Amid Patent Litigation Headwinds

The firm saw modest revenue growth and a 7.2 percent rise in profits per equity partner in 2018.

March 06, 2019 at 04:28 PM

4 minute read

Fish & Richardson's offices in Washington, D.C., Aug. 28, 2018. (Photo: Diego M. Radzinschi/ALM)

Fish & Richardson's offices in Washington, D.C., Aug. 28, 2018. (Photo: Diego M. Radzinschi/ALM)

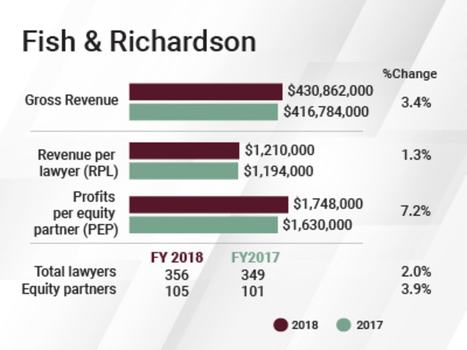

Despite a declining volume of new patent litigation in the U.S., intellectual property powerhouse Fish & Richardson managed to increase gross revenue in 2018 to nearly $431 million, while profits per equity partner grew by more than 7.2 percent to just under $1.75 million.

Fish posted a 3.4 percent growth in top-line revenue in 2018, bringing its total to $430,86 million, up from $416.78 million in 2017, according to ALM data.

Revenue per lawyer reached $1.21 million, up 1.3 percent from 2017, amid a 2 percent increase in head count to 356 lawyers.

Fish's partnership grew 3.9 percent, with 105 equity partners in 2018. Those partners shared a larger profits pie, with net income up 11.4 percent in 2018 to $183.67 million. The firm also added three nonequity partners, bringing that roster up to 66 partners.

Fish President and CEO Peter Devlin said the firm's financial results continue a streak of record figures over the past few years, even as the number of newly filed patent lawsuits has dropped over the same period.

Devlin said the firm has maintained active IP practices that go beyond traditional patent litigation, citing Patent and Appeal Board post-grant review cases and transactional work in which the firm advises startups and other companies on developing and protecting their IP portfolios.

Devlin said the firm has maintained active IP practices that go beyond traditional patent litigation, citing Patent and Appeal Board post-grant review cases and transactional work in which the firm advises startups and other companies on developing and protecting their IP portfolios.

With respect to the PTAB work, Devlin said that Fish is closing in on its 1,000th appearance in front of the board, which was created as part of a set of patent reforms in the 2011 America Invents Act.

Devlin also credited Fish's keen focus on reining in expenses. The firm typically seeks to keep any year-over-year growth in expenses to about 2 percent, he said.

“Our business has really been on the upswing. It's driven by revenue and very disciplined management of our expenses,” Devlin said. “Although IP litigation has been trending down, year-over-year, our business has been growing, and I think that's a direct reflection of our strength and brand.”

Devlin noted that the firm's life sciences work, both in litigation and transactions, was particularly busy throughout the year. The firm's founding office in Boston is still its largest, said Devlin, pointing out that the city has become a hotbed for life sciences and biotechnology companies.

The firm's transactional work often involves helping startups and other clients develop and manage their portfolio of patents and other IP. Devlin said Fish has been advising cancer therapy developer Loxo Oncology Inc. in connection with its worldwide patent strategy for several years, work that helped prepare the company for an early 2019 acquisition by Eli Lilly & Co. valued at about $8 billion. Fish also advises San Diego-based Samumed, which has made waves in the life sciences sector for its work on potential anti-aging therapies.

On the litigation side, the firm secured a number of positive results for clients in 2018. Among those was a successful defense of Gilead Sciences Inc. in a patent infringement action brought by Idenix Pharmaceuticals LLC related to hepatitis C drugs. After Idenix secured a $2.5 billion verdict from a jury that found Gilead liable for willful patent infringement, Fish convinced a federal district judge to declare Idenix's patent invalid, effectively wiping out the damages award.

Separately, Fish guided Gilead to a win against Merck & Co. Inc. following another adverse jury verdict. At a federal district court in 2016, Fish successfully vacated a $200 million verdict against Gilead. The firm followed that with an affirmance at the U.S. Court of Appeals for the Federal Circuit, which in July awarded Gilead $14 million in attorney fees.

This content has been archived. It is available through our partners, LexisNexis® and Bloomberg Law.

To view this content, please continue to their sites.

Not a Lexis Subscriber?

Subscribe Now

Not a Bloomberg Law Subscriber?

Subscribe Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

You Might Like

View All

Government Attorneys Face Reassignment, Rescinded Job Offers in First Days of Trump Administration

4 minute read

Energy Lawyers Field Client Questions as Trump Issues Executive Orders on Industry Funding, Oversight

6 minute readTrending Stories

- 1Doug Emhoff, Husband of Former VP Harris, Lands at Willkie

- 2LexisNexis Announces Public Availability of Personalized AI Assistant Protégé

- 3Some Thoughts on What It Takes to Connect With Millennial Jurors

- 4Artificial Wisdom or Automated Folly? Practical Considerations for Arbitration Practitioners to Address the AI Conundrum

- 5The New Global M&A Kings All Have Something in Common

Who Got The Work

J. Brugh Lower of Gibbons has entered an appearance for industrial equipment supplier Devco Corporation in a pending trademark infringement lawsuit. The suit, accusing the defendant of selling knock-off Graco products, was filed Dec. 18 in New Jersey District Court by Rivkin Radler on behalf of Graco Inc. and Graco Minnesota. The case, assigned to U.S. District Judge Zahid N. Quraishi, is 3:24-cv-11294, Graco Inc. et al v. Devco Corporation.

Who Got The Work

Rebecca Maller-Stein and Kent A. Yalowitz of Arnold & Porter Kaye Scholer have entered their appearances for Hanaco Venture Capital and its executives, Lior Prosor and David Frankel, in a pending securities lawsuit. The action, filed on Dec. 24 in New York Southern District Court by Zell, Aron & Co. on behalf of Goldeneye Advisors, accuses the defendants of negligently and fraudulently managing the plaintiff's $1 million investment. The case, assigned to U.S. District Judge Vernon S. Broderick, is 1:24-cv-09918, Goldeneye Advisors, LLC v. Hanaco Venture Capital, Ltd. et al.

Who Got The Work

Attorneys from A&O Shearman has stepped in as defense counsel for Toronto-Dominion Bank and other defendants in a pending securities class action. The suit, filed Dec. 11 in New York Southern District Court by Bleichmar Fonti & Auld, accuses the defendants of concealing the bank's 'pervasive' deficiencies in regards to its compliance with the Bank Secrecy Act and the quality of its anti-money laundering controls. The case, assigned to U.S. District Judge Arun Subramanian, is 1:24-cv-09445, Gonzalez v. The Toronto-Dominion Bank et al.

Who Got The Work

Crown Castle International, a Pennsylvania company providing shared communications infrastructure, has turned to Luke D. Wolf of Gordon Rees Scully Mansukhani to fend off a pending breach-of-contract lawsuit. The court action, filed Nov. 25 in Michigan Eastern District Court by Hooper Hathaway PC on behalf of The Town Residences LLC, accuses Crown Castle of failing to transfer approximately $30,000 in utility payments from T-Mobile in breach of a roof-top lease and assignment agreement. The case, assigned to U.S. District Judge Susan K. Declercq, is 2:24-cv-13131, The Town Residences LLC v. T-Mobile US, Inc. et al.

Who Got The Work

Wilfred P. Coronato and Daniel M. Schwartz of McCarter & English have stepped in as defense counsel to Electrolux Home Products Inc. in a pending product liability lawsuit. The court action, filed Nov. 26 in New York Eastern District Court by Poulos Lopiccolo PC and Nagel Rice LLP on behalf of David Stern, alleges that the defendant's refrigerators’ drawers and shelving repeatedly break and fall apart within months after purchase. The case, assigned to U.S. District Judge Joan M. Azrack, is 2:24-cv-08204, Stern v. Electrolux Home Products, Inc.

Featured Firms

Law Offices of Gary Martin Hays & Associates, P.C.

(470) 294-1674

Law Offices of Mark E. Salomone

(857) 444-6468

Smith & Hassler

(713) 739-1250